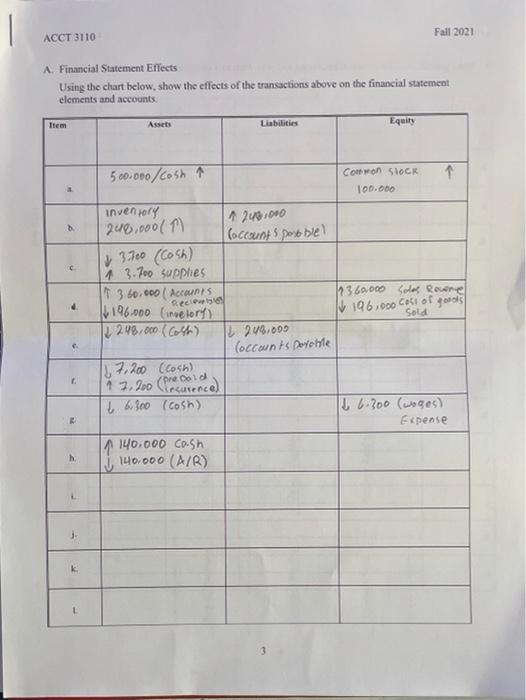

A. financial statment effects, show the effects of the transactions above on the financial statment elements and accounts.

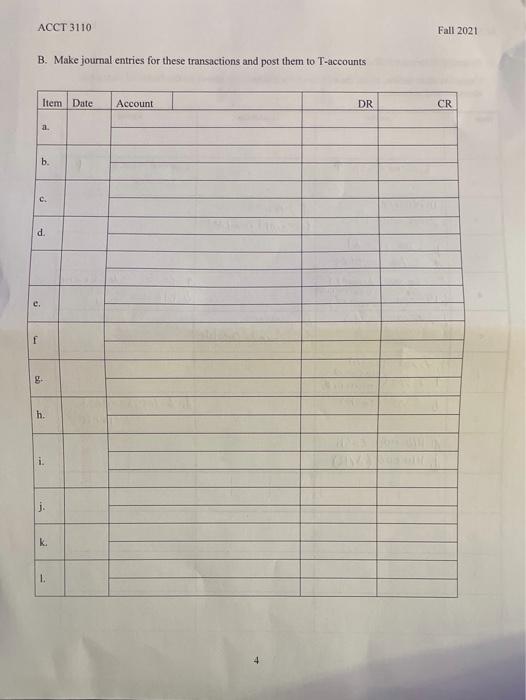

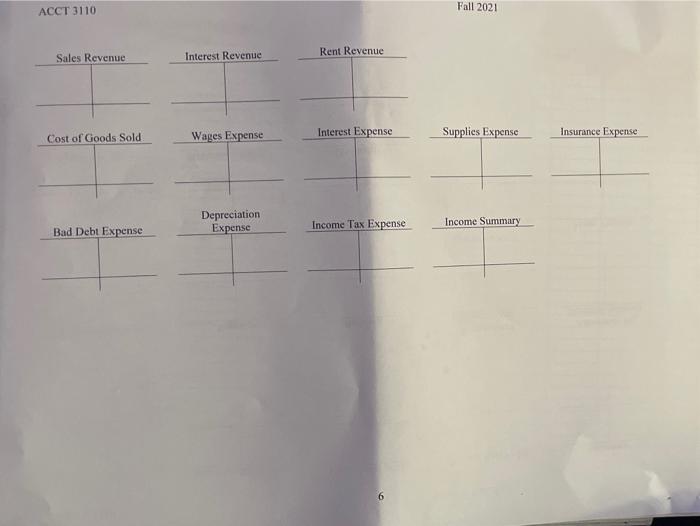

B.Make the journal entries for these transcations and post them to T-accounts.

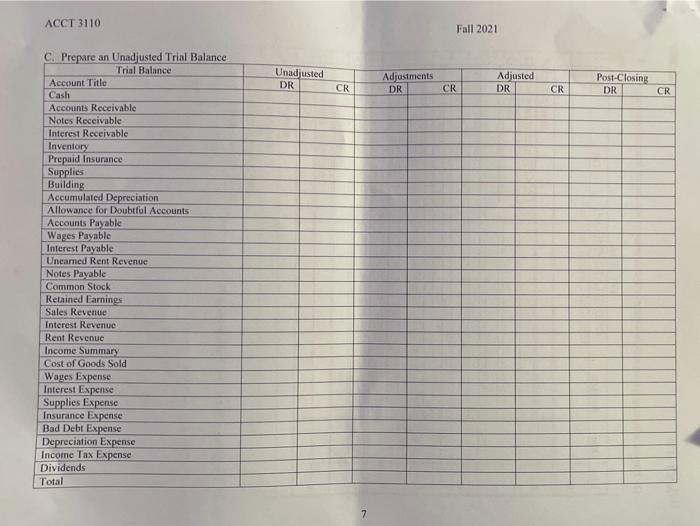

C.prepare an Unadjusted Trial balance.

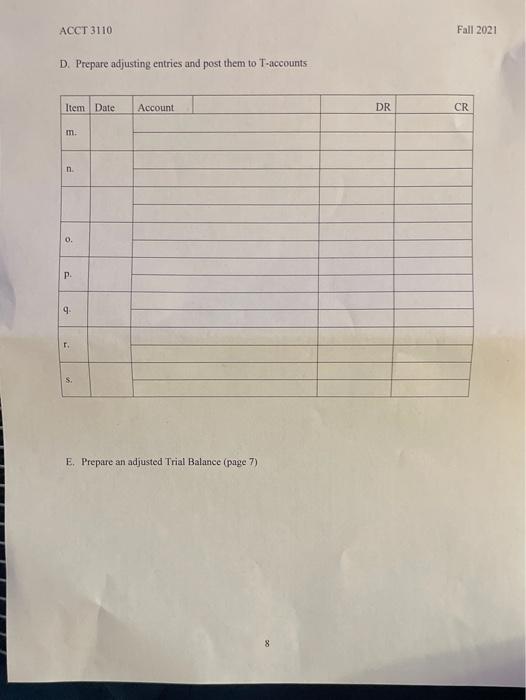

D prepare adjusting entries and post them to T-accounts.

E.prepare an adjusted Trial Balance.

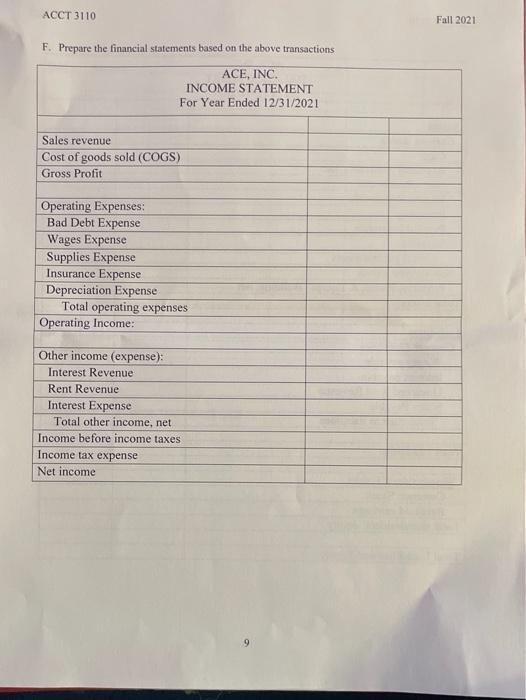

F.prepare the financial statements based on the above transactions.

1. income stament.

