A. First, predict your companys future behavior through forecasting, projecting its likely performance based on the most recent year of financial information. Project the companys likely consolidated financial performance for each of the next three years. Support your analysis with an appendix spreadsheet showing actual results for the most recent year, along with your projections and assumptions. Remember that your supervisor is interested in fresh perspectives, so you should not just replicate existing financial statements: You should add other relevant calculations or disaggregations to help inform decisions.

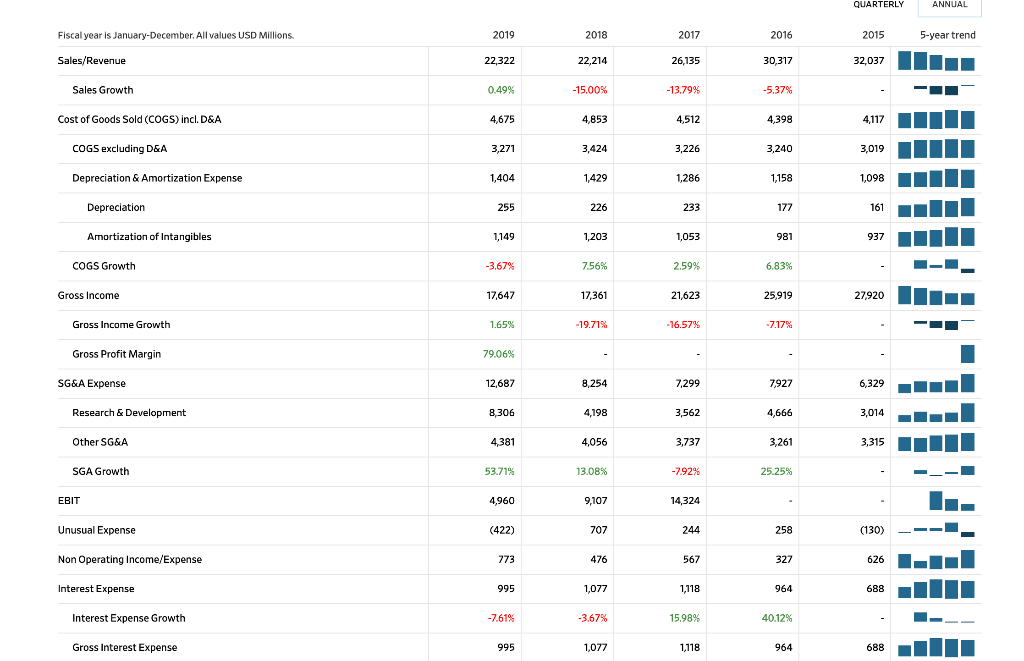

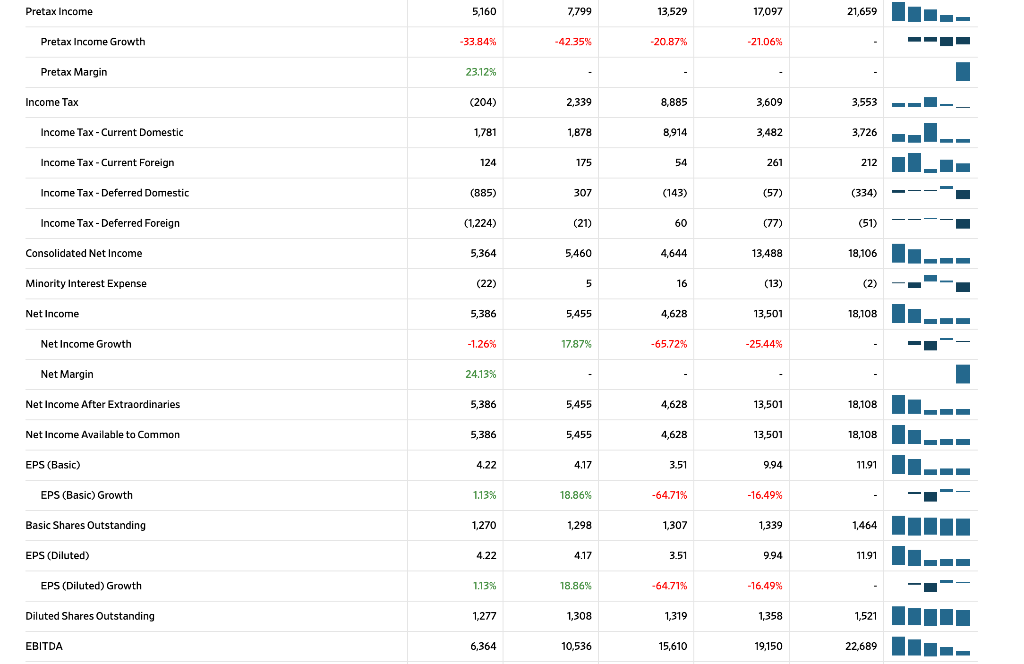

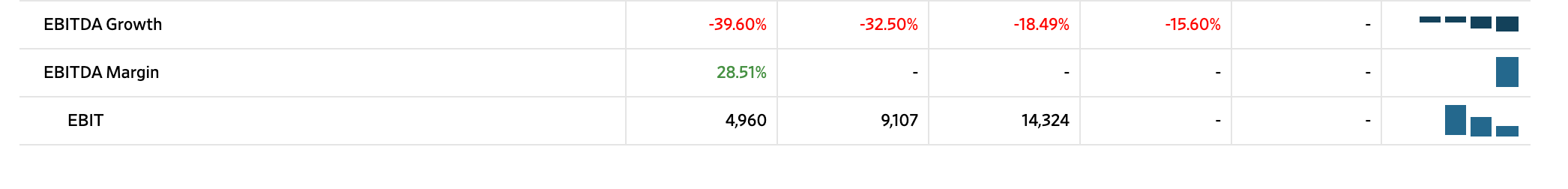

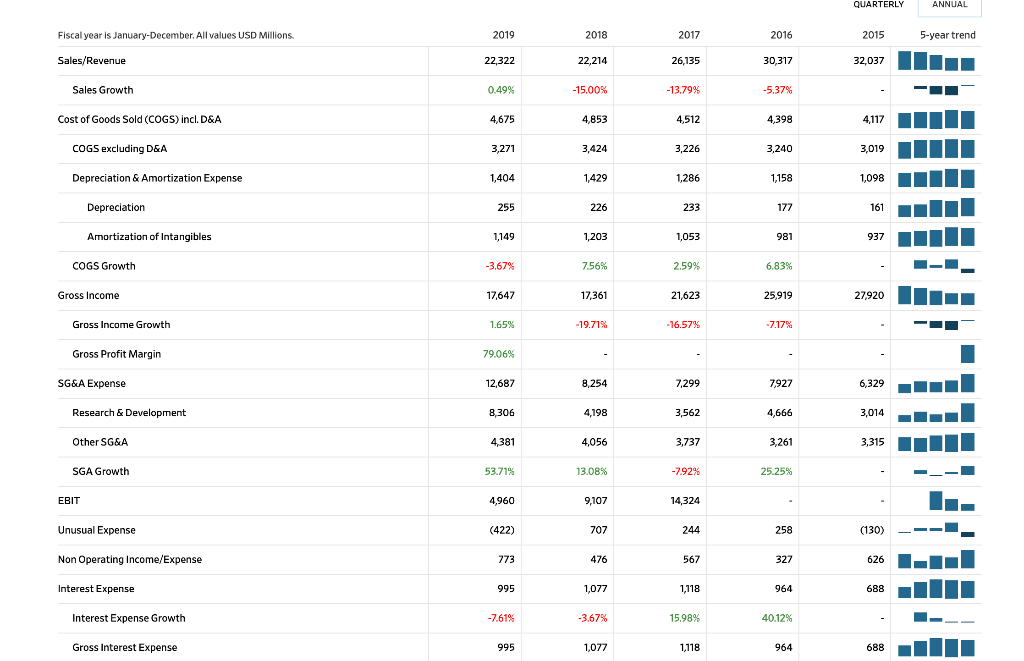

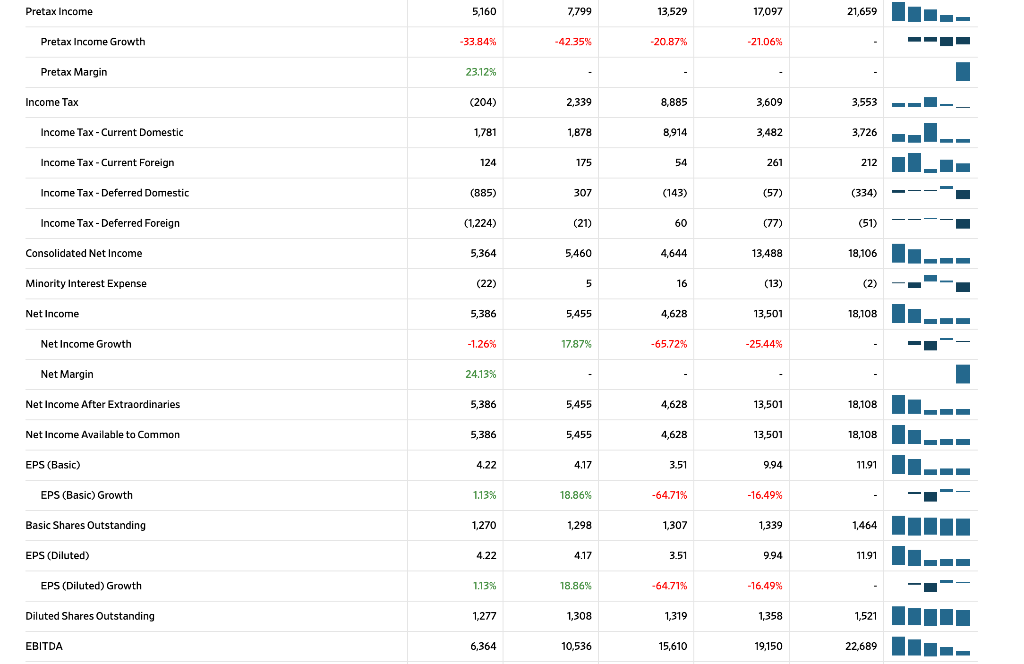

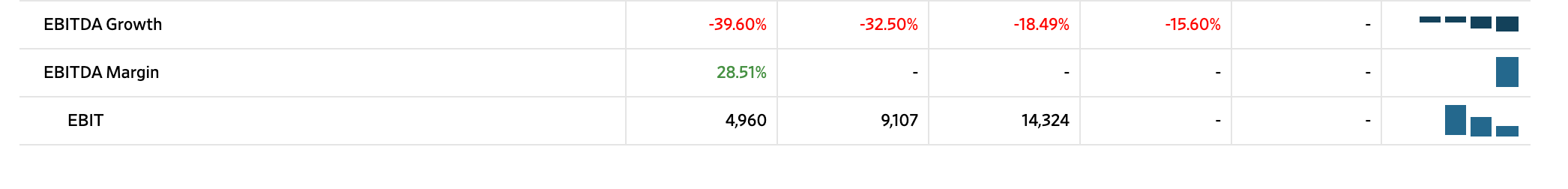

QUARTERLY ANNUAL Fiscal year is January-December. All values USD Millions 2019 2018 2017 2016 2015 5-year trend Sales/Revenue 22,322 22,214 26,135 30,317 32,037 Sales Growth 0.49% -15.00% -13.79% -5.37% Cost of Goods Sold (COGS) incl. D&A 4,675 4.853 4,512 4.398 4.117 COGS excluding D&A 3.271 3,424 3,226 3,240 3,019 Depreciation & Amortization Expense 1,404 1,429 1,286 1,158 1,098 Depreciation 255 226 233 177 161 Amortization of Intangibles 1,149 1,203 1,053 981 937 COGS Growth -3,67% 7.56% 2.59% 6.83% Gross Income 17,647 17,361 21,623 25,919 27,920 Gross Income Growth 1.65% -19.71% -16.57% -7.17% Gross Profit Margin 79.06% SG&A Expense 12,687 8,254 7,299 7,927 6,329 Research & Development 8,306 4,198 3,562 4,666 3,014 Other SG&A 4,381 4,056 3.737 3,261 3,315 SGA Growth 53.71% 13.08% -7.92% 25.25% EBIