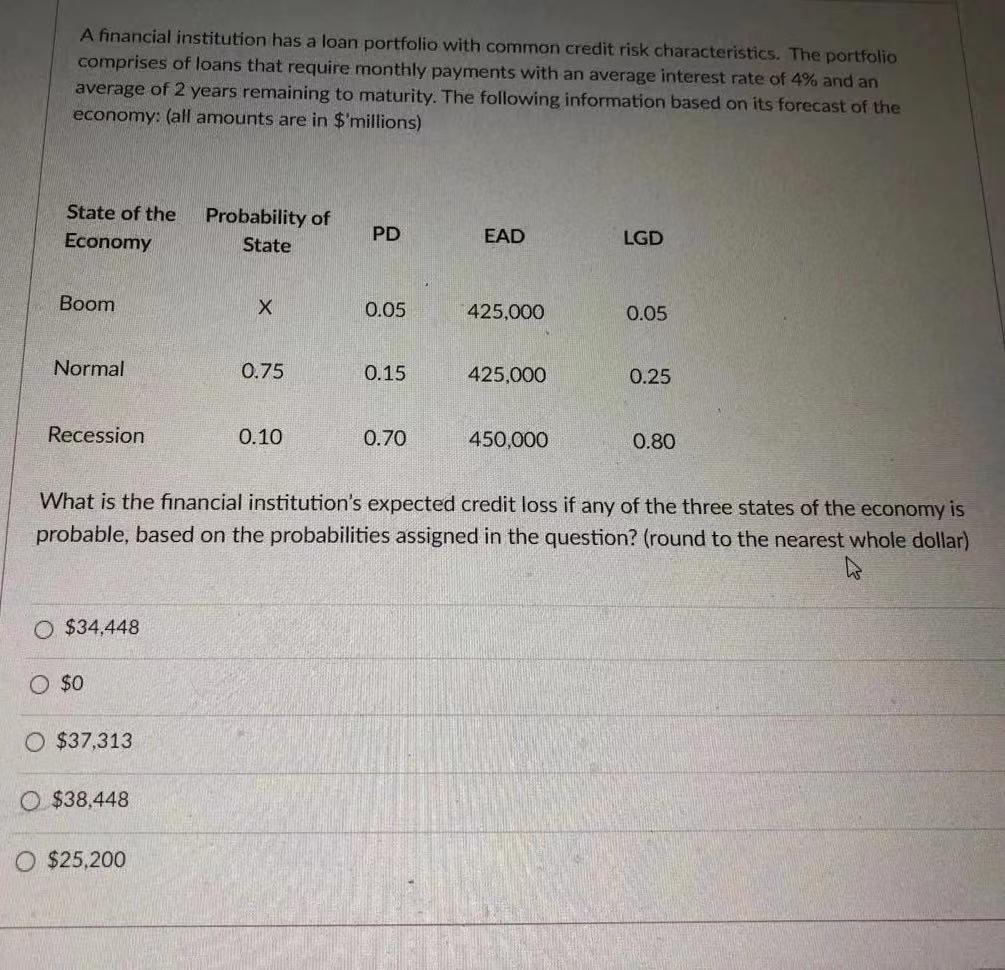

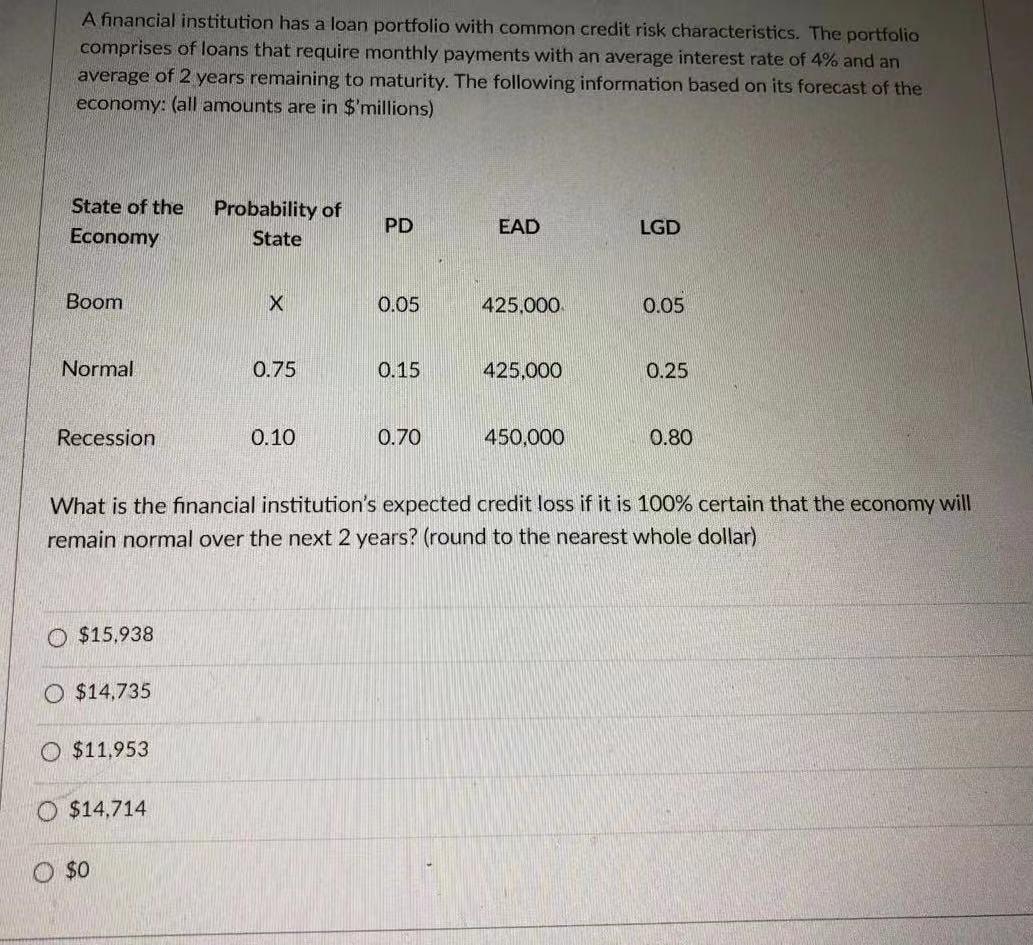

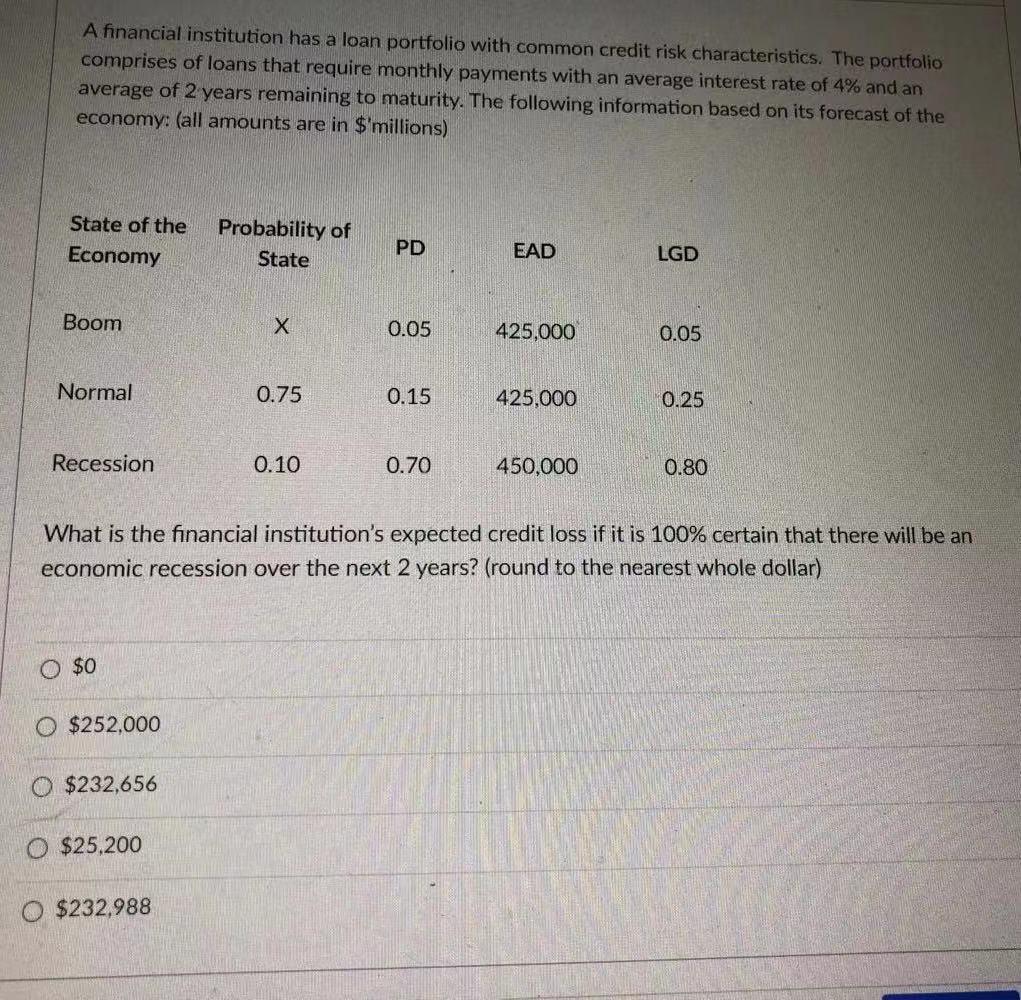

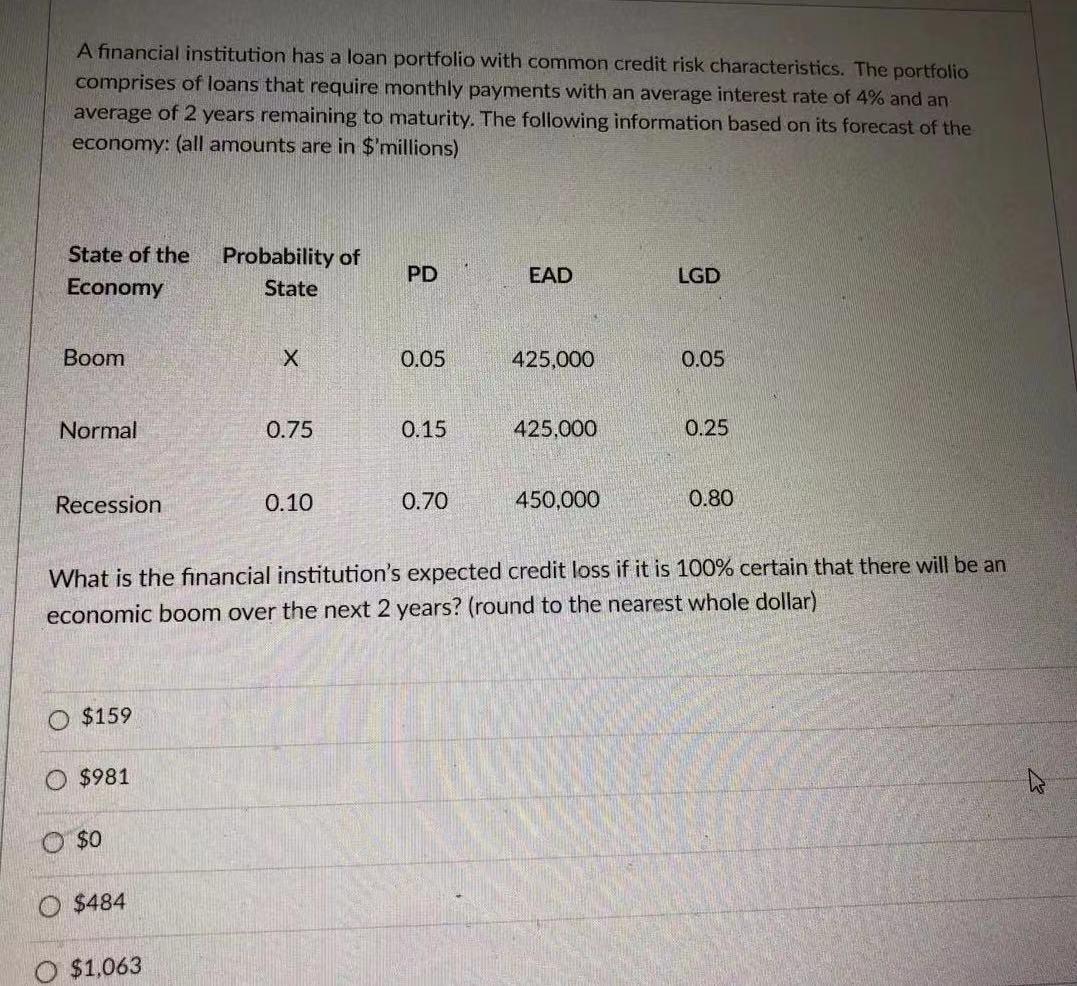

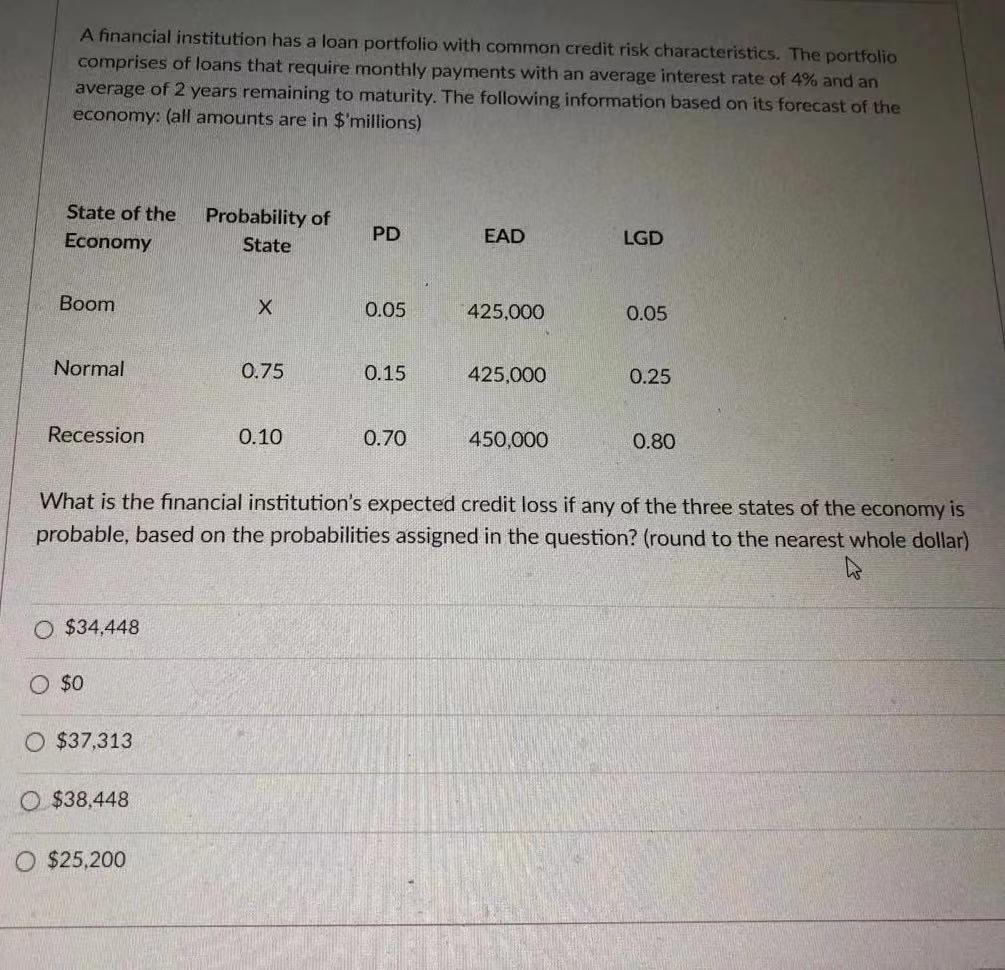

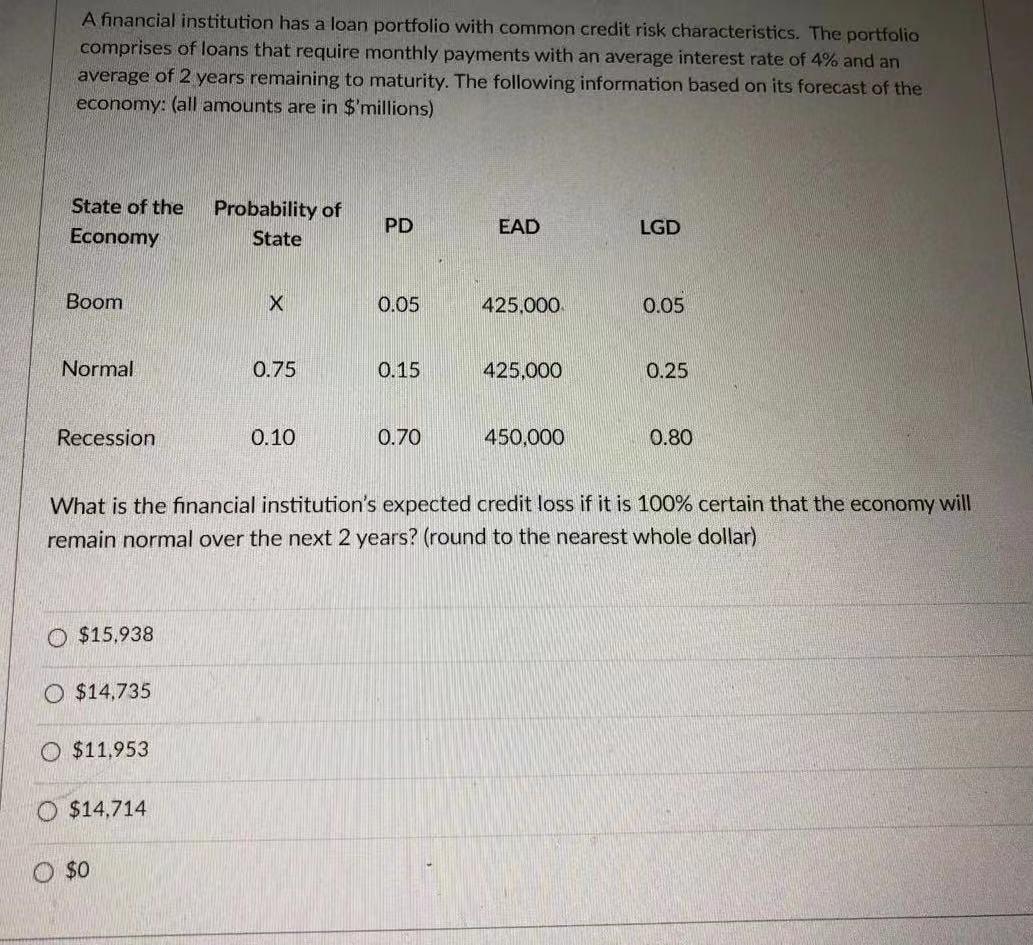

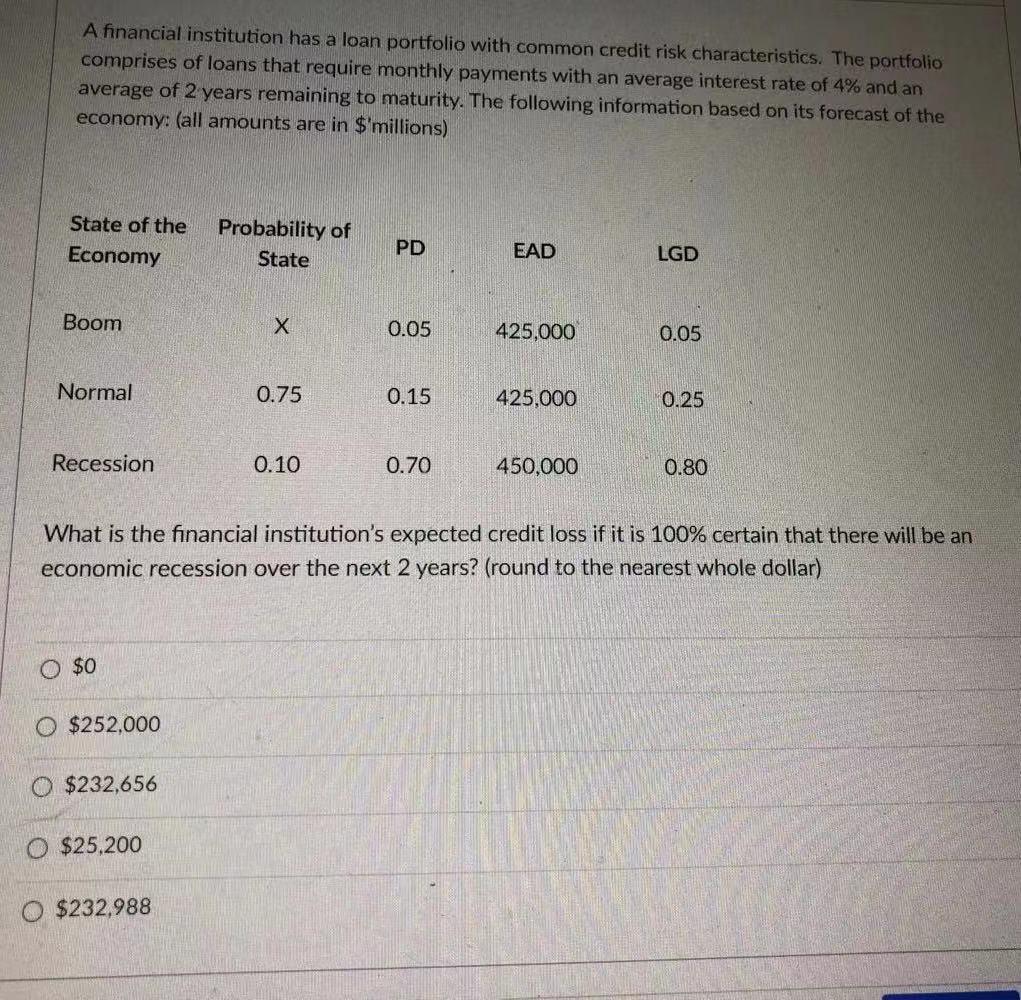

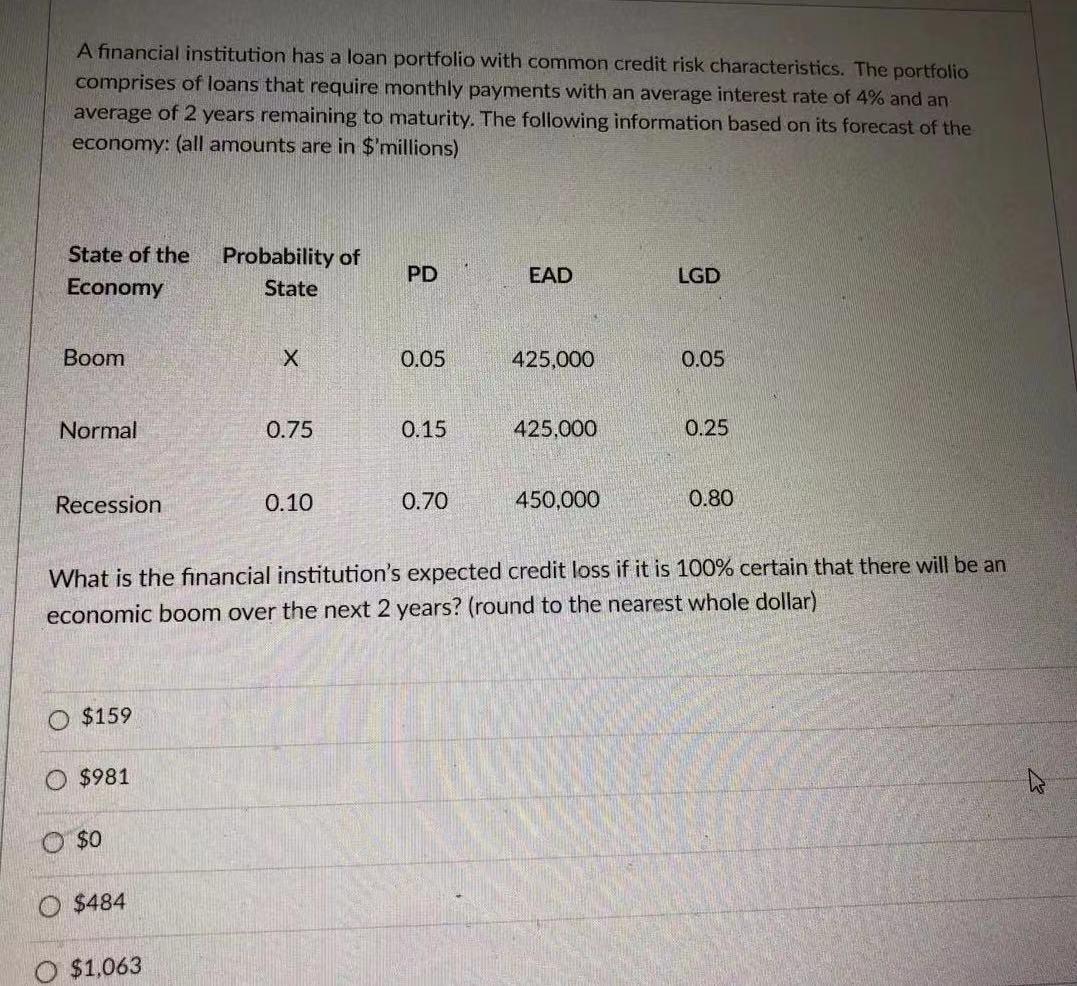

A financial institution has a loan portfolio with common credit risk characteristics. The portfolio comprises of loans that require monthly payments with an average interest rate of 4% and an average of 2 years remaining to maturity. The following information based on its forecast of the economy: (all amounts are in $'millions) State of the Economy Probability of State PD EAD LGD Boom X 0.05 425,000 0.05 Normal 0.75 0.15 425,000 0.25 Recession 0.10 0.70 450,000 0.80 What is the financial institution's expected credit loss if any of the three states of the economy is probable, based on the probabilities assigned in the question? (round to the nearest whole dollar) O $34,448 $0 O $37,313 O $38,448 O $25,200 A financial institution has a loan portfolio with common credit risk characteristics. The portfolio comprises of loans that require monthly payments with an average interest rate of 4% and an average of 2 years remaining to maturity. The following information based on its forecast of the economy: (all amounts are in $'millions) State of the Economy Probability of State PD EAD LGD Boom X 0.05 425.000 0.05 Normal 0.75 0.15 425,000 0.25 Recession 0.10 0.70 450,000 0.80 What is the financial institution's expected credit loss if it is 100% certain that the economy will remain normal over the next 2 years? (round to the nearest whole dollar) $15.938 0 $14,735 O $11.953 $14,714 0 $0 A financial institution has a loan portfolio with common credit risk characteristics. The portfolio comprises of loans that require monthly payments with an average interest rate of 4% and an average of 2 years remaining to maturity. The following information based on its forecast of the economy: (all amounts are in $'millions) State of the Economy Probability of State PD EAD LGD Boom 0.05 425,000 0.05 Normal 0.75 0.15 425,000 0.25 Re ssion 0.10 0.70 450,000 0.80 What is the financial institution's expected credit loss if it is 100% certain that there will be an economic recession over the next 2 years? (round to the nearest whole dollar) $0 O $252,000 0 $232,656 $25,200 $232,988 A financial institution has a loan portfolio with common credit risk characteristics. The portfolio comprises of loans that require monthly payments with an average interest rate of 4% and an average of 2 years remaining to maturity. The following information based on its forecast of the economy: (all amounts are in $'millions) State of the Economy Probability of State PD EAD LGD Boom x 0.05 425,000 0.05 Normal 0.75 0.15 425,000 0.25 Recession 0.10 0.70 450,000 0.80 What is the financial institution's expected credit loss if it is 100% certain that there will be an economic boom over the next 2 years? (round to the nearest whole dollar) O $159 $981 O $0 $484 $1,063 A financial institution has a loan portfolio with common credit risk characteristics. The portfolio comprises of loans that require monthly payments with an average interest rate of 4% and an average of 2 years remaining to maturity. The following information based on its forecast of the economy: (all amounts are in $'millions) State of the Economy Probability of State PD EAD LGD Boom X 0.05 425,000 0.05 Normal 0.75 0.15 425,000 0.25 Recession 0.10 0.70 450,000 0.80 What is the financial institution's expected credit loss if any of the three states of the