Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A firm estimates that it needs to make an initial investment of US$ 16 million in order to extract a mineral resource in the

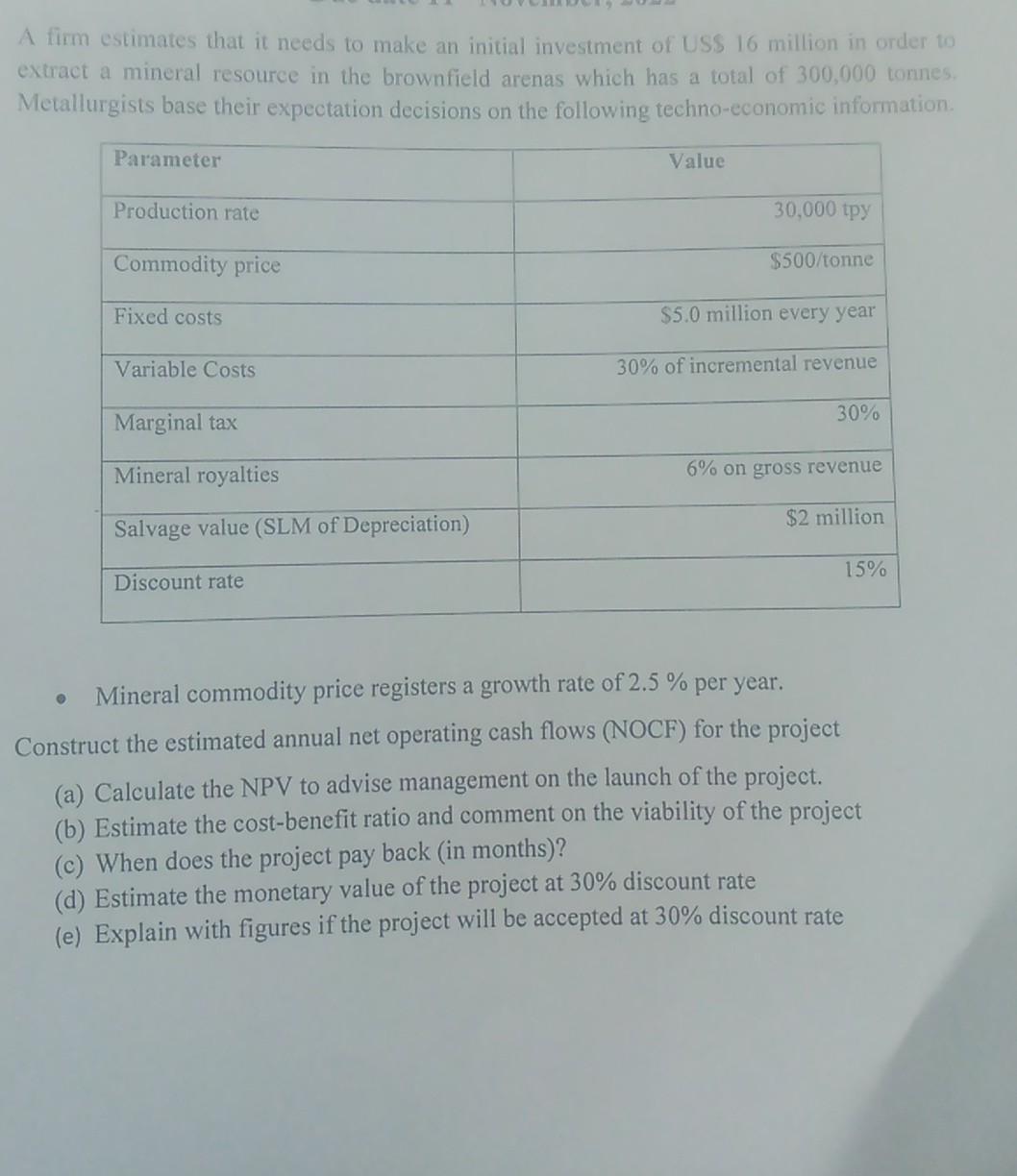

A firm estimates that it needs to make an initial investment of US$ 16 million in order to extract a mineral resource in the brownfield arenas which has a total of 300,000 tonnes. Metallurgists base their expectation decisions on the following techno-economic information. Parameter Production rate Commodity price Fixed costs Variable Costs Marginal tax Mineral royalties Salvage value (SLM of Depreciation) Discount rate Value 30,000 tpy $500/tonne $5.0 million every year 30% of incremental revenue 30% 6% on gross revenue $2 million 15% Mineral commodity price registers a growth rate of 2.5 % per year. Construct the estimated annual net operating cash flows (NOCF) for the project (a) Calculate the NPV to advise management on the launch of the project. (b) Estimate the cost-benefit ratio and comment on the viability of the project (c) When does the project pay back (in months)? (d) Estimate the monetary value of the project at 30% discount rate (e) Explain with figures if the project will be accepted at 30% discount rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started