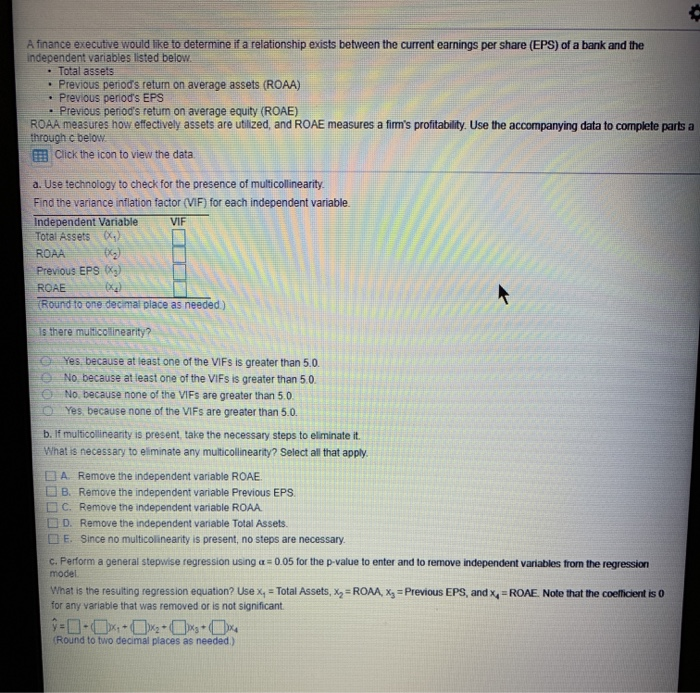

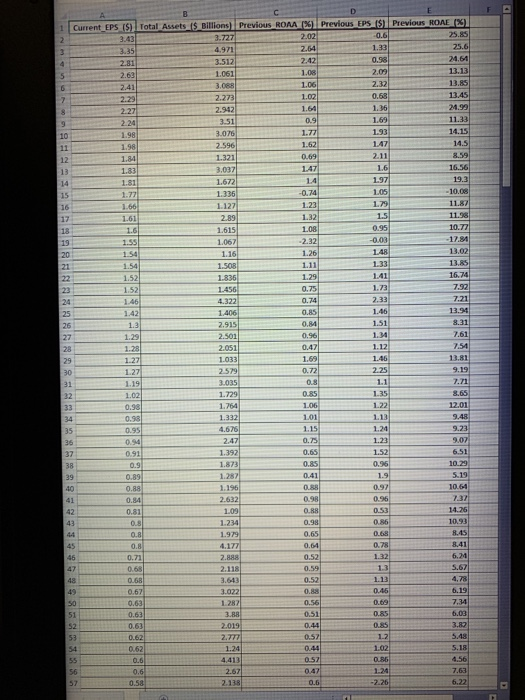

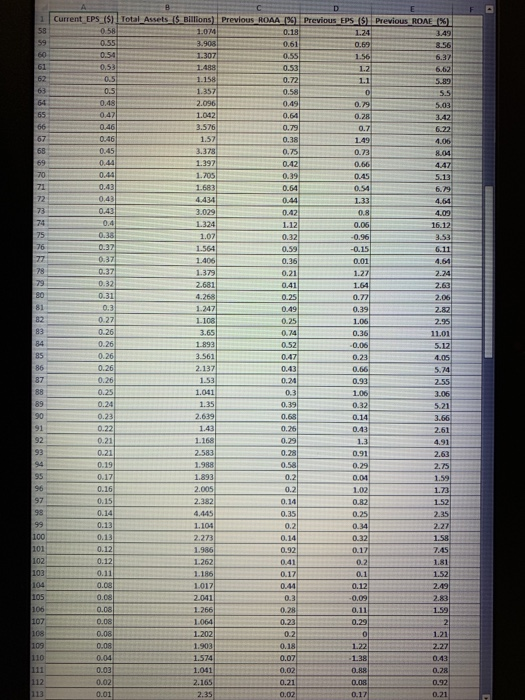

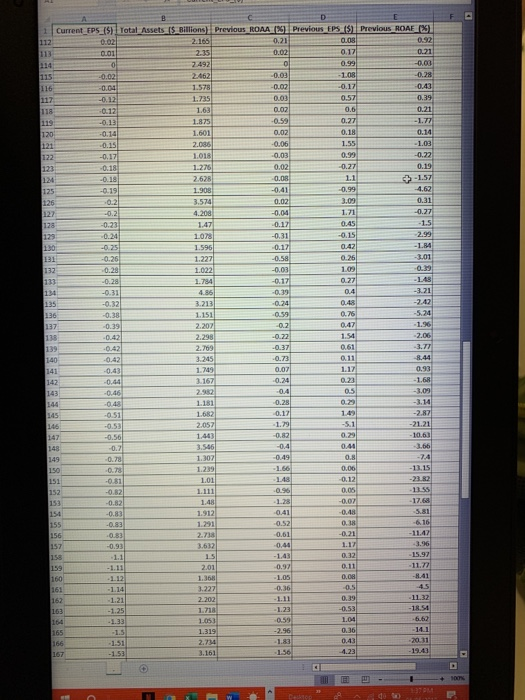

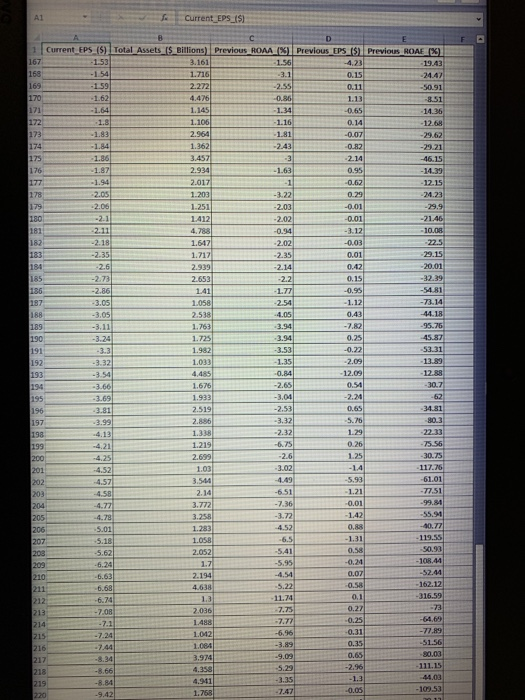

A finance executive would like to determine if a relationship exists between the current earnings per share (EPS) of a bank and the independent variables listed below Total assets Previous period's return on average assets (ROAA) Previous period's EPS Previous period's retun on average equity (ROAE) ROAA measures how effectively assets are utilized, and ROAE measures a fim's profitability. Use the accompanying data to complete parts a through c below FE Click the icon to view the data a. Use technology to check for the presence of multicollinearity. Find the variance inflation factor (VIF) for each independent variable. Independent Variable Total Assets ) VIF ROAA Previous EPS (X) (x.) ROAE (Round to one decimal place as needed) is there multicollinearity? O Yes, because at least one of the VIFS is greater than 5.0 No because at least one of the VIFS is qreater than 5 .0 No because none of the VIFS are greater than 5.0 Yes because none of the VIFS are greater than 5.0 b. If multicollinearity is present, take the necessary steps to eliminate it. What is necessary to eliminate any multicollinearity? Select all that apply A Remove the independent variable ROAE B. Remove the independent variable Previous EPS. C. Remove the independent variable ROAA D. Remove the independent variable Total Assets. E. Since no multicolinearity is present, no steps are necessary. C. Perform a general stepwise regression using a 0.05 for the p-value to enter and to remove independent variables from the regression model What is the resulting regression equation? Use x, Total Assets, x ROAA, X Previous EPS, and x, ROAE Note that the coelficient is 0 for any variable that was removed or is not significant (Round to two decimal places as needed) Previous ROAA ( % ) Previous EPS (S) Previous ROAE (% ) Current EPS IS) Total Assets (S Billions) 25.85 -0.6 2.02 3.727 3.43 2 25.6 2.64 1,33 4.971 3.35 24.64 0.98 2.42 3.512 2.81 4 13.13 2.09 1.08 1.061 2.63 5 13.85 3.088 2,32 106 2.41 6 0.68 13.45 1.02 2.273 2.29 24.99 1.36 1.64 2.942 8 2.27 