Answered step by step

Verified Expert Solution

Question

1 Approved Answer

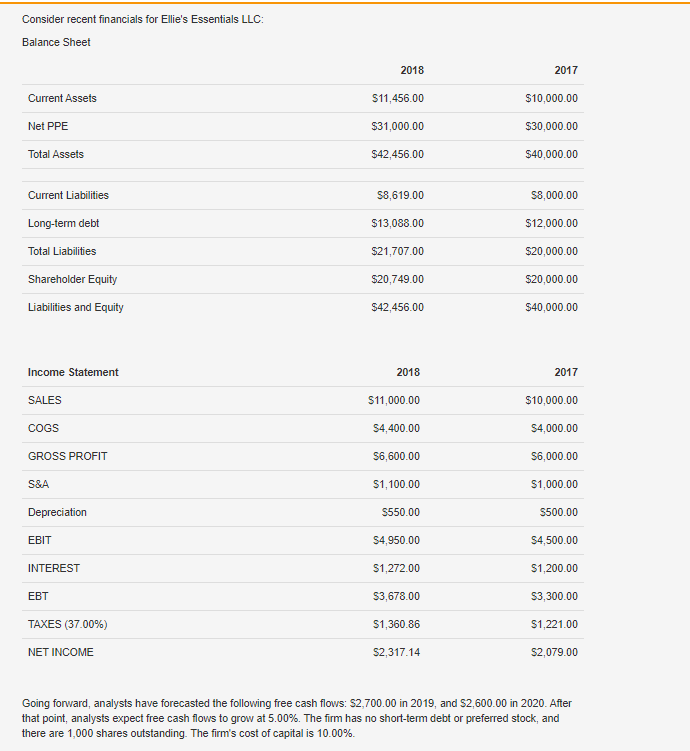

A) Find the free cash flow for the firm in 2018. B) Estimate the firms price per share using the discounted cash flow model. C)

A) Find the free cash flow for the firm in 2018.

B) Estimate the firms price per share using the discounted cash flow model.

C) You are trying to estimate the value of Doc McRuffins Incorporated. It is a rival firm to Ellie's Essentials, but not publicly traded. You do know that Doc McRuffins has an EBITDA of $4,750 for 2018. Using multiples, what is a rough estimate for the enterprise value of Doc McRuffins

Consider recent financials for Ellie's Essentials LLC: Balance Sheet 2018 2017 Current Assets S11,456.00 $10,000.00 Net PPE $31,000.00 $30,000.00 Total Assets $42,456.00 $40,000.00 Current Liabilities $8,619.00 S8,000.00 Long-term debt $13,088.00 $12,000.00 $21,707.00 Total Liabilities $20,000.00 Shareholder Equity $20,000.00 $20,749.00 Liabilities and Equity $42,456.00 $40,000.00 Income Statement 2018 2017 SALES S11,000.00 $10,000.00 COGS $4,400.00 S4,000.00 S6,600.00 GROSS PROFIT S6,000.00 S&A S1,100.00 S1,000.00 S500.00 Depreciation S550.00 BIT S4,950.00 S4,500.00 S1,272.00 INTEREST S1,200.00 T S3,678.00 S3,300.00 TAXES (37.00%) S1,360.86 S1,221.00 NET INCOME S2,317.14 S2,079.00 Going forward, analysts have forecasted the following free cash flows: $2,700.00 in 2019, and S2,600.00 in 2020. After that point, analysts expect free cash flows to grow at 5.00 %. The fim has no short-tem debt or preferred stock, and there are 1,000 shares outstanding. The firm's cost of capital is 10.00% Consider recent financials for Ellie's Essentials LLC: Balance Sheet 2018 2017 Current Assets S11,456.00 $10,000.00 Net PPE $31,000.00 $30,000.00 Total Assets $42,456.00 $40,000.00 Current Liabilities $8,619.00 S8,000.00 Long-term debt $13,088.00 $12,000.00 $21,707.00 Total Liabilities $20,000.00 Shareholder Equity $20,000.00 $20,749.00 Liabilities and Equity $42,456.00 $40,000.00 Income Statement 2018 2017 SALES S11,000.00 $10,000.00 COGS $4,400.00 S4,000.00 S6,600.00 GROSS PROFIT S6,000.00 S&A S1,100.00 S1,000.00 S500.00 Depreciation S550.00 BIT S4,950.00 S4,500.00 S1,272.00 INTEREST S1,200.00 T S3,678.00 S3,300.00 TAXES (37.00%) S1,360.86 S1,221.00 NET INCOME S2,317.14 S2,079.00 Going forward, analysts have forecasted the following free cash flows: $2,700.00 in 2019, and S2,600.00 in 2020. After that point, analysts expect free cash flows to grow at 5.00 %. The fim has no short-tem debt or preferred stock, and there are 1,000 shares outstanding. The firm's cost of capital is 10.00%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started