Answered step by step

Verified Expert Solution

Question

1 Approved Answer

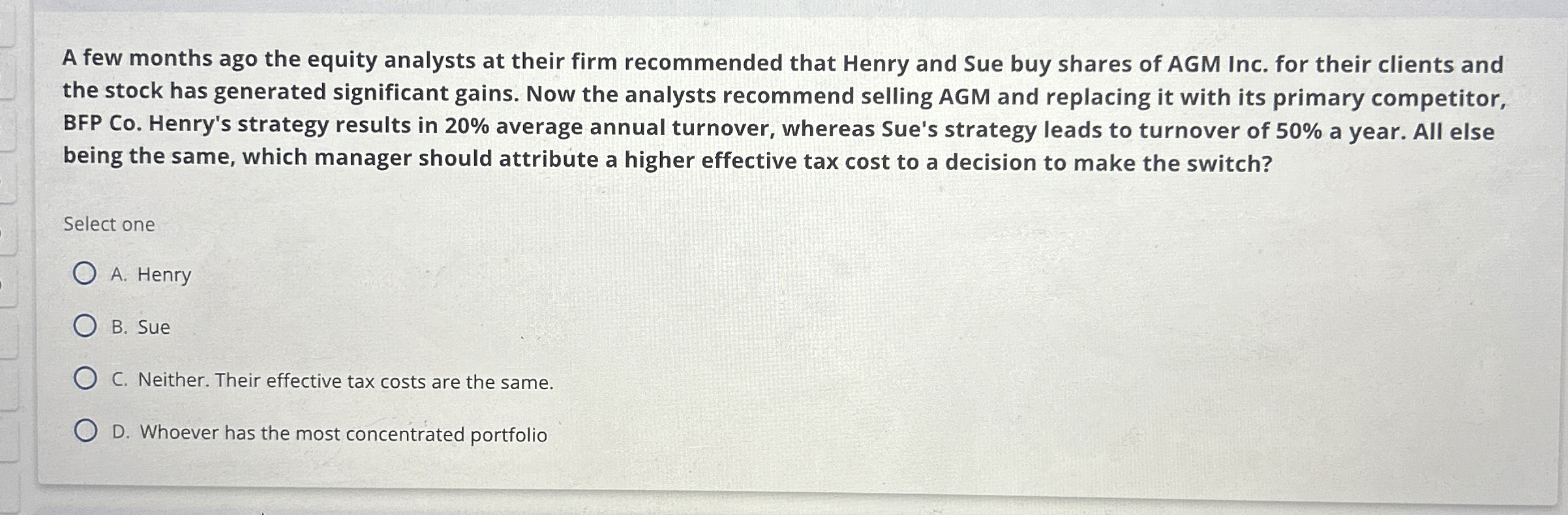

A few months ago the equity analysts at their firm recommended that Henry and Sue buy shares of AGM Inc. for their clients and the

A few months ago the equity analysts at their firm recommended that Henry and Sue buy shares of AGM Inc. for their clients and the stock has generated significant gains. Now the analysts recommend selling AGM and replacing it with its primary competitor, BFP Co Henry's strategy results in average annual turnover, whereas Sue's strategy leads to turnover of a year. All else being the same, which manager should attribute a higher effective tax cost to a decision to make the switch?

Select one

A Henry

B Sue

C Neither. Their effective tax costs are the same.

D Whoever has the most concentrated portfolio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started