11.33 0.9 1.69 3.51 2.24 9 14.15 193 1.77 3.076 1.98 10 14.5 147 1.62 2.596 1.98 11 8.59 2.11 0.69 1.321 1.84 12 16.56 16 147 3.037 1.83 13 19.3 197 14 1.672 14 1.81 10.08 105 -0.74 15 16 1.336 1.77 11.87 179 123 1.127 1.66 11.98 1.5 1.32 2.89 17 1.61 10.77 0.95 108 1.6 1.615 18 17.84 -0.03 -2.32 1.55 1.067 19 13.02 148 20 21 1.54 1.26 1.16 13.85 1.33 1.11 1.54 1.508 16.74 141 1.73 2.33 1836 1.29 22 1.52 1.52 7.92 23 1456 4.322 0.75 7.21 24 0.74 146 13.94 1.46 1.42) 0.85 1406 25. 8.31 1.51 0.84 1.3 2.915 26 7,61 1.M 2.501 0.96 27 1.29 1.28 7.54 0.47 1.12 2.051 28 1.46 13.81 1.69 1.27 1.033 29 2.25 9.19 2.579 0.72 30 1.27 3.035 7.71 0.8 1.1 31 1.19 8.65 1.729 0.85 135 1.02 22 1.764 106 1.22 12.01 0.98 33 101 1.13 9.48 1.332 34 0.98 9.23 4.676 1.15 1.24 0.95 35 0.94 9.07 2.47 0.75 1.23 36 37 0.65 1.52 6.51 1.392 0.91 10.29 1.873 0.85 0.96 0.9 38 5.19 1.287 0.41 1.9 39 0.89 088 0.97 10.64 1.196 40 0.88 2.632 0.98 7.37 0.96 0.84 41 14.26 1.09 0.88 0.53 42 0.81 10.93 0.98 43 0.86 0.8 1.234 0.65 8.45 0.68 44 0.8 1,979 0.78 8.41 45 0.8 4.177 0.64 6.24 0.52 1.32 46 0.71 2.888 S.67 1.3 47 0.68 2.118 0.59 48 49 1.13 4,78 0.52 0.68 3.643 6.19 0.88 0.45 0.67 3.022 0.69 7.34 0.63 1.287 0.56 50 51 3.88 6.03 0.51 0.85 0.63 2.019 0.85 3.82 52 0.63 0.44 0.57 5.48 53 2.777 1.2 0.62 1.24 0.44 1.02 5.18 54 0.62 4.56 55 4413 0.57 0.86 0.6 0.47 56 2.67 1.24 7,63 0.6 -2.26 2.138 0.6 6.22 0.58 57 D Current EPS ($) Total Assets (S Billions) Previous ROAA (% ) Previous EPS (S) Previous ROAE (%) 58 0.58 1.074 0.18 1.24 3,49 59 0.61) 0.55 3.908 0.69 8.56 0.54 60 1.307 0.55 1.56 6.37 61 62 63 0.53 1.488 0.53 1.2 6,62 0.5 1.158 0.72 1.1 5.89 0.58 0.5 1.357 5.5 64 0.48 2.096 0.49 0.79 5,03 65 66 047 1.042 0.64 0.28 3.42 0.46 3.576 0.79 0.7 6.22 67 0.46 1.57 0.38 149 4.06 68 0.45 3,378 8.04 4.47 0.75 0.73 69 0.44 1.397 0.66 0.42 70 0.44 1.705 0.39 0.45 5.13 71 0.43 1.683 0.64 0.54 6,79 72 0.43 4.434 0.44 1.33 4.64 73 0.43 0.8 3.029 0.42 4.00 0.4 74 1.324 1.12 0.06 16.12 0.38 75 1.07 0.32 -0.96 3.53 76 0.37 1.564 0.59 -0.15 6.11 77 0.37 1406 0.36 0.01 4.64 78 0.37 1.379 0.21 1.27 2.24 79 0.32 1.64 2.63 2.681 0.41 80 0.31 4.268 0.25 0.77 2.06 81 0.3 1.247 0.49 0.39 2.82 L108 82 0.27 0.25 1.06 2,95 83 0.26 3.65 0.74 0.36 11.01 84 0.26 1.893 0.52 