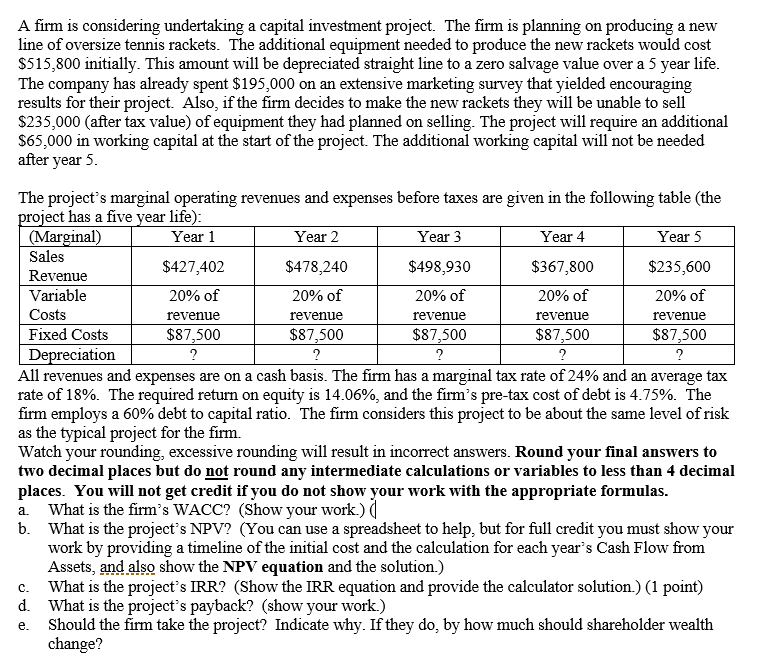

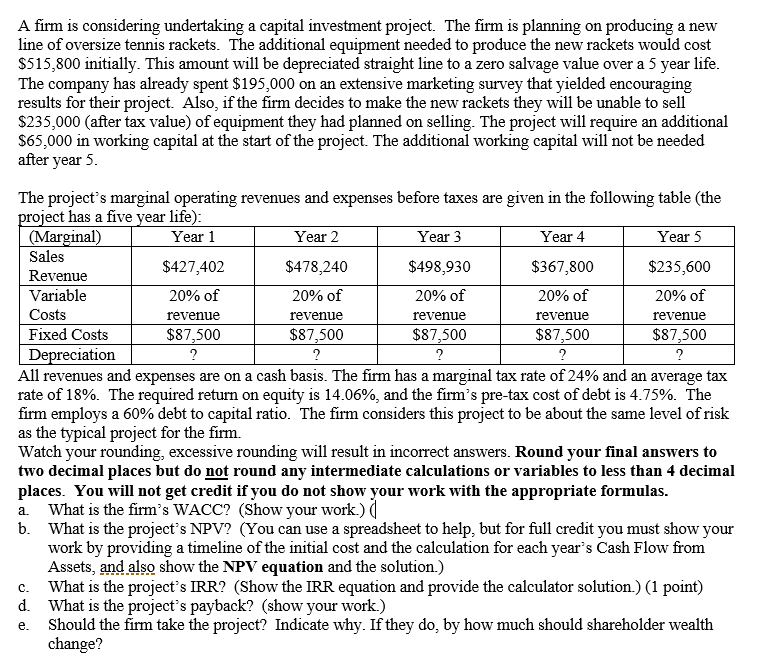

A firm is considering undertaking a capital investment project. The firm is planning on producing a new line of oversize tennis rackets. The additional equipment needed to produce the new rackets would cost $515,800 initially. This amount will be depreciated straight line to a zero salvage value over a 5 year life. The company has already spent $195,000 on an extensive marketing survey that yielded encouraging results for their project. Also, if the firm decides to make the new rackets they will be unable to sell $235,000 (after tax value) of equipment they had planned on selling. The project will require an additional $65,000 in working capital at the start of the project. The additional working capital will not be needed after year 5. The project's marginal operating revenues and expenses before taxes are given in the following table (the project has a five year life): (Marginal) Year 1 Year 2 Year 3 Year 4 Year 5 Sales $427,402 $478.240 $498,930 $367,800 $235,600 Revenue Variable 20% of 20% of 20% of 20% of 20% of Costs revenue revenue revenue revenue revenue Fixed Costs $87,500 $87,500 $87,500 $87,500 $87,500 Depreciation All revenues and expenses are on a cash basis. The firm has a marginal tax rate of 24% and an average tax rate of 18%. The required return on equity is 14.06%, and the firm's pre-tax cost of debt is 4.75%. The firm employs a 60% debt to capital ratio. The firm considers this project to be about the same level of risk as the typical project for the firm. Watch your rounding, excessive rounding will result in incorrect answers. Round your final answers to two decimal places but do not round any intermediate calculations or variables to less than 4 decimal places. You will not get credit if you do not show your work with the appropriate formulas. a. What is the firm's WACC? (Show your work.) b. What is the project's NPV? (You can use a spreadsheet to help, but for full credit you must show your work by providing a timeline of the initial cost and the calculation for each year's Cash Flow from Assets, and also show the NPV equation and the solution.) c. What is the project's IRR? (Show the IRR equation and provide the calculator solution.) (1 point) d. What is the project's payback? (show your work.) e Should the firm take the project? Indicate why. If they do, by how much should shareholder wealth change