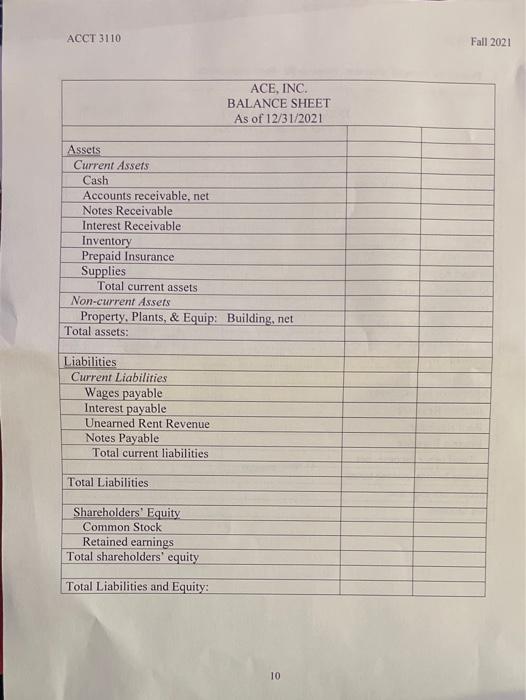

2. Balance sheet.

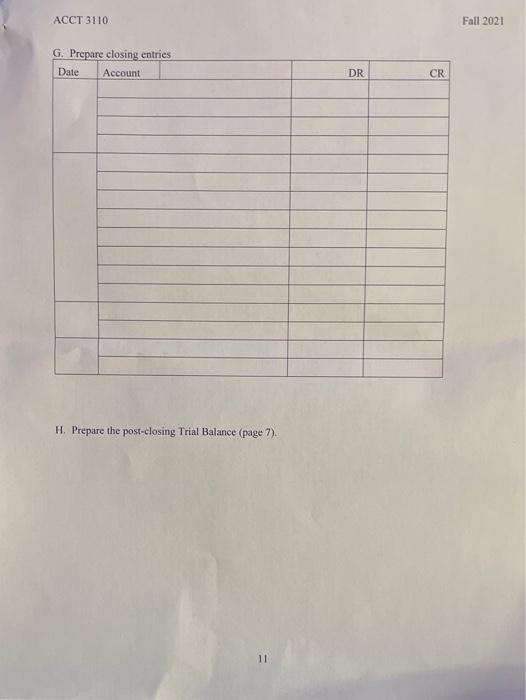

G. peepare closing entries.

H. prepare the post-closing Trial Balance.

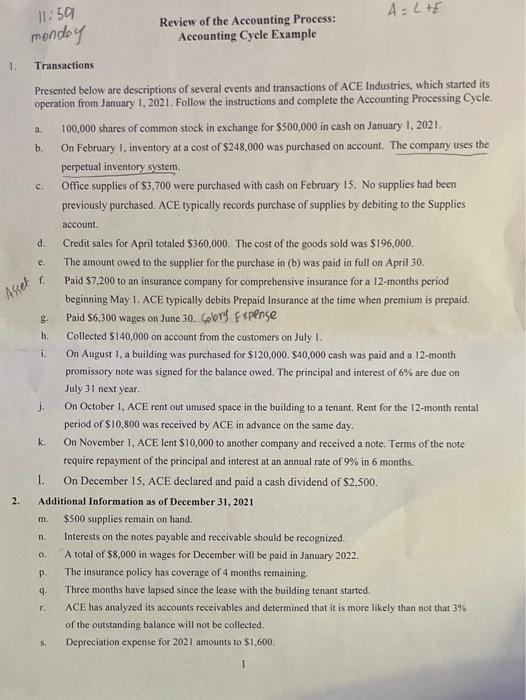

11:59 1. Review of the Accounting Process: A=L+E monday Accounting Cycle Example Transactions Presented below are descriptions of several events and transactions of ACE Industries, which started its operation from January 1, 2021. Follow the instructions and complete the Accounting Processing Cycle. 100,000 shares of common stock in exchange for $500,000 in cash on January 1, 2021. On February 1, inventory at a cost of $248,000 was purchased on account. The company uses the perpetual inventory system Office supplies of $3,700 were purchased with cash on February 15. No supplies had been previously purchased. ACE typically records purchase of supplies by debiting to the Supplies a. b. C. account. d. e. Asset h. i k Credit sales for April totaled $360,000. The cost of the goods sold was $196,000. The amount owed to the supplier for the purchase in (b) was paid in full on April 30. Paid $7.200 to an insurance company for comprehensive insurance for a 12-months period beginning May I. ACE typically debits Prepaid Insurance at the time when premium is prepaid g. Paid $6,300 wages on June 30. Gobry Expense Collected S140,000 on account from the customers on July 1. On August 1, a building was purchased for $120,000.540,000 cash was paid and a 12-month promissory note was signed for the balance owed. The principal and interest of 6% are due on July 31 next year. j On October 1. ACE rent out unused space in the building to a tenant. Rent for the 12-month rental period of $10,800 was received by ACE in advance on the same day. On November 1, ACE lent $10,000 to another company and received a note. Terms of the note require repayment of the principal and interest at an annual rate of 9% in 6 months. 1. On December 15. ACE declared and paid a cash dividend of S2,500. Additional Information as of December 31, 2021 $500 supplies remain on hand. Interests on the notes payable and receivable should be recognized. A total of $8,000 in wages for December will be paid in January 2022 The insurance policy has coverage of 4 months remaining, Three months have lapsed since the lease with the building tenant started. ACE has analyzed its accounts receivables and determined that it is more likely than not that 3% of the outstanding balance will not be collected. Depreciation expense for 2021 amounts to $1,600. 2. m. n. 0, P 4. 1 Fall 2021 ACCT 3110 A Financial Statement Effects Using the chart below, show the effects of the transactions above on the financial statement elements and accounts Item Assets Liabilities Equity b 500.000 /cosh 1 Common Stock 1 100. One inventory 1 248.000 248,000(1) Coccounts per ble Iv 3.700 (Cosh) 4.3.700 supplies 1 360.000 Accounts 113.60.000 soles Rovene Rece 196.000 (invelory 196.000 Cast of oos Sold 12 248,000 (Cash) 209.009 Coccounts Deychle 17,200 (cosh) 17.200 (precated te 6.300 (cosh) 11 6.300 (woges) Expense 140.000 cash 140,000 (A/R) h 1 3 ACCT 3110 Fall 2021 B. Make journal entries for these transactions and post them to T-accounts Item Date Account DR CR a. b. C. d. f g h. i. j K. 1. ACCT 3110 Fall 2021 Cash Accounts Receivable Notes Receivable Interest Receivable Inventory Prepaid Insurance Supplies Accumulated Depreciation Allowance for Doubtful Account Building Unearned Rent Revenue Accounts Payable Wages Payable Interest Payable Notes Payable Common Stock Retained Earnings Dividends ACCT 3110 Fall 2021 Rent Revenue Sales Revenue Interest Revenue Cost of Goods Sold Wages Expense Interest Expense Supplies Expense Insurance Expense Depreciation Expense Bad Debt Expense Income