0,06 5.12 85 0.47 0.26 3.561 0.23 4.05 86 0.66 0.26 2.137 0.43 5.74 1.53 0.24 87 0.26 0.93 2.55 88 89 106 0.25 1.041 0.3 3.06 0.24 1.35 0.39 0.32 5.21 90 0.14 0.23 2.639 0.68 3.66 91 0.22 1.43 0.26 0.43 2.61 92 0.29 0.21 1.3 1.168 4.91 93 0.21 2.583 0.28 0.91 2.63 94 0.58 0.29 0.19 1.988 2.75 0.17 0.16 0.15 0.14 95 1.893 0.2 0.04 1.59 96 0.2 0.14 2.005 1.02 1.73 97 2.382 0.82 1.52 98 4.445 0.35 0.25 2.35 99 0.13 1.104 0.2 2.27 0.34 100 0.14 0.13 2.273 0.32 1.58 0.12 101 1.986 0.92 0.17 745 102 103 104 0.2 0.12 1.262 0.41 1,81 1.186 0.17 0.11 0.1 1.52 0.08 1.017 0.44 0.12 2.49 105 106 107 108 0.08 0.3 2041 0.09 2.83 0.08 0.28 1.266 0.11 1,59 0.08 1064 0.23 0.29 2 0.21 0.08 1.202 1.21 109 0.08 1.903 0.18 1.22 2,27 110 0.04 1,574 0.07 1.38 0.43 111 112 113 0.03 0,02 1.041 0.88 0.28 0,02 2.165 0.21 0,08 0.92 2.35 0.02 0.17 0.01 0.21 Current FPS (S) Yotal Assets ($ Billions) Previous ROAA (%) Previous EPS (S) Previous ROAE X) 112 113 114 0,08 0.92 2.165 0.21 0.02 0.02 0.17 0.21 2.35 CL01 0.99 -0,03 0 2492 0.28] 2462 -0.02 -0.03 -108 115 0.43 116 117 1.578 0.02 -0.17 -0.04 -0.12 0,03 0.57 0.39 1.735 0.21 - 1.77 0.6 1.63 118 0.02 0.12 1.875 -0.59 0.27 119 -0.13 0.02 -0.06 0.14 1.601 0.18 120 121 122 123 124 125 126 127 128 129 -0.14 1.55 -1.03 0.15 2.086 0.22 0,03 0.99 1.018 -0.17 1.276 0.02 0.08 -0.27 0.19 -0.18 -1.57) 1.1 2.628 -0.18 -0.99 4.62 -0.41 ) -0.19 1,908 0.02) 0.31 3.09 0.2 3.574 -0.04 1.71 -0.27 4.208 0.2 0.45 -1.5 -0.17) -0.23 147 2.99 -0.31 -0.15 0.24 1078 0.17) 0.42 -184 -0.25 1.596 -0.26 -0.58 3.01 131 132 0.26 1.227 0.39 -0.03 -0.17) 109 0.28 1.022 133 0.27 -L48 0.28 1.784 -0.39 -3.21 134 04 -0.31 4.86 0.24 -2.42 135 0.48 -0.32 3.213 0.76 -5.24 -0.38 1.151 -0.59 1.96 137 138 047 -0.39 2.207 0.2 -2.06 1.54 2.298 -0.22 -0.42 2.769 0.37 0.61 -3.77 139 -0.42 011 8.44 140 3.245 -0.73 -0.42 0,07 1.749 0.93 141 142 1.17 -0.43 -1.68 0.23 3.167 0.24 -0.44 2.982 0.5 -3.09 143 144 -04 -0.46 029 - 3.14 1.181 -0.28 048 1.49 -2.87 145 1.682 -0.17 -0.51 -5.1 -21.21 146 2.057 -1.79 -0.53 0,82 -10.63 144 0.29 -0.56 - 3.66 148 3.546 -0.4 0.44 -0.7 -74 1.307 -0.49 0.8 149 -0.78 -13.15 150 1.239 -1.66 0,06 -0.78 -23.82 151 148 -0.12 -0.81 1.01 0.05 -13.55 152 -0.96 -0.82 1.111 -0.07 -17.68 153 1.28 -0.82 1.48 -0.48 154 155 156 157 158 -0.83 -5.81 1.912 -041 -6.16 0.38 -0.83 1.291 -0.52 -0.21) 0.83 -11.47 2.738 0.61 -3.96 15.97 1.17 3.632 -0.44 -0.93 -1.43 0.32 -1.1 15 -11.77 0.11 159 -0.97 -1.11 2.01 -8.41 0.08 160 161 1.368 -1.05 1.12 45 -0.36 0.5 3.227 2.202 1.718 -1.14 11.32 162 -111 0.39 -1.21 -18.54 -1.23 -0.53 163 -1.25 -6.62 059 104 164 1.053 -1.33 -2.96 0.36 -14.1 165 1.319 -1.5 0.43 20.31 2.734. -1.83 66 1.51 - 19.43 167 4.23 3.161 1.56 -1.53 100% R8EB8588E368 Current EPS (S) A1 Current EPS (5)I Total Assets (S Billions) Previous ROAA (% ) Previous EPS (S) Previous ROAE (X) 167 168 169 170 171 -153 3.161 -1.56 -4.23 19.43 -1.54 1.716 -3.1 0.15 -24.47 -159 2.272 -2.55 0.11 -50.91 -0.86 -1.62 4.476 1.13 -8.51 -1.34 -1.64 1.145 -0.65 14.36 - 1.16 172 173 174 175 176 177 12.68 1.8 1.106 0.14 2.964 -1.83 -1.81 -0.07 29.62 -1.84 1.362 -2.43 -0.82 -29.21 -1.86 3.457 -2.14 46.15 2.934 1.87 -1.63 0.95 -14.39 2.017 - 1.94 -0.62 12.15 178 179 180 2.05 1.203 -3.22 0.29 24.23 -2.06 -0.01 -29.9 1.251 -2.03 -21.46 -2.1 1412 -2.02 -001) 181 182 2.11 10.08 4,788 0.9 -3.12 -22.5 -2.18 1.647 -2.02 -0.03 29.15 183 1.717 - 2-35 -2.35 0.01 184 185 186 187 188 189 190 2.939 -2.14 -20,01 2.6 0.42 2.653 -32.39 -2.73 -2.2 0.15 141 -54.81 -2.86 -1.77 -0.95 -73.14 3.05 1058 -2.54 - 1.12 44.18 0.43 -3.05 2.538 4.05 3.94 -7.82 -95.76 -3.11 1.763 - 3.94 0.25 45.87 -3.24 1.725 191 192 -53.31 1,982 -3.53 -0.22 3.3 13.89 1.033 -1.35 -2.09 -3.32 12.88 -12.09 193 -3.54 4.485 0.84 194 195 196 197 198 -2.65 0.54 30.7 1.676 - 3.66 -3.04 - 2.24 -62 -3.69 1.933 -2.53 0.65 34.81 -3.81 2.519 2.886 -5.76 - 3.32 80.3 -3.99 1.29 -2.32 22.33 1.338 4.13 -6,75 75.56 1.219 0.26 199 200 201 202 203 204 205 206 207 208 4.21 -2.6 1.25 30.75 2.699 -4,25 117.76 -3.02 4.52 -14 1.03 -61.01 -4.49 -5.93 3.544 -4.57 - 1.21 -4.58 -77.51 -6.51 2.14 -99.84 -7.36 -0.01 3.772 4.77 -55.94 -1.42 3.258 -3.72 -4.78 4.52 0.88 -40.77 5.01 1.283 119.55 -6.5 -1.31 1.058 -5.18 -50,93 -541 0.58 2.052 5.62 -0.24 -108.44 -5.95 209 210 211 212 213 214 215 216 217 218 219 220 1.7 -6.24 -52.44 2.194 0.07 -4.54 -6.63 162.12 0.58 -6.68 -5.225 4.638 11.74 316.59 0.1 1.3 -6.74 -73 0.27 7.75 2.036- -7.08 -64.69 0.25 -7.77 1.488 -7.1 -6.96 -3.89 -77.89 -0.31 1.042 -7.24 -51.56 1.084 -7.44 0,65 80,03 3.974 -9.09 - 8.34 -111.15 - 2.96 -5.29 4.358 -8.66 44.03 -1.3 -a.35 -8.84 4,941 109.53 0.05 -7.47 -9.42 1.768 A finance executive would like to determine if a relationship exists between the current earnings per share (EPS) of a bank and the independent variables listed below Total assets Previous period's return on average assets (ROAA) Previous period's EPS Previous period's retun on average equity (ROAE) ROAA measures how effectively assets are utilized, and ROAE measures a fim's profitability. Use the accompanying data to complete parts a through c below FE Click the icon to view the data a. Use technology to check for the presence of multicollinearity. Find the variance inflation factor (VIF) for each independent variable. Independent Variable Total Assets ) VIF ROAA Previous EPS (X) (x.) ROAE (Round to one decimal place as needed) is there multicollinearity? O Yes, because at least one of the VIFS is greater than 5.0 No because at least one of the VIFS is qreater than 5 .0 No because none of the VIFS are greater than 5.0 Yes because none of the VIFS are greater than 5.0 b. If multicollinearity is present, take the necessary steps to eliminate it. What is necessary to eliminate any multicollinearity? Select all that apply A Remove the independent variable ROAE B. Remove the independent variable Previous EPS. C. Remove the independent variable ROAA D. Remove the independent variable Total Assets. E. Since no multicolinearity is present, no steps are necessary. C. Perform a general stepwise regression using a 0.05 for the p-value to enter and to remove independent variables from the regression model What is the resulting regression equation? Use x, Total Assets, x ROAA, X Previous EPS, and x, ROAE Note that the coelficient is 0 for any variable that was removed or is not significant (Round to two decimal places as needed) Previous ROAA ( % ) Previous EPS (S) Previous ROAE (% ) Current EPS IS) Total Assets (S Billions) 25.85 -0.6 2.02 3.727 3.43 2 25.6 2.64 1,33 4.971 3.35 24.64 0.98 2.42 3.512 2.81 4 13.13 2.09 1.08 1.061 2.63 5 13.85 3.088 2,32 106 2.41 6 0.68 13.45 1.02 2.273 2.29 24.99 1.36 1.64 2.942 8 2.27 11.33 0.9 1.69 3.51 2.24 9 14.15 193 1.77 3.076 1.98 10 14.5 147 1.62 2.596 1.98 11 8.59 2.11 0.69 1.321 