Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A firm with required rate of return 10% and tax rate 20% evaluates the following 3-year in- vestment plan: Initial investment is $30,000 depreciated

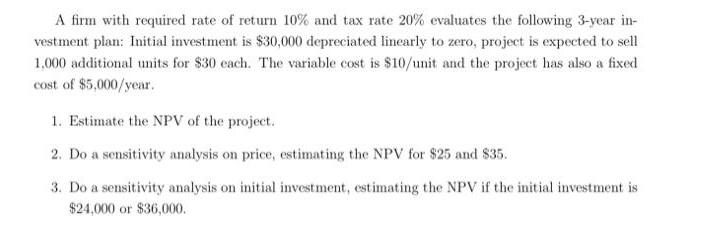

A firm with required rate of return 10% and tax rate 20% evaluates the following 3-year in- vestment plan: Initial investment is $30,000 depreciated linearly to zero, project is expected to sell 1,000 additional units for $30 each. The variable cost is $10/unit and the project has also a fixed cost of $5,000/year. 1. Estimate the NPV of the project. 2. Do a sensitivity analysis on price, estimating the NPV for $25 and $35. 3. Do a sensitivity analysis on initial investment, estimating the NPV if the initial investment is $24,000 or $36,000. A firm with required rate of return 10% and tax rate 20% evaluates the following 3-year in- vestment plan: Initial investment is $30,000 depreciated linearly to zero, project is expected to sell 1,000 additional units for $30 each. The variable cost is $10/unit and the project has also a fixed cost of $5,000/year. 1. Estimate the NPV of the project. 2. Do a sensitivity analysis on price, estimating the NPV for $25 and $35. 3. Do a sensitivity analysis on initial investment, estimating the NPV if the initial investment is $24,000 or $36,000.

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the net present value NPV of the project we need to estimate the cash flows for each year and discount them to present value using the required rate of return Lets break down the calculat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started