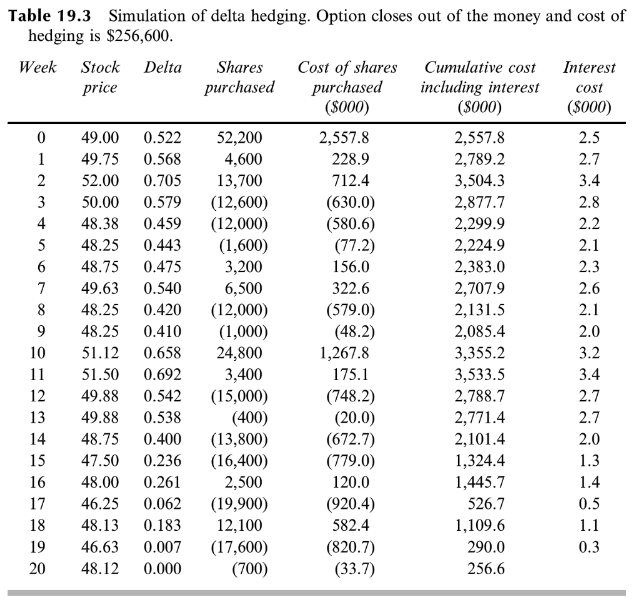

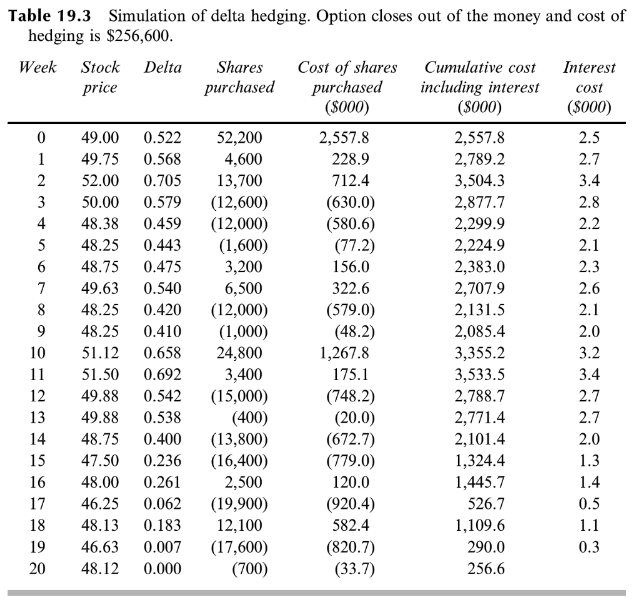

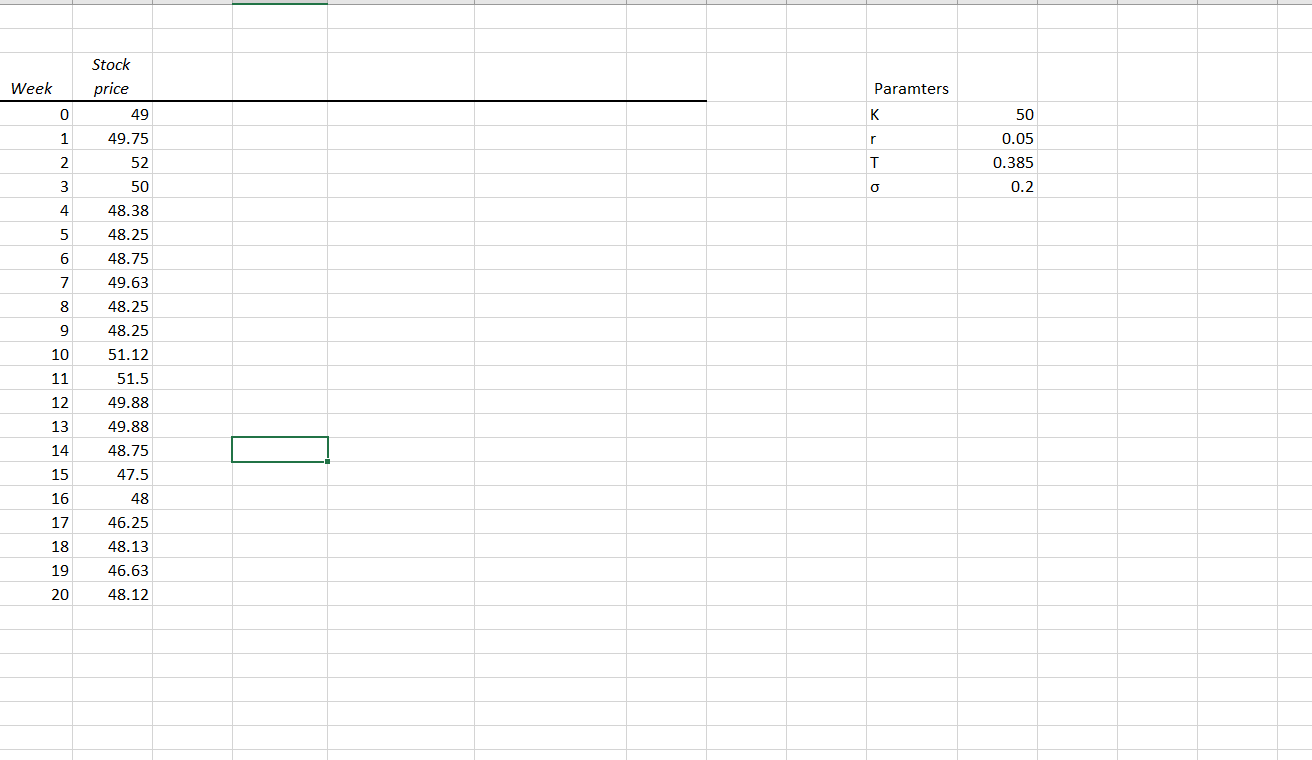

A financial institution has sold a European put option on 100,000 shares of a non-dividend paying stock. We assume that the stock price is $49, the strike price is $50, the risk-free interest rate is 5% per annum, the stock price volatility is 20% per annum, the time to maturity is 20 weeks (0.3846 years), and the expected return from the stock is 13% per annum. Given the simulated weekly prices for 20 weeks, produce a table similar to Table 19.3 on p.405 of the textbook. How much does the total hedging cost? Compare the hedging cost to the theoretical Black-Scholes-Merton price

A financial institution has sold a European put option on 100,000 shares of a non-dividend paying stock. We assume that the stock price is $49, the strike price is $50, the risk-free interest rate is 5% per annum, the stock price volatility is 20% per annum, the time to maturity is 20 weeks (0.3846 years), and the expected return from the stock is 13% per annum. Given the simulated weekly prices for 20 weeks, produce a table similar to Table 19.3 on p.405 of the textbook. How much does the total hedging cost? Compare the hedging cost to the theoretical Black-Scholes-Merton price