1.84 12 16.56 16 147 3.037 1.83 13 19.3 197 14 1.672 14 1.81 10.08 105 -0.74 15 16 1.336 1.77 11.87 179 123 1.127 1.66 11.98 1.5 1.32 2.89 17 1.61 10.77 0.95 108 1.6 1.615 18 17.84 -0.03 -2.32 1.55 1.067 19 13.02 148 20 21 1.54 1.26 1.16 13.85 1.33 1.11 1.54 1.508 16.74 141 1.73 2.33 1836 1.29 22 1.52 1.52 7.92 23 1456 4.322 0.75 7.21 24 0.74 146 13.94 1.46 1.42) 0.85 1406 25. 8.31 1.51 0.84 1.3 2.915 26 7,61 1.M 2.501 0.96 27 1.29 1.28 7.54 0.47 1.12 2.051 28 1.46 13.81 1.69 1.27 1.033 29 2.25 9.19 2.579 0.72 30 1.27 3.035 7.71 0.8 1.1 31 1.19 8.65 1.729 0.85 135 1.02 22 1.764 106 1.22 12.01 0.98 33 101 1.13 9.48 1.332 34 0.98 9.23 4.676 1.15 1.24 0.95 35 0.94 9.07 2.47 0.75 1.23 36 37 0.65 1.52 6.51 1.392 0.91 10.29 1.873 0.85 0.96 0.9 38 5.19 1.287 0.41 1.9 39 0.89 088 0.97 10.64 1.196 40 0.88 2.632 0.98 7.37 0.96 0.84 41 14.26 1.09 0.88 0.53 42 0.81 10.93 0.98 43 0.86 0.8 1.234 0.65 8.45 0.68 44 0.8 1,979 0.78 8.41 45 0.8 4.177 0.64 6.24 0.52 1.32 46 0.71 2.888 S.67 1.3 47 0.68 2.118 0.59 48 49 1.13 4,78 0.52 0.68 3.643 6.19 0.88 0.45 0.67 3.022 0.69 7.34 0.63 1.287 0.56 50 51 3.88 6.03 0.51 0.85 0.63 2.019 0.85 3.82 52 0.63 0.44 0.57 5.48 53 2.777 1.2 0.62 1.24 0.44 1.02 5.18 54 0.62 4.56 55 4413 0.57 0.86 0.6 0.47 56 2.67 1.24 7,63 0.6 -2.26 2.138 0.6 6.22 0.58 57 D Current EPS ($) Total Assets (S Billions) Previous ROAA (% ) Previous EPS (S) Previous ROAE (%) 58 0.58 1.074 0.18 1.24 3,49 59 0.61) 0.55 3.908 0.69 8.56 0.54 60 1.307 0.55 1.56 6.37 61 62 63 0.53 1.488 0.53 1.2 6,62 0.5 1.158 0.72 1.1 5.89 0.58 0.5 1.357 5.5 64 0.48 2.096 0.49 0.79 5,03 65 66 047 1.042 0.64 0.28 3.42 0.46 3.576 0.79 0.7 6.22 67 0.46 1.57 0.38 149 4.06 68 0.45 3,378 8.04 4.47 0.75 0.73 69 0.44 1.397 0.66 0.42 70 0.44 1.705 0.39 0.45 5.13 71 0.43 1.683 0.64 0.54 6,79 72 0.43 4.434 0.44 1.33 4.64 73 0.43 0.8 3.029 0.42 4.00 0.4 74 1.324 1.12 0.06 16.12 0.38 75 1.07 0.32 -0.96 3.53 76 0.37 1.564 0.59 -0.15 6.11 77 0.37 1406 0.36 0.01 4.64 78 0.37 1.379 0.21 1.27 2.24 79 0.32 1.64 2.63 2.681 0.41 80 0.31 4.268 0.25 0.77 2.06 81 0.3 1.247 0.49 0.39 2.82 L108 82 0.27 0.25 1.06 2,95 83 0.26 3.65 0.74 0.36 11.01 84 0.26 1.893 0.52 0,06 5.12 85 0.47 0.26 3.561 0.23 4.05 86 0.66 0.26 2.137 0.43 5.74 1.53 0.24 87 0.26 0.93 2.55 88 89 106 0.25 1.041 0.3 3.06 0.24 1.35 0.39 0.32 5.21 90 0.14 0.23 2.639 0.68 3.66 91 0.22 1.43 0.26 0.43 2.61 92 0.29 0.21 1.3 1.168 4.91 93 0.21 2.583 0.28 0.91 2.63 94 0.58 0.29 0.19 1.988 2.75 0.17 0.16 0.15 0.14 95 1.893 0.2 0.04 1.59 96 0.2 0.14 2.005 1.02 1.73 97 2.382 0.82 1.52 98 4.445 0.35 0.25 2.35 99 0.13 1.104 0.2 2.27 0.34 100 0.14 0.13 2.273 0.32 1.58 0.12 101 1.986 0.92 0.17 745 102 103 104 0.2 0.12 1.262 0.41 1,81 1.186 0.17 0.11 0.1 1.52 0.08 1.017 0.44 0.12 2.49 105 106 107 108 0.08 0.3 2041 0.09 2.83 0.08 0.28 1.266 0.11 1,59 0.08 1064 0.23 0.29 2 0.21 0.08 1.202 1.21 109 0.08 1.903 0.18 1.22 2,27 110 0.04 1,574 0.07 1.38 0.43 111 112 113 0.03 0,02 1.041 0.88 0.28 0,02 2.165 0.21 0,08 0.92 2.35 0.02 0.17 0.01 0.21 Current FPS (S) Yotal Assets ($ Billions) Previous ROAA (%) Previous EPS (S) Previous ROAE X) 112 113 114 0,08 0.92 2.165 0.21 0.02 0.02 0.17 0.21 2.35 CL01 0.99 -0,03 0 2492 0.28] 2462 -0.02 -0.03 -108 115 0.43 116 117 1.578 0.02 -0.17 -0.04 -0.12 0,03 0.57 0.39 1.735 0.21 - 1.77 0.6 1.63 118 0.02 0.12 1.875 -0.59 0.27 119 -0.13 0.02 -0.06 0.14 1.601 0.18 120 121 122 123 124 125 126 127 128 129 -0.14 1.55 -1.03 0.15 2.086 0.22 0,03 0.99 1.018 -0.17 1.276 0.02 0.08 -0.27 0.19 -0.18 -1.57) 1.1 2.628 -0.18 -0.99 4.62 -0.41 ) -0.19 1,908 0.02) 0.31 3.09 0.2 3.574 -0.04 1.71 -0.27 4.208 0.2 0.45 -1.5 -0.17) -0.23 147 2.99 -0.31 -0.15 0.24 1078 0.17) 0.42 -184 -0.25 1.596 -0.26 -0.58 3.01 131 132 0.26 1.227 0.39 -0.03 -0.17) 109 0.28 1.022 133 0.27 -L48 0.28 1.784 -0.39 -3.21 134 04 -0.31 4.86 0.24 -2.42 135 0.48 -0.32 3.213 0.76 -5.24 -0.38 1.151 -0.59 1.96 137 138 047 -0.39 2.207 0.2 -2.06 1.54 2.298 -0.22 -0.42 2.769 0.37 0.61 -3.77 139 -0.42 011 8.44 140 3.245 -0.73 -0.42 0,07 1.749 0.93 141 142 1.17 -0.43 -1.68 0.23 3.167 0.24 -0.44 2.982 0.5 -3.09 143 144 -04 -0.46 029 - 3.14 1.181 -0.28 048 1.49 -2.87 145 1.682 -0.17 -0.51 -5.1 -21.21 146 2.057 -1.79 -0.53 0,82 -10.63 144 0.29 -0.56 - 3.66 148 3.546 -0.4 0.44 -0.7 -74 1.307 -0.49 0.8 149 -0.78 -13.15 150 1.239 -1.66 0,06 -0.78 -23.82 151 148 -0.12 -0.81 1.01 0.05 -13.55 152 -0.96 -0.82 1.111 -0.07 -17.68 153 1.28 -0.82 1.48 -0.48 154 155 156 157 158 -0.83 -5.81 1.912 -041 -6.16 0.38 -0.83 1.291 -0.52 -0.21) 0.83 -11.47 2.738 0.61 -3.96 15.97 1.17 3.632 -0.44 -0.93 -1.43 0.32 -1.1 15 -11.77 0.11 159 -0.97 -1.11 2.01 -8.41 0.08 160 161 1.368 -1.05 1.12 45 -0.36 0.5 3.227 2.202 1.718 -1.14 11.32 162 -111 0.39 -1.21 -18.54 -1.23 -0.53 163 -1.25 -6.62 059 104 164 1.053 -1.33 -2.96 0.36 -14.1 165 1.319 -1.5 0.43 20.31 2.734. -1.83 66 1.51 - 19.43 167 4.23 3.161 1.56 -1.53 100% R8EB8588E368 Current EPS (S) A1 Current EPS (5)I Total Assets (S Billions) Previous ROAA (% ) Previous EPS (S) Previous ROAE (X) 167 168 169 170 171 -153 3.161 -1.56 -4.23 19.43 -1.54 1.716 -3.1 0.15 -24.47 -159 2.272 -2.55 0.11 -50.91 -0.86 -1.62 4.476 1.13 -8.51 -1.34 -1.64 1.145 -0.65 14.36 - 1.16 172 173 174 175 176 177 12.68 1.8 1.106 0.14 2.964 -1.83 -1.81 -0.07 29.62 -1.84 1.362 -2.43 -0.82 -29.21 -1.86 3.457 -2.14 46.15 2.934 1.87 -1.63 0.95 -14.39 2.017 - 1.94 -0.62 12.15 178 179 180 2.05 1.203 -3.22 0.29 24.23 -2.06 -0.01 -29.9 1.251 -2.03 -21.46 -2.1 1412 -2.02 -001) 181 182 2.11 10.08 4,788 0.9 -3.12 -22.5 -2.18 1.647 -2.02 -0.03 29.15 183 1.717 - 2-35 -2.35 0.01 184 185 186 187 188 189 190 2.939 -2.14 -20,01 2.6 0.42 2.653 -32.39 -2.73 -2.2 0.15 141 -54.81 -2.86 -1.77 -0.95 -73.14 3.05 1058 -2.54 - 1.12 44.18 0.43 -3.05 2.538 4.05 3.94 -7.82 -95.76 -3.11 1.763 - 3.94 0.25 45.87 -3.24 1.725 191 192 -53.31 1,982 -3.53 -0.22 3.3 13.89 1.033 -1.35 -2.09 -3.32 12.88 -12.09 193 -3.54 4.485 0.84 194 195 196 197 198 -2.65 0.54 30.7 1.676 - 3.66 -3.04 - 2.24 -62 -3.69 1.933 -2.53 0.65 34.81 -3.81 2.519 2.886 -5.76 - 3.32 80.3 -3.99 1.29 -2.32 22.33 1.338 4.13 -6,75 75.56 1.219 0.26 199 200 201 202 203 204 205 206 207 208 4.21 -2.6 1.25 30.75 2.699 -4,25 117.76 -3.02 4.52 -14 1.03 -61.01 -4.49 -5.93 3.544 -4.57 - 1.21 -4.58 -77.51 -6.51 2.14 -99.84 -7.36 -0.01 3.772 4.77 -55.94 -1.42 3.258 -3.72 -4.78 4.52 0.88 -40.77 5.01 1.283 119.55 -6.5 -1.31 1.058 -5.18 -50,93 -541 0.58 2.052 5.62 -0.24 -108.44 -5.95 209 210 211 212 213 214 215 216 217 218 219 220 1.7 -6.24 -52.44 2.194 0.07 -4.54 -6.63 162.12 0.58 -6.68 -5.225 4.638 11.74 316.59 0.1 1.3 -6.74 -73 0.27 7.75 2.036- -7.08 -64.69 0.25 -7.77 1.488 -7.1 -6.96 -3.89 -77.89 -0.31 1.042 -7.24 -51.56 1.084 -7.44 0,65 80,03 3.974 -9.09 - 8.34 -111.15 - 2.96 -5.29 4.358 -8.66 44.03 -1.3 -a.35 -8.84 4,941 109.53 0.05 -7.47 -9.42 1.768