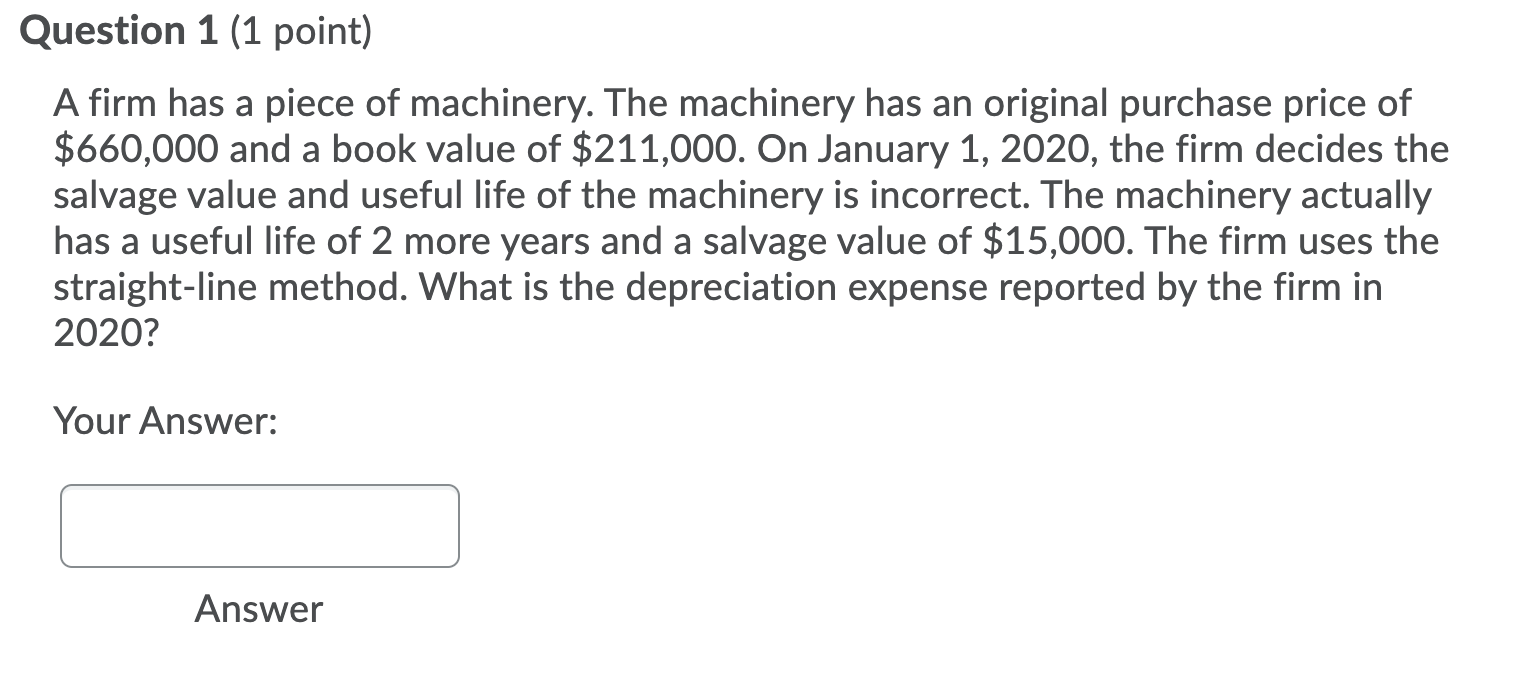

A firm has a piece of machinery. The machinery has an original purchase price of $660,000 and a book value of $211,000. On January 1, 2020, the firm decides the salvage value and useful life of the machinery is incorrect. The machinery actually has a useful life of 2 more years and a salvage value of $15,000. The firm uses the straight-line method. What is the depreciation expense reported by the firm in 2020? Your Answer:

A firm has a piece of machinery. The machinery has an original purchase price of $660,000 and a book value of $211,000. On January 1, 2020, the firm decides the salvage value and useful life of the machinery is incorrect. The machinery actually has a useful life of 2 more years and a salvage value of $15,000. The firm uses the straight-line method. What is the depreciation expense reported by the firm in 2020? Your Answer:

