Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A firm that is planning to expand its existing factory operations. The firm currently owns a parcel of land that it bought ten years

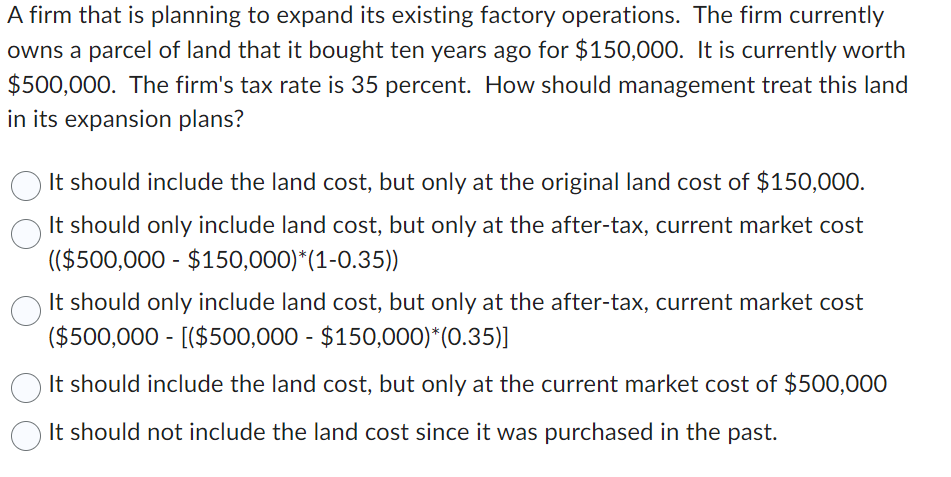

A firm that is planning to expand its existing factory operations. The firm currently owns a parcel of land that it bought ten years ago for $150,000. It is currently worth $500,000. The firm's tax rate is 35 percent. How should management treat this land in its expansion plans? It should include the land cost, but only at the original land cost of $150,000. It should only include land cost, but only at the after-tax, current market cost (($500,000 - $150,000)*(1-0.35)) It should only include land cost, but only at the after-tax, current market cost ($500,000 - [($500,000 - $150,000)*(0.35)] It should include the land cost, but only at the current market cost of $500,000 It should not include the land cost since it was purchased in the past.

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The firm should include the land cost i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started