Summary Income Tax Expense 6 ACCT 3110 Fall 2021 Unadjusted DR Adjustments DR Adjusted DR CR Post-Closing DR CR CR CR C. Prepare an Unadjusted Trial Balance Trial Balance Account Title Cash Accounts Receivable Notes Receivable Interest Receivable Inventory Prepaid Insurance Supplies Building Accumulated Depreciation Allowance for Doubtful Accounts Accounts Payable Wages Payable Interest Payable Uncarned Rent Revenue Notes Payable Common Stock Retained Earnings Sales Revenue Interest Revenue Rent Revenue Income Summary Cost of Goods Sold Wages Expense Interest Expense Supplies Expense Insurance Expense Bad Debt Expense Depreciation Expense Income Tax Expense Dividends Total 7 ACCT 3110 Fall 2021 D. Prepare adjusting entries and post them to T-accounts Item Date Account DR CR m. n. 0. p 9 S. E. Prepare an adjusted Trial Balance (page 7) ACCT 3110 Fall 2021 F. Prepare the financial statements based on the above transactions ACE, INC. INCOME STATEMENT For Year Ended 12/31/2021 Sales revenue Cost of goods sold (COGS) Gross Profit Operating Expenses Bad Debt Expense Wages Expense Supplies Expense Insurance Expense Depreciation Expense Total operating expenses Operating Income: Other income (expense): Interest Revenue Rent Revenue Interest Expense Total other income, net Income before income taxes Income tax expense Net income 9 ACCT 3110 Fall 2021 ACE, INC. BALANCE SHEET As of 12/31/2021 Assets Current Assets Cash Accounts receivable, net Notes Receivable Interest Receivable Inventory Prepaid Insurance Supplies Total current assets Non-current Assets Property, Plants, & Equip: Building, net Total assets: Liabilities Current Liabilities Wages payable Interest payable Unearned Rent Revenue Notes Payable Total current liabilities Total Liabilities Shareholders' Equity Common Stock Retained earnings Total shareholders' equity Total Liabilities and Equity: 10 ACCT 3110 Fall 2021 G. Prepare closing entries Date Account DR CR H. Prepare the post-closing Trial Balance (page 2). 11:59 1. Review of the Accounting Process: A=L+E monday Accounting Cycle Example Transactions Presented below are descriptions of several events and transactions of ACE Industries, which started its operation from January 1, 2021. Follow the instructions and complete the Accounting Processing Cycle. 100,000 shares of common stock in exchange for $500,000 in cash on January 1, 2021. On February 1, inventory at a cost of $248,000 was purchased on account. The company uses the perpetual inventory system Office supplies of $3,700 were purchased with cash on February 15. No supplies had been previously purchased. ACE typically records purchase of supplies by debiting to the Supplies a. b. C. account. d. e. Asset h. i k Credit sales for April totaled $360,000. The cost of the goods sold was $196,000. The amount owed to the supplier for the purchase in (b) was paid in full on April 30. Paid $7.200 to an insurance company for comprehensive insurance for a 12-months period beginning May I. ACE typically debits Prepaid Insurance at the time when premium is prepaid g. Paid $6,300 wages on June 30. Gobry Expense Collected S140,000 on account from the customers on July 1. On August 1, a building was purchased for $120,000.540,000 cash was paid and a 12-month promissory note was signed for the balance owed. The principal and interest of 6% are due on July 31 next year. j On October 1. ACE rent out unused space in the building to a tenant. Rent for the 12-month rental period of $10,800 was received by ACE in advance on the same day. On November 1, ACE lent $10,000 to another company and received a note. Terms of the note require repayment of the principal and interest at an annual rate of 9% in 6 months. 