Answered step by step

Verified Expert Solution

Question

1 Approved Answer

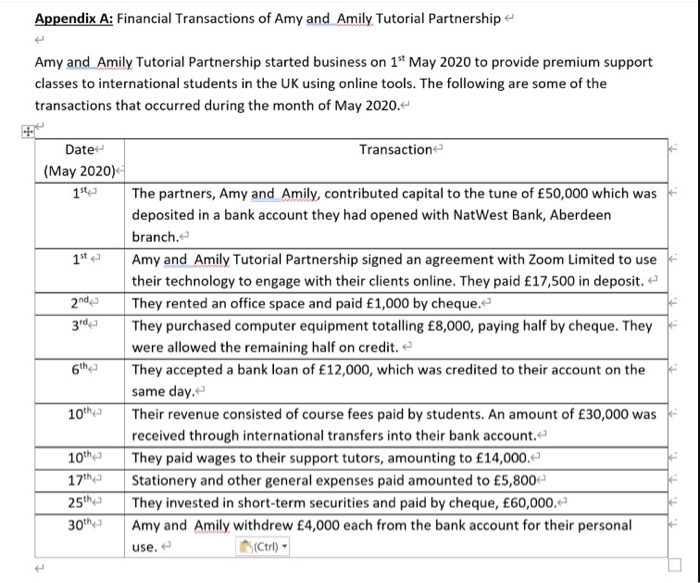

a) Explain whether or not the following are, or can be, stakeholders of Amy & Amily Tutorial Partnership: (i) NatWest Bank, (ii) Trade Unions, (iii)

a) Explain whether or not the following are, or can be, stakeholders of Amy & Amily Tutorial Partnership: (i) NatWest Bank, (ii) Trade Unions, (iii) Management, and (iv) Parents of students of Anna & Akwasi Tutorial Partnership. Give reasons. . (12 marks)

b) Explain the need and use of financial information for each of the stakeholders, where applicable. Give examples of specific financial information they may need to support your answer in each stakeholders case, where applicable, and explain the usefulness of the specific information so indicated. Examples of financial information include, but not limited to, income statements, statements of financial position, cash budgets and breakeven analysis. (16 marks)