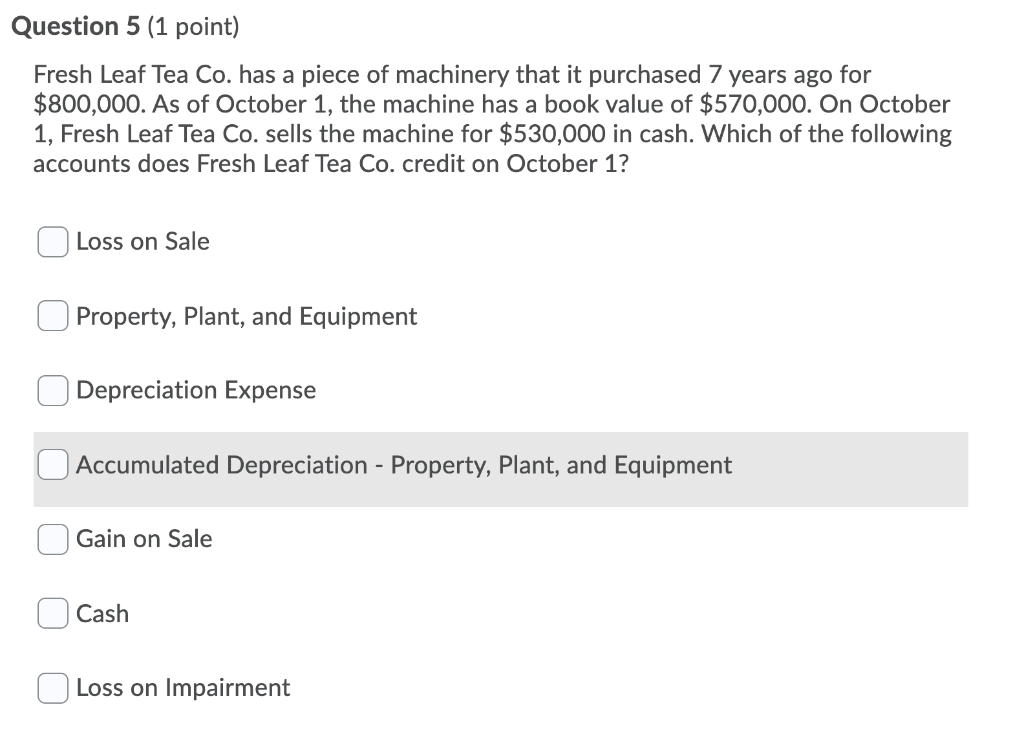

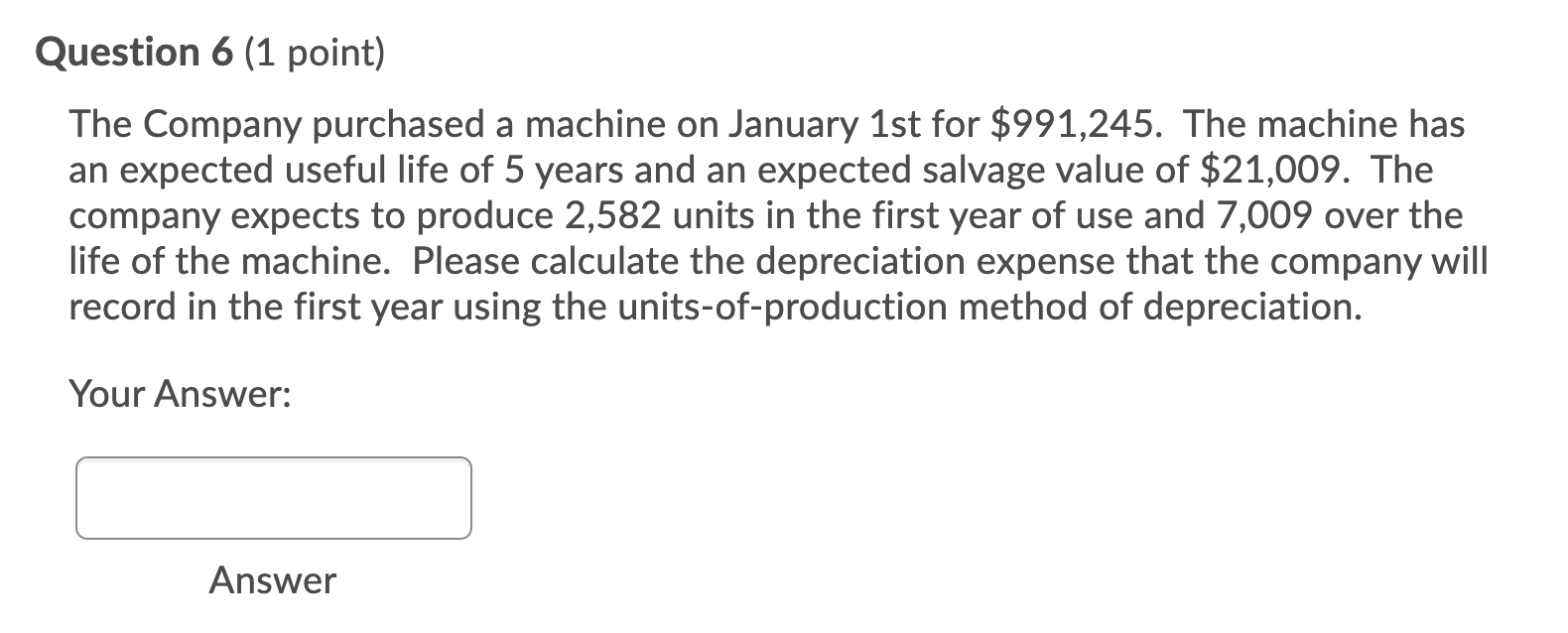

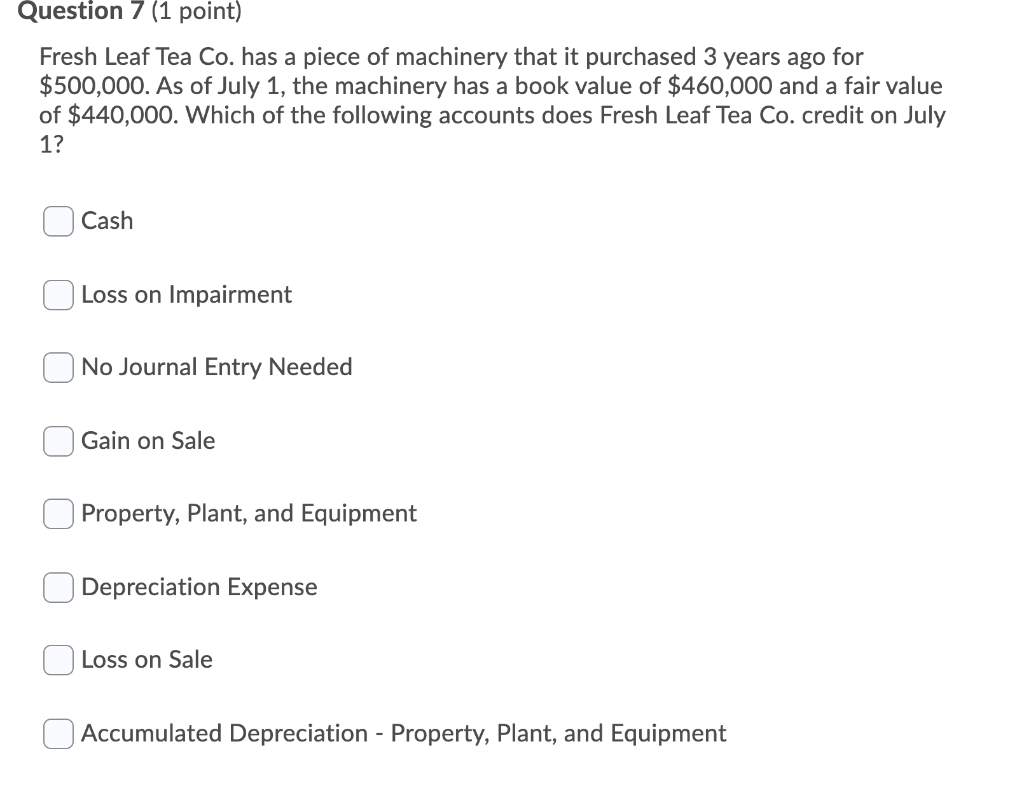

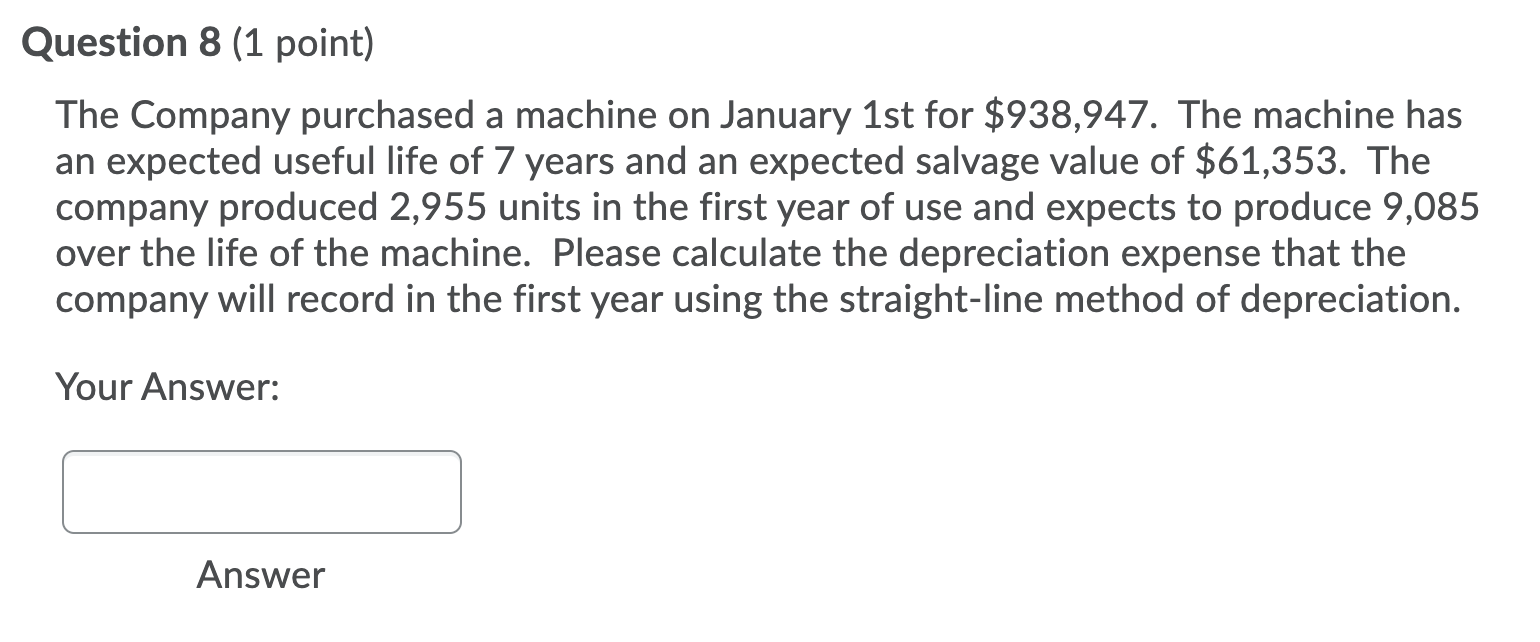

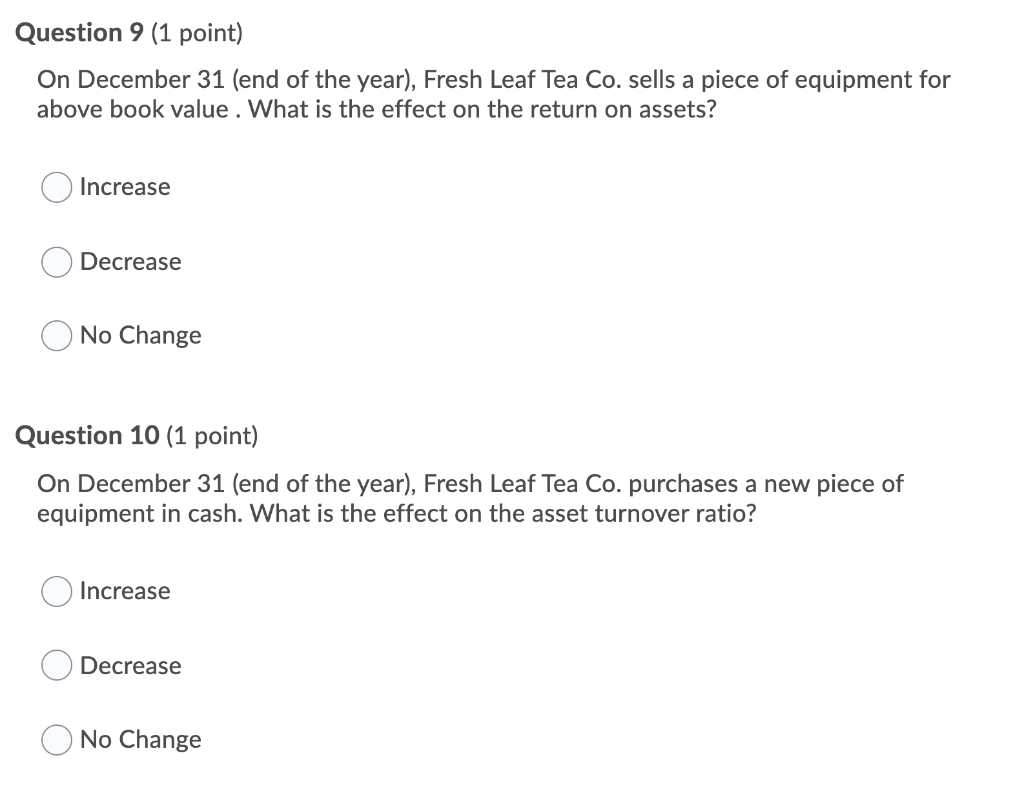

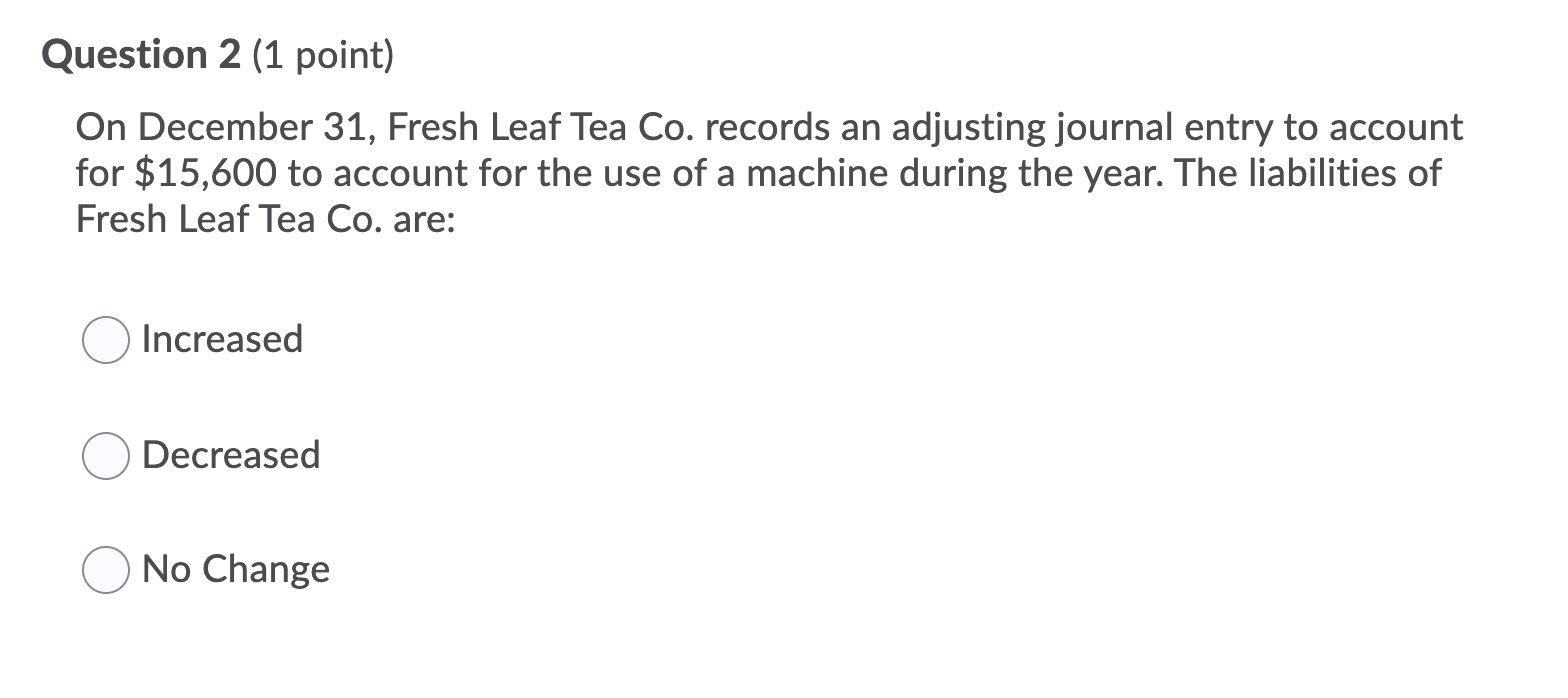

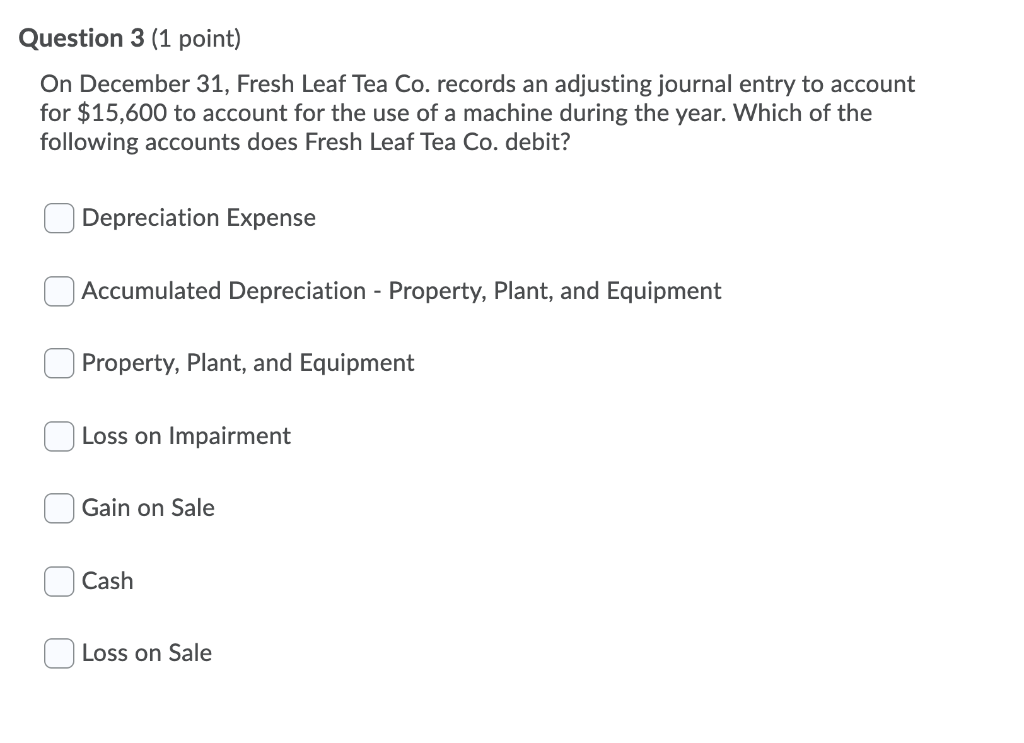

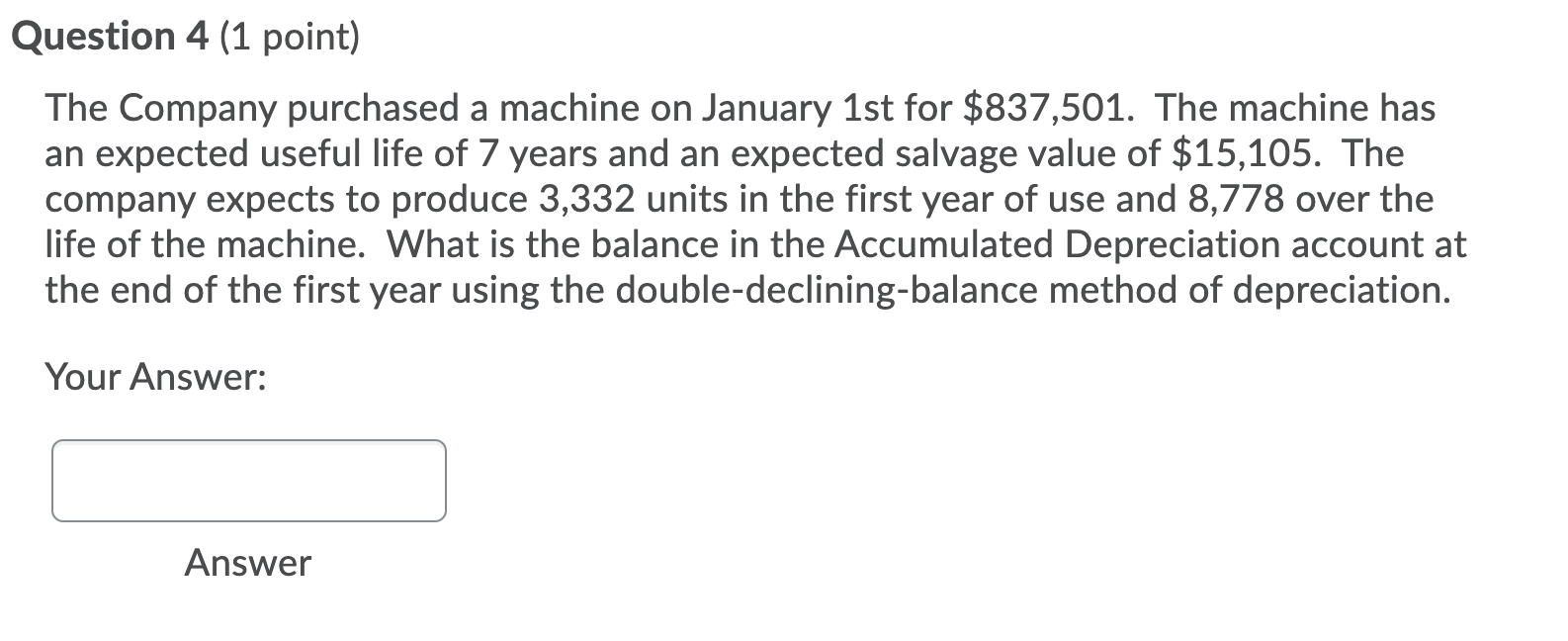

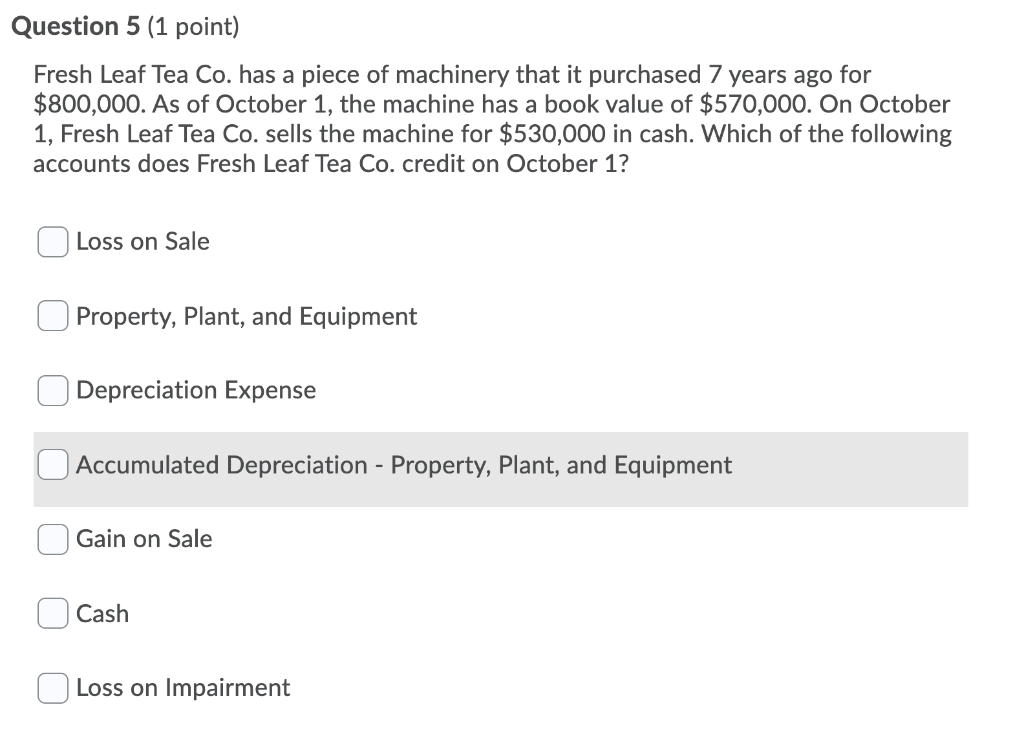

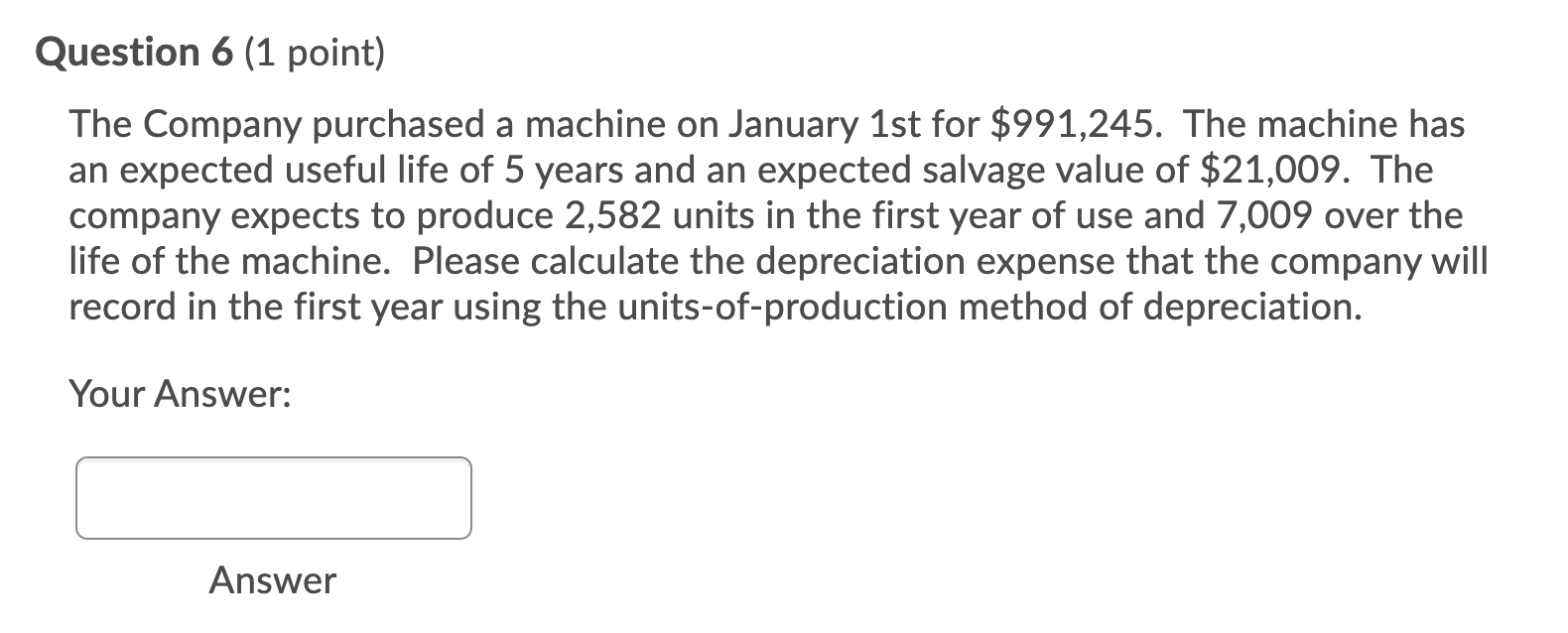

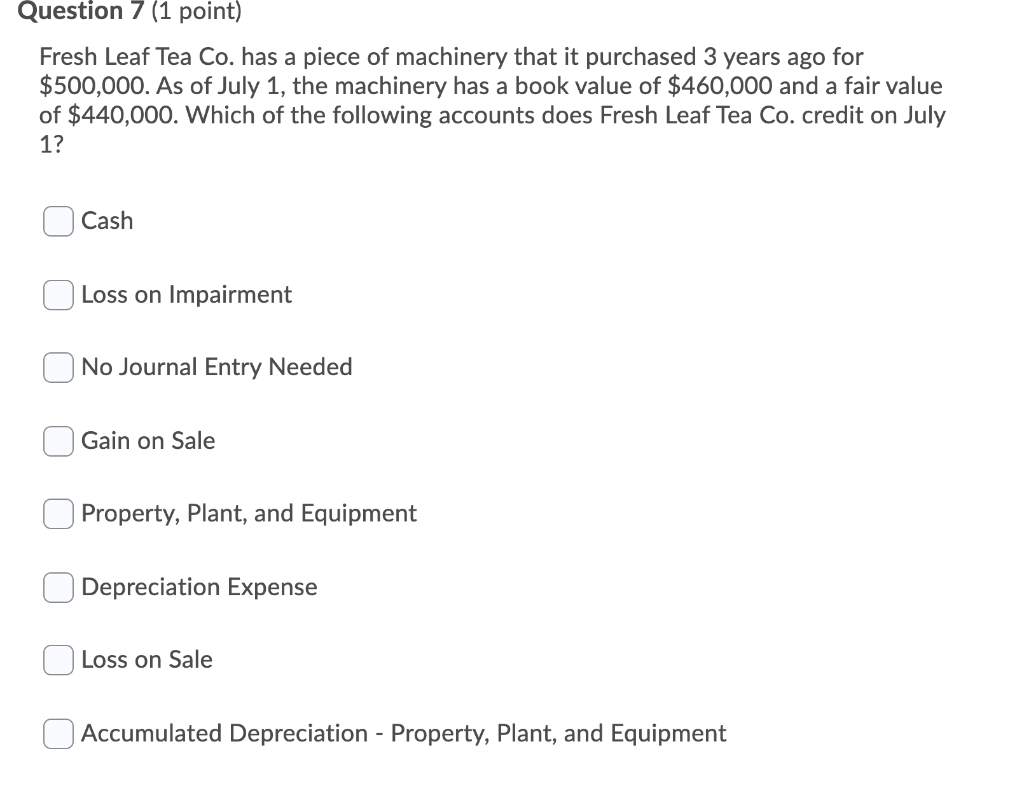

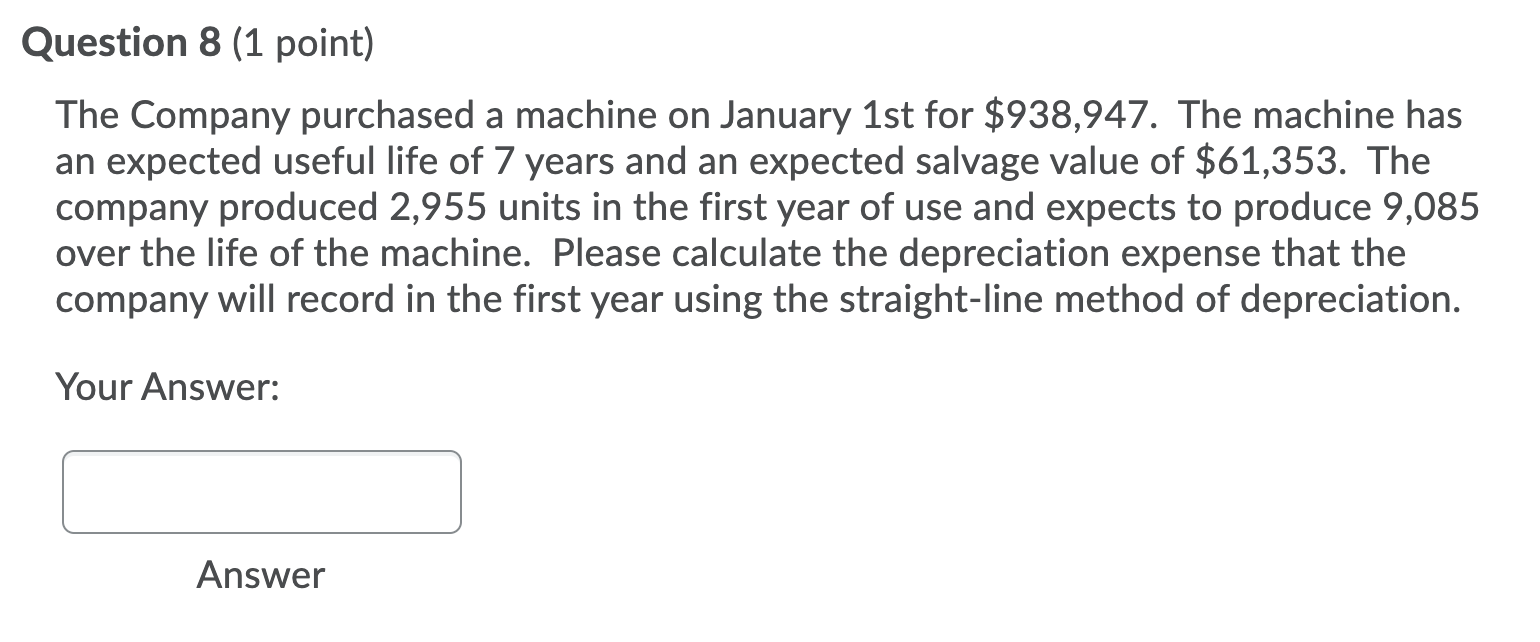

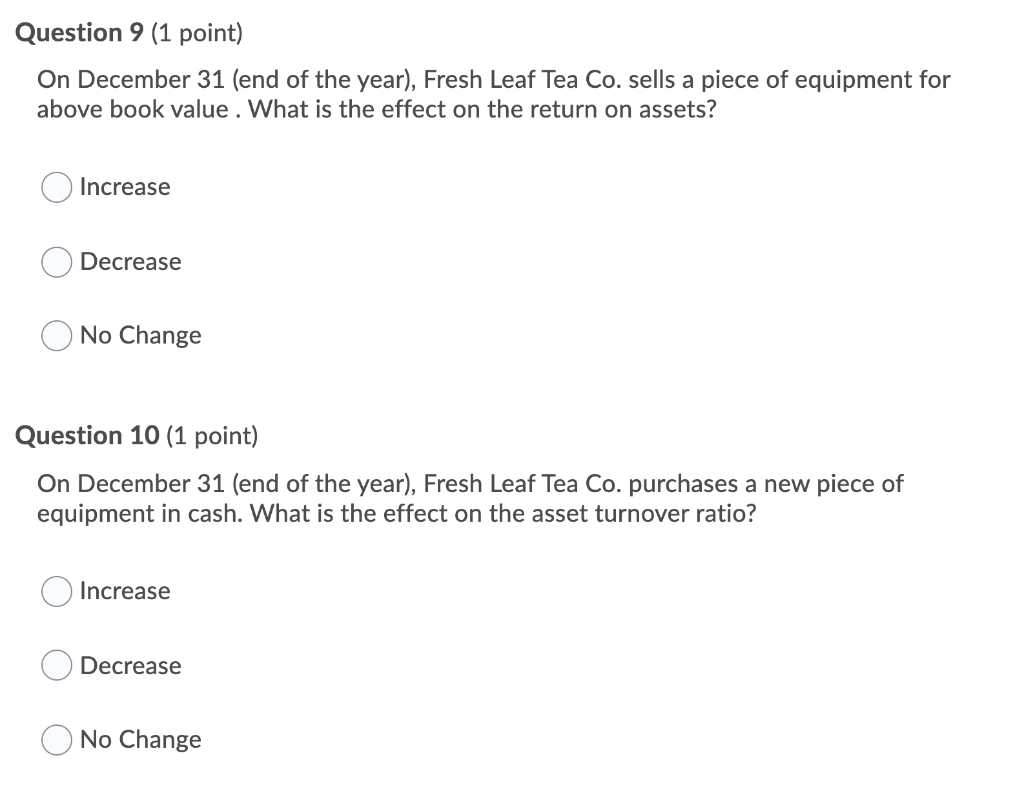

Question 1 (1 point) A firm has a piece of machinery. The machinery has an original purchase price of $660,000 and a book value of $211,000. On January 1, 2020, the firm decides the salvage