Answered step by step

Verified Expert Solution

Question

1 Approved Answer

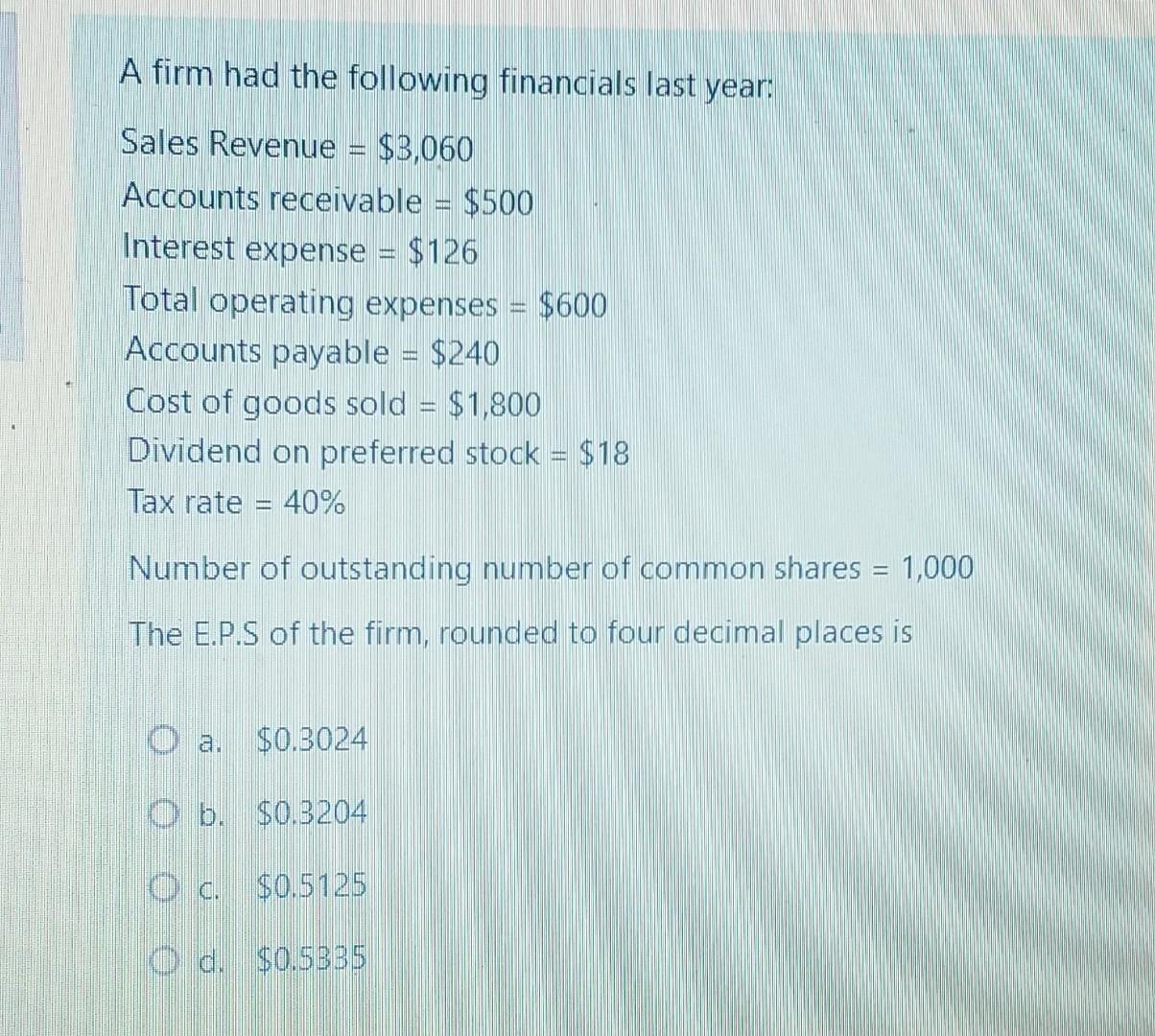

A firm had the following financials last year: Sales Revenue = $3,060 Accounts receivable = $500 Interest expense = $126 Total operating expenses =