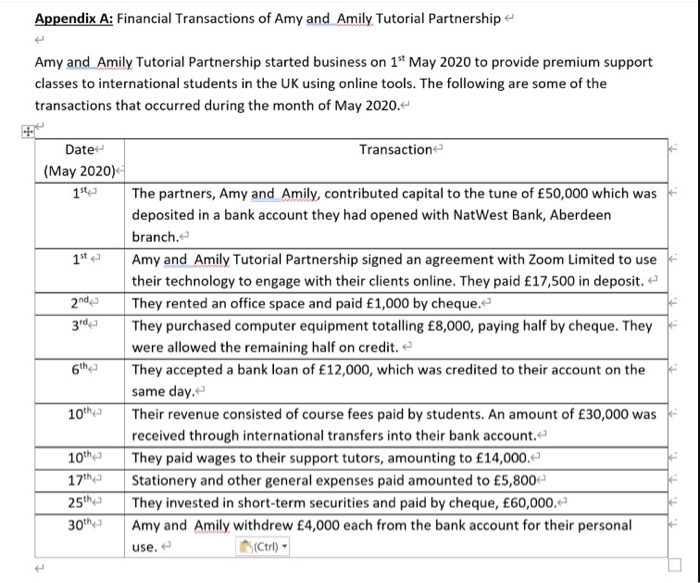

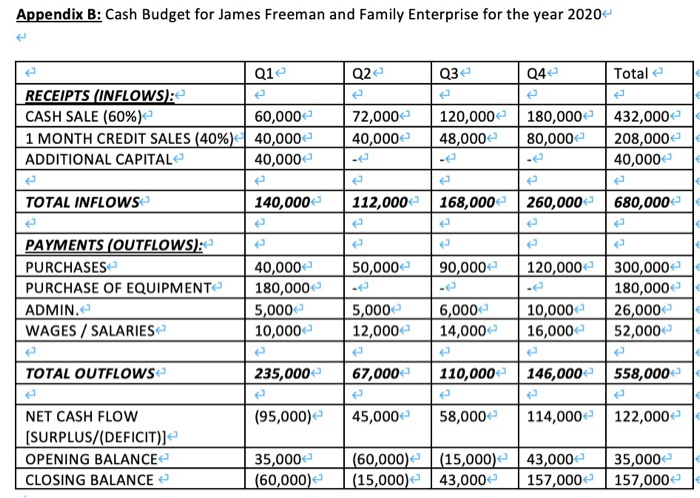

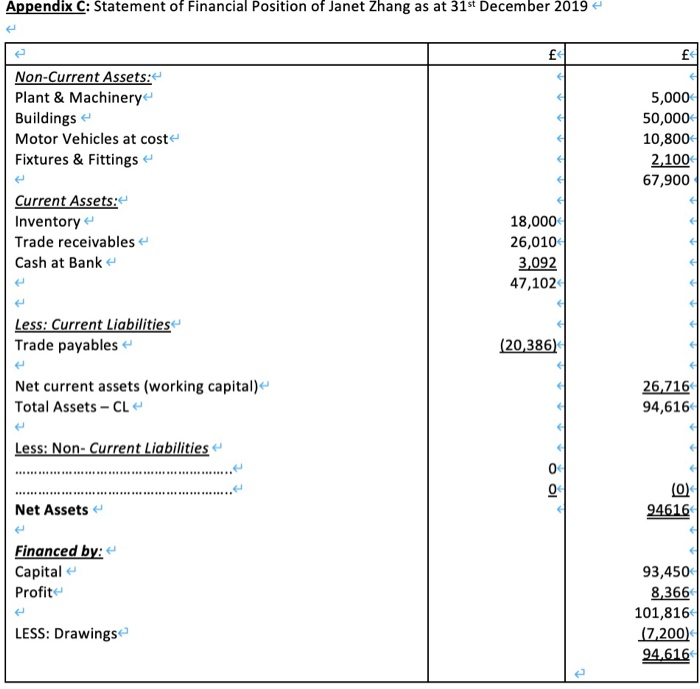

c) Specifically, discuss how the cash budget in Appendix B (for James Freeman and Family Enterprise for the year 2020), and the statement of financial position in Appendix C (for Janet Zhang) could be useful to (i) employees, and (ii) lenders of the respective organisations.

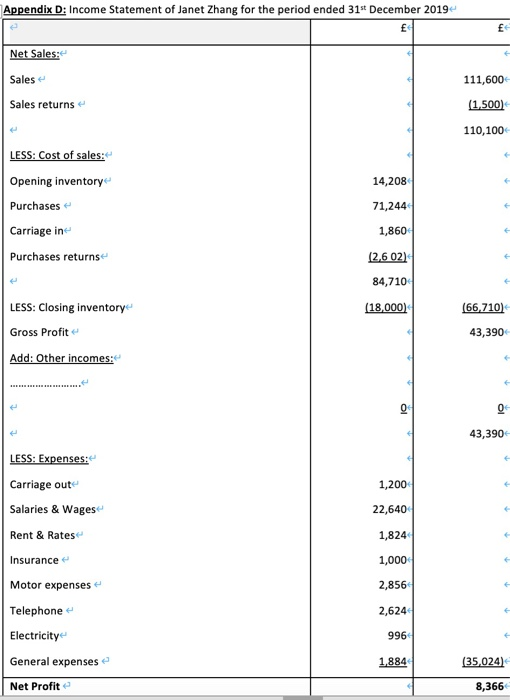

d) Explain the difference between profit and cash. Use information in the cash budget (Appendix B) and the income statement (Appendix D), respectively, to illustrate the difference.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started