value and useful life of the machinery is incorrect. The machinery actually has a useful life of 2 more years and a salvage value of $15,000. The firm uses the straight-line method. What is the depreciation expense reported by the firm in 2020? Your Answer: Answer Question 2 (1 point) On December 31, Fresh Leaf Tea Co. records an adjusting journal entry to account for $15,600 to account for the use of a machine during the year. The liabilities of Fresh Leaf Tea Co. are: Increased Decreased No Change Question 3 (1 point) On December 31, Fresh Leaf Tea Co. records an adjusting journal entry to account for $15,600 to account for the use of a machine during the year. Which of the following accounts does Fresh Leaf Tea Co. debit? Depreciation Expense Accumulated Depreciation - Property, Plant, and Equipment Property, Plant, and Equipment Loss on Impairment Gain on Sale Cash Loss on Sale Question 4 (1 point) The Company purchased a machine on January 1st for $837,501. The machine has an expected useful life of 7 years and an expected salvage value of $15,105. The company expects to produce 3,332 units in the first year of use and 8,778 over the life of the machine. What is the balance in the Accumulated Depreciation account at the end of the first year using the double-declining-balance method of depreciation. Your Answer: Answer Question 5 (1 point) Fresh Leaf Tea Co. has a piece of machinery that it purchased 7 years ago for $800,000. As of October 1, the