economy is probable, based on the probabilities assigned in the question? (round to the nearest whole dollar) O $34,448 $0 O $37,313 O $38,448 O $25,200 A financial institution has a loan portfolio with common credit risk characteristics. The portfolio comprises of loans that require monthly payments with an average interest rate of 4% and an average of 2 years remaining to maturity. The following information based on its forecast of the economy: (all amounts are in $'millions) State of the Economy Probability of State PD EAD LGD Boom X 0.05 425.000 0.05 Normal 0.75 0.15 425,000 0.25 Recession 0.10 0.70 450,000 0.80 What is the financial institution's expected credit loss if it is 100% certain that the economy will remain normal over the next 2 years? (round to the nearest whole dollar) $15.938 0 $14,735 O $11.953 $14,714 0 $0 A financial institution has a loan portfolio with common credit risk characteristics. The portfolio comprises of loans that require monthly payments with an average interest rate of 4% and an average of 2 years remaining to maturity. The following information based on its forecast of the economy: (all amounts are in $'millions) State of the Economy Probability of State PD EAD LGD Boom 0.05 425,000 0.05 Normal 0.75 0.15 425,000 0.25 Re ssion 0.10 0.70 450,000 0.80 What is the financial institution's expected credit loss if it is 100% certain that there will be an economic recession over the next 2 years? (round to the nearest whole dollar) $0 O $252,000 0 $232,656 $25,200 $232,988 A financial institution has a loan portfolio with common credit risk characteristics. The portfolio comprises of loans that require monthly payments with an average interest rate of 4% and an average of 2 years remaining to maturity. The following information based on its forecast of the economy: (all amounts are in $'millions) State of the Economy Probability of State PD EAD LGD Boom x 0.05 425,000 0.05 Normal 0.75 0.15 425,000 0.25 Recession 0.10 0.70 450,000 0.80 What is the financial institution's expected credit loss if it is 100% certain that there will be an economic boom over the next 2 years? (round to the nearest whole dollar) O $159 $981 O $0 $484 $1,063