1 Table 19.3 Simulation of delta hedging. Option closes out of the money and cost of hedging is $256,600. Week Stock Delta Shares Cost of shares Cumulative cost Interest price purchased purchased including interest cost (8000) ($000) (5000) 0 49.00 0.522 52,200 2,557.8 2,557.8 2.5 49.75 0.568 4,600 228.9 2,789.2 2.7 2 52.00 0.705 13,700 712.4 3,504.3 3.4 3 50.00 0.579 (12,600) (630.0) 2,877.7 2.8 4 48.38 0.459 (12,000) (580.6) 2,299.9 2.2 5 48.25 0.443 (1,600) (77.2) 2,224.9 2.1 6 48.75 0.475 3,200 156.0 2,383.0 2.3 7 49.63 0.540 6,500 322.6 2,707.9 2.6 8 48.25 0.420 (12,000) (579.0) 2,131.5 2.1 9 48.25 0.410 (1,000) (48.2) 2,085.4 2.0 10 51.12 0.658 24,800 1,267.8 3,355.2 3.2 11 51.50 0.692 3,400 175.1 3,533.5 3.4 12 49.88 0.542 (15,000) (748.2) 2,788.7 2.7 13 49.88 0.538 (400) (20.0) 2,771.4 2.7 14 48.75 0.400 (13,800) (672.7) 2,101.4 2.0 15 47.50 0.236 (16,400) (779.0) 1,324.4 1.3 16 48.00 0.261 2,500 120.0 1,445.7 1.4 17 46.25 0.062 (19,900) (920.4) 526.7 0.5 18 48.13 0.183 12,100 582.4 1,109.6 1.1 19 46.63 0.007 (17,600) (820.7) 290.0 0.3 20 48.12 0.000 (700) (33.7) 256.6 Stock price Week Paramters 0 49 K 50 1 49.75 r 0.05 0.385 2 52 T 3 50 0 0.2 4 5 48.38 48.25 48.75 6 7 49.63 8 48.25 9 48.25 51.12 10 11 12 13 51.5 49.88 49.88 48.75 47.5 14 15 16 48 17 46.25 18 48.13 19 46.63 20 48.12 1 Table 19.3 Simulation of delta hedging. Option closes out of the money and cost of hedging is $256,600. Week Stock Delta Shares Cost of shares Cumulative cost Interest price purchased purchased including interest cost (8000) ($000) (5000) 0 49.00 0.522 52,200 2,557.8 2,557.8 2.5 49.75 0.568 4,600 228.9 2,789.2 2.7 2 52.00 0.705 13,700 712.4 3,504.3 3.4 3 50.00 0.579 (12,600) (630.0) 2,877.7 2.8 4 48.38 0.459 (12,000) (580.6) 2,299.9 2.2 5 48.25 0.443 (1,600) (77.2) 2,224.9 2.1 6 48.75 0.475 3,200 156.0 2,383.0 2.3 7 49.63 0.540 6,500 322.6 2,707.9 2.6 8 48.25 0.420 (12,000) (579.0) 2,131.5 2.1 9 48.25 0.410 (1,000) (48.2) 2,085.4 2.0 10 51.12 0.658 24,800 1,267.8 3,355.2 3.2 11 51.50 0.692 3,400 175.1 3,533.5 3.4 12 49.88 0.542 (15,000) (748.2) 2,788.7 2.7 13 49.88 0.538 (400) (20.0) 2,771.4 2.7 14 48.75 0.400 (13,800) (672.7) 2,101.4 2.0 15 47.50 0.236 (16,400) (779.0) 1,324.4 1.3 16 48.00 0.261 2,500 120.0 1,445.7 1.4 17 46.25 0.062 (19,900) (920.4) 526.7 0.5 18 48.13 0.183 12,100 582.4 1,109.6 1.1 19 46.63 0.007 (17,600) (820.7) 290.0 0.3 20 48.12 0.000 (700) (33.7) 256.6 Stock price Week Paramters 0 49 K 50 1 49.75 r 0.05 0.385 2 52 T 3 50 0 0.2 4 5 48.38 48.25 48.75 6 7 49.63 8 48.25 9 48.25 51.12 10 11 12 13 51.5 49.88 49.88 48.75 47.5 14 15 16 48 17 46.25 18 48.13 19 46.63 20 48.12

A financial institution has sold a European put option on 100,000 shares of a non-dividend paying stock. We assume that the stock price is $49, the strike price is $50, the risk-free interest rate is 5% per annum, the stock price volatility is 20% per annum, the time to maturity is 20 weeks (0.3846 years), and the expected return from the stock is 13% per annum. Given the simulated weekly prices for 20 weeks, produce a table similar to Table 19.3 on p.405 of the textbook. How much does the total hedging cost? Compare the hedging cost to the theoretical Black-Scholes-Merton price

A financial institution has sold a European put option on 100,000 shares of a non-dividend paying stock. We assume that the stock price is $49, the strike price is $50, the risk-free interest rate is 5% per annum, the stock price volatility is 20% per annum, the time to maturity is 20 weeks (0.3846 years), and the expected return from the stock is 13% per annum. Given the simulated weekly prices for 20 weeks, produce a table similar to Table 19.3 on p.405 of the textbook. How much does the total hedging cost? Compare the hedging cost to the theoretical Black-Scholes-Merton price