machine has a book value of $570,000. On October 1, Fresh Leaf Tea Co. sells the machine for $530,000 in cash. Which of the following accounts does Fresh Leaf Tea Co. credit on October 1? Loss on Sale Property, Plant, and Equipment Depreciation Expense Accumulated Depreciation - Property, Plant, and Equipment Gain on Sale Cash Loss on Impairment Question 6 (1 point) The Company purchased a machine on January 1st for $991,245. The machine has an expected useful life of 5 years and an expected salvage value of $21,009. The company expects to produce 2,582 units in the first year of use and 7,009 over the life of the machine. Please calculate the depreciation expense that the company will record in the first year using the units-of-production method of depreciation. Your Answer: Answer Question 7 (1 point) Fresh Leaf Tea Co. has a piece of machinery that it purchased 3 years ago for $500,000. As of July 1, the machinery has a book value of $460,000 and a fair value of $440,000. Which of the following accounts does Fresh Leaf Tea Co. credit on July 1? Cash Loss on Impairment | No Journal Entry Needed Gain on Sale Property, Plant, and Equipment Depreciation Expense Loss on Sale Accumulated Depreciation - Property, Plant, and Equipment - Question 8 (1 point) The Company purchased a machine on January 1st for $938,947. The machine has an expected useful life of 7 years and an expected salvage value of $61,353. The company produced 2,955 units in the first year of use and expects to produce 9,085 over the life of the machine. Please calculate the depreciation expense that the company will record in the first year using the straight-line method of depreciation. Your Answer: Answer Question 9 (1 point) On December 31 (end of the year), Fresh Leaf Tea Co. sells a piece of equipment for above book value. What is the effect on the return on assets? a Increase Decrease No Change Question 10 (1 point) On December 31 (end of the year), Fresh Leaf Tea Co. purchases a new piece of equipment in cash. What is the effect on the asset turnover ratio? Increase Decrease No Change

A firm has a piece of machinery. The machinery has an original purchase price of $660,000 and a book value of $211,000. On January 1, 2020, the firm decides the salvage value and useful life of the machinery is incorrect. The machinery actually has a useful life of 2 more years and a salvage value of $15,000. The firm uses the straight-line method. What is the depreciation expense reported by the firm in 2020? Your Answer:

A firm has a piece of machinery. The machinery has an original purchase price of $660,000 and a book value of $211,000. On January 1, 2020, the firm decides the salvage value and useful life of the machinery is incorrect. The machinery actually has a useful life of 2 more years and a salvage value of $15,000. The firm uses the straight-line method. What is the depreciation expense reported by the firm in 2020? Your Answer: