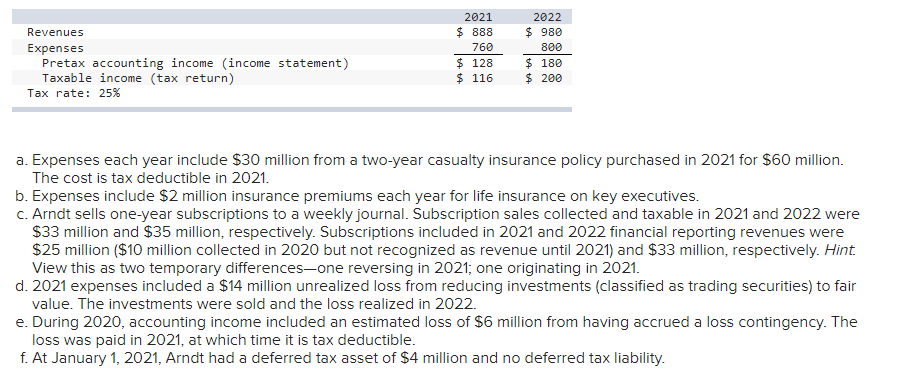

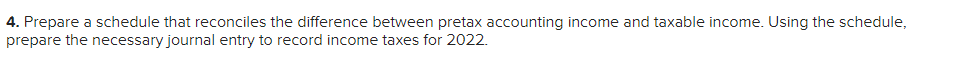

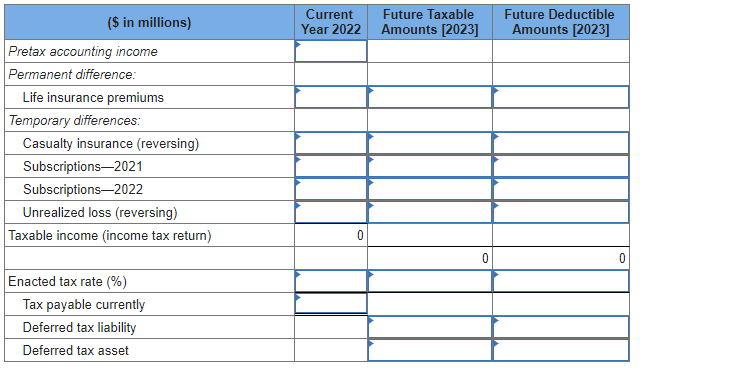

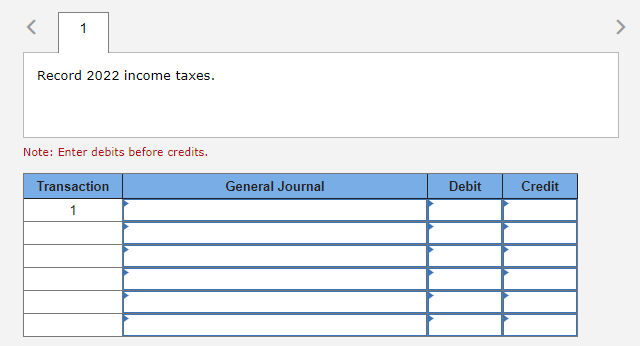

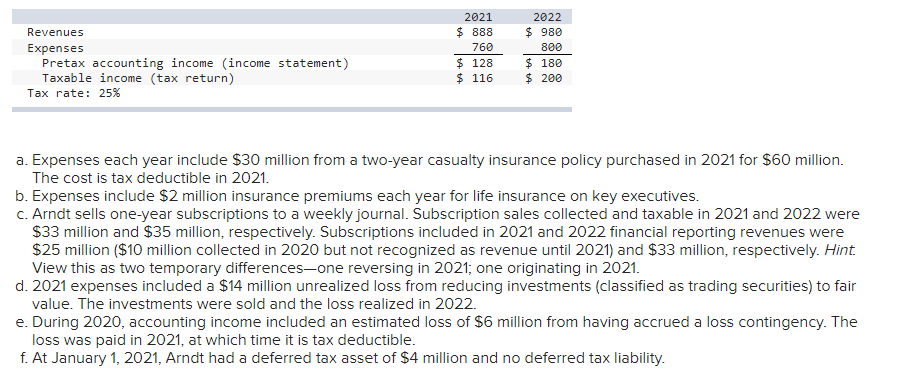

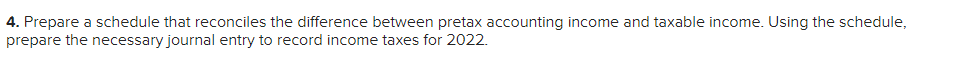

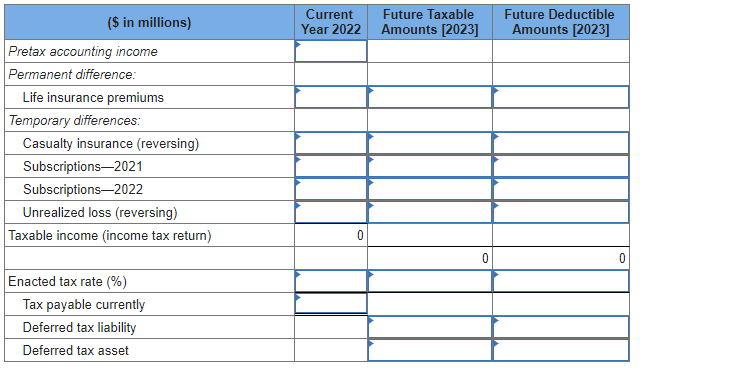

a. Expenses each year include $30 million from a two-year casualty insurance policy purchased in 2021 for $60 million. The cost is tax deductible in 2021 . b. Expenses include $2 million insurance premiums each year for life insurance on key executives. c. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2021 and 2022 were $33 million and $35 million, respectively. Subscriptions included in 2021 and 2022 financial reporting revenues were $25 million (\$10 million collected in 2020 but not recognized as revenue until 2021) and $33 million, respectively. Hint. View this as two temporary differences-one reversing in 2021 ; one originating in 2021. d. 2021 expenses included a $14 million unrealized loss from reducing investments (classified as trading securities) to fair value. The investments were sold and the loss realized in 2022. e. During 2020 , accounting income included an estimated loss of $6 million from having accrued a loss contingency. The loss was paid in 2021 , at which time it is tax deductible. f. At January 1, 2021, Arndt had a deferred tax asset of $4 million and no deferred tax liability. 4. Prepare a schedule that reconciles the difference between pretax accounting income and taxable income. Using the schedule, orepare the necessary journal entry to record income taxes for 2022 . \begin{tabular}{|c|c|c|c|} \hline \multicolumn{1}{|c|}{ (\$ in millions) } & Current Year 2022 & Future Taxable Amounts [2023] & Future Deductible Amounts [2023] \\ \hline Pretax accounting income & & & \\ \hline Permanent difference: & & & \\ \hline Life insurance premiums & & & \\ \hline Temporary differences: & & & \\ \hline Casualty insurance (reversing) & & & \\ \hline Subscriptions-2021 & & & \\ \hline Subscriptions-2022 & & & \\ \hline Unrealized loss (reversing) & & & \\ \hline Taxable income (income tax return) & & & \\ \hline Dacted tax rate (\%) & & & \\ \hline Tax payable currently & & & \\ \hline Deferred tax liability & & & \\ \hline Deferred tax asset & & & \\ \hline \end{tabular} Note: Enter debits before credits