1. On December 15. ACE declared and paid a cash dividend of S2,500. Additional Information as of December 31, 2021 $500 supplies remain on hand. Interests on the notes payable and receivable should be recognized. A total of $8,000 in wages for December will be paid in January 2022 The insurance policy has coverage of 4 months remaining, Three months have lapsed since the lease with the building tenant started. ACE has analyzed its accounts receivables and determined that it is more likely than not that 3% of the outstanding balance will not be collected. Depreciation expense for 2021 amounts to $1,600. 2. m. n. 0, P 4. 1 Fall 2021 ACCT 3110 A Financial Statement Effects Using the chart below, show the effects of the transactions above on the financial statement elements and accounts Item Assets Liabilities Equity b 500.000 /cosh 1 Common Stock 1 100. One inventory 1 248.000 248,000(1) Coccounts per ble Iv 3.700 (Cosh) 4.3.700 supplies 1 360.000 Accounts 113.60.000 soles Rovene Rece 196.000 (invelory 196.000 Cast of oos Sold 12 248,000 (Cash) 209.009 Coccounts Deychle 17,200 (cosh) 17.200 (precated te 6.300 (cosh) 11 6.300 (woges) Expense 140.000 cash 140,000 (A/R) h 1 3 ACCT 3110 Fall 2021 B. Make journal entries for these transactions and post them to T-accounts Item Date Account DR CR a. b. C. d. f g h. i. j K. 1. ACCT 3110 Fall 2021 Cash Accounts Receivable Notes Receivable Interest Receivable Inventory Prepaid Insurance Supplies Accumulated Depreciation Allowance for Doubtful Account Building Unearned Rent Revenue Accounts Payable Wages Payable Interest Payable Notes Payable Common Stock Retained Earnings Dividends ACCT 3110 Fall 2021 Rent Revenue Sales Revenue Interest Revenue Cost of Goods Sold Wages Expense Interest Expense Supplies Expense Insurance Expense Depreciation Expense Bad Debt Expense Income Summary Income Tax Expense 6 ACCT 3110 Fall 2021 Unadjusted DR Adjustments DR Adjusted DR CR Post-Closing DR CR CR CR C. Prepare an Unadjusted Trial Balance Trial Balance Account Title Cash Accounts Receivable Notes Receivable Interest Receivable Inventory Prepaid Insurance Supplies Building Accumulated Depreciation Allowance for Doubtful Accounts Accounts Payable Wages Payable Interest Payable Uncarned Rent Revenue Notes Payable Common Stock Retained Earnings Sales Revenue Interest Revenue Rent Revenue Income Summary Cost of Goods Sold Wages Expense Interest Expense Supplies Expense Insurance Expense Bad Debt Expense Depreciation Expense Income Tax Expense Dividends Total 7 ACCT 3110 Fall 2021 D. Prepare adjusting entries and post them to T-accounts Item Date Account DR CR m. n. 0. p 9 S. E. Prepare an adjusted Trial Balance (page 7) ACCT 3110 Fall 2021 F. Prepare the financial statements based on the above transactions ACE, INC. INCOME STATEMENT For Year Ended 12/31/2021 Sales revenue Cost of goods sold (COGS) Gross Profit Operating Expenses Bad Debt Expense Wages Expense Supplies Expense Insurance Expense Depreciation Expense Total operating expenses Operating Income: Other income (expense): Interest Revenue Rent Revenue Interest Expense Total other income, net Income before income taxes Income tax expense Net income 9 ACCT 3110 Fall 2021 ACE, INC. BALANCE SHEET As of 12/31/2021 Assets Current Assets Cash Accounts receivable, net Notes Receivable Interest Receivable Inventory Prepaid Insurance Supplies Total current assets Non-current Assets Property, Plants, & Equip: Building, net Total assets: Liabilities Current Liabilities Wages payable Interest payable Unearned Rent Revenue Notes Payable Total current liabilities Total Liabilities Shareholders' Equity Common Stock Retained earnings Total shareholders' equity Total Liabilities and Equity: 10 ACCT 3110 Fall 2021 G. Prepare closing entries Date Account DR CR H. Prepare the post-closing Trial Balance (page 2)