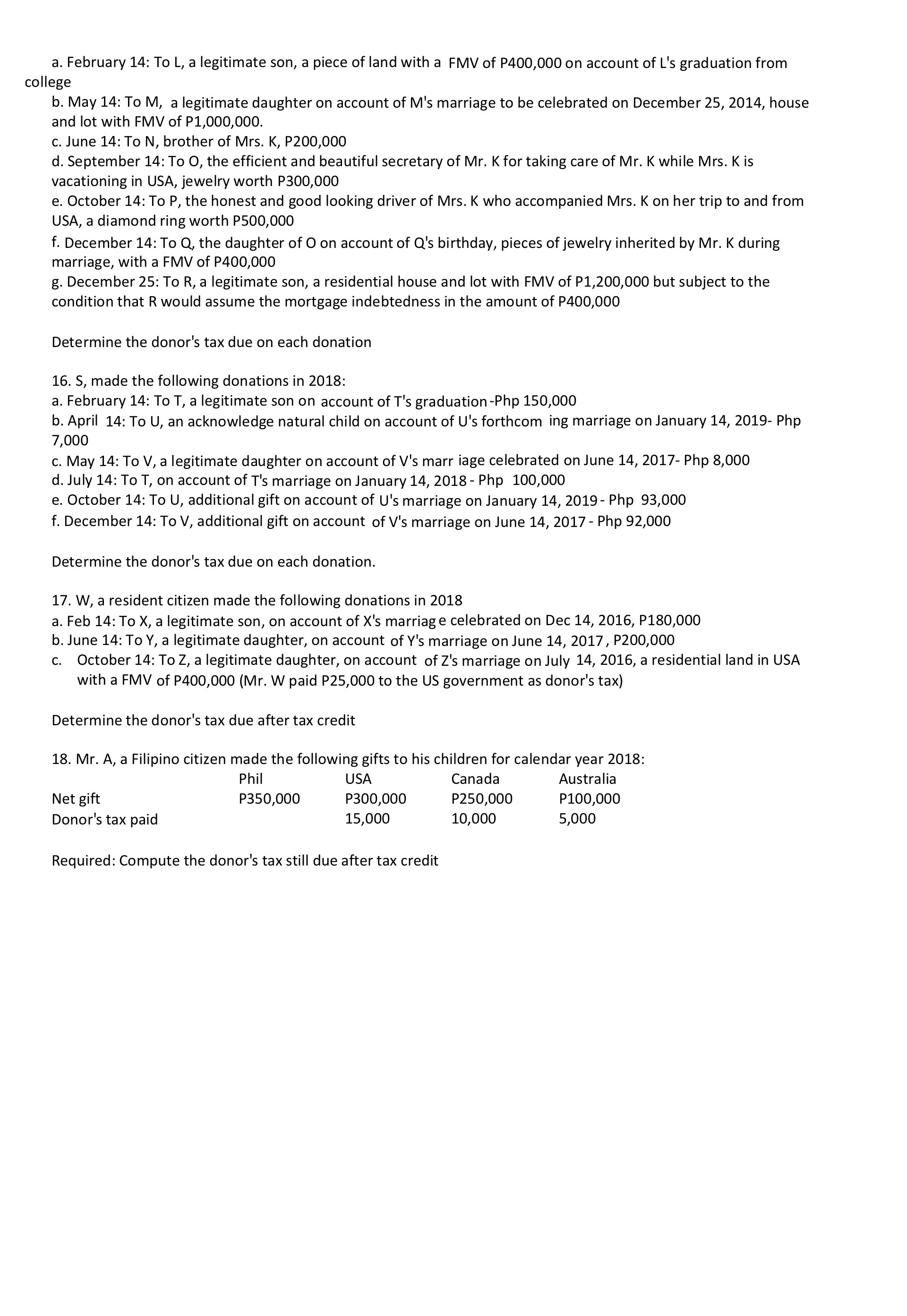

a. February 14: To L, a legitimate son, a piece of land with a FMV of P400,000 on account of L's graduation from college . May 14: To M, a legitimate daughter on account of M's marriage to be celebrated on December 25, 2014, house and lot with FMV of P1,000,000. c. June 14: To N, brother of Mrs. K, P200,000 d. September 14: To O, the efficient and beautiful secretary of Mr. K for taking care of Mr. K while Mrs. K is vacationing in USA, jewelry worth P300,000 e. October 14: To P, the honest and good looking driver of Mrs. K who accompanied Mrs. K on her trip to and from USA, a diamond ring worth P500,000 f. December 14: To Q, the daughter of O on account of Q's birthday, pieces of jewelry inherited by Mr. K during marriage, with a FMV of P400,000 g. December 25: To R, a legitimate son, a residential house and lot with FMV of P1,200,000 but subject to the condition that R would assume the mortgage indebtedness in the amount of P400,000 Determine the donor's tax due on each donation 16. S, made the following donations in 2018: a. February 14: To T, a legitimate son on account of T's graduation-Php 150,000 b. April 14: To U, an acknowledge natural child on account of U's forthcom ing marriage on January 14, 2019- Php 7,000 c. May 14: To V, a legitimate daughter on account of V's marriage celebrated on June 14, 2017- Php 8,000 d. July 14: To T, on account of T's marriage on January 14, 2018 - Php 100,000 e. October 14: To U, additional gift on account of U's marriage on January 14, 2019 - Php 93,000 f. December 14: To V, additional gift on account of V's marriage on June 14, 2017 - Php 92,000 Determine the donor's tax due on each donation. 17. W, a resident citizen made the following donations in 2018 a. Feb 14: To X, a legitimate son, on account of X's marriage celebrated on Dec 14, 2016, P180,000 b. June 14: To Y, a legitimate daughter, on account of Y's marriage on June 14, 2017, P200,000 c. October 14: To Z, a legitimate daughter, on account of Z's marriage on July 14, 2016, a residential land in USA with a FMV of P400,000 (Mr. W paid P25,000 to the US government as donor's tax) Determine the donor's tax due after tax credit 18. Mr. A, a Filipino citizen made the following gifts to his children for calendar year 2018: Phil USA Canada Australia Net gift P350,000 P300,000 P250,000 P100,000 Donor's tax paid 15,000 10,000 5,000 Required: Compute the donor's tax still due after tax credit