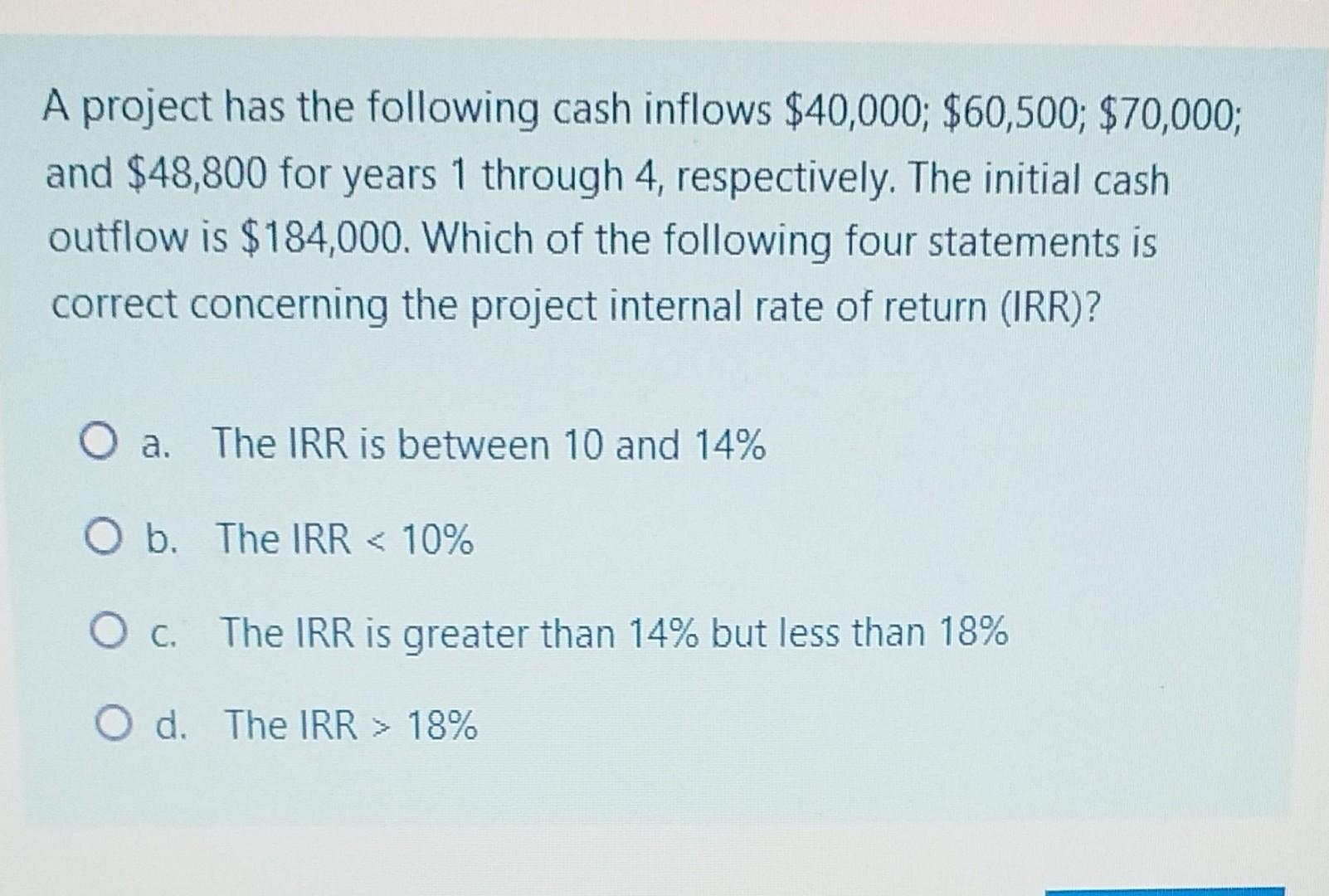

A firm had the following financials last year: Sales Revenue = $3,060 Accounts receivable = $500 Interest expense = $126 Total operating expenses = $600 Accounts payable = $240 Cost of goods sold = $1,800 Dividend on preferred stock = $18 Tax rate = 40% Number of outstanding number of common shares = 1,000 The E.P.S of the firm, rounded to four decimal places is Oa. $0.3024 Ob. $0.3204 O c. $0.5125 Od. $0.5335 A project has the following cash inflows $40,000; $60,500; $70,000; and $48,800 for years 1 through 4, respectively. The initial cash outflow is $184,000. Which of the following four statements is correct concerning the project internal rate of return (IRR)? O a. The IRR is between 10 and 14% O b. The IRR < 10% O c. The IRR is greater than 14% but less than 18% O d. The IRR > 18%

Step by Step Solution

★★★★★

3.50 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Sales Revenue 3060 Accounts receivable 500 Interest expense 126 Total operating expenses 600 Account...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started