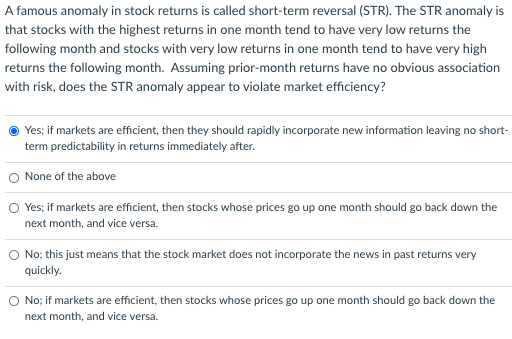

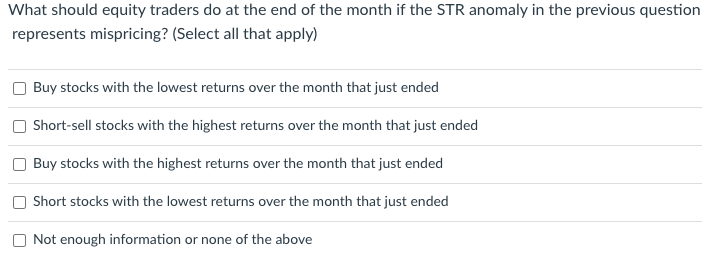

A famous anomaly in stock returns is called short-term reversal (STR). The STR anomaly is that stocks with the highest returns in one month tend to have very low returns the following month and stocks with very low returns in one month tend to have very high returns the following month. Assuming prior-month returns have no obvious association with risk, does the STR anomaly appear to violate market efficiency? Yes; if markets are efficient, then they should rapidly incorporate new information leaving no short- term predictability in returns immediately after. None of the above Yes; if markets are efficient, then stocks whose prices go up one month should go back down the next month, and vice versa. No; this just means that the stock market does not incorporate the news in past returns very quickly. No; if markets are efficient, then stocks whose prices go up one month should go back down the next month, and vice versa. What should equity traders do at the end of the month if the STR anomaly in the previous question represents mispricing? (Select all that apply) Buy stocks with the lowest returns over the month that just ended Short-sell stocks with the highest returns over the month that just ended Buy stocks with the highest returns over the month that just ended Short stocks with the lowest returns over the month that just ended Not enough information or none of the above A famous anomaly in stock returns is called short-term reversal (STR). The STR anomaly is that stocks with the highest returns in one month tend to have very low returns the following month and stocks with very low returns in one month tend to have very high returns the following month. Assuming prior-month returns have no obvious association with risk, does the STR anomaly appear to violate market efficiency? Yes; if markets are efficient, then they should rapidly incorporate new information leaving no short- term predictability in returns immediately after. None of the above Yes; if markets are efficient, then stocks whose prices go up one month should go back down the next month, and vice versa. No; this just means that the stock market does not incorporate the news in past returns very quickly. No; if markets are efficient, then stocks whose prices go up one month should go back down the next month, and vice versa. What should equity traders do at the end of the month if the STR anomaly in the previous question represents mispricing? (Select all that apply) Buy stocks with the lowest returns over the month that just ended Short-sell stocks with the highest returns over the month that just ended Buy stocks with the highest returns over the month that just ended Short stocks with the lowest returns over the month that just ended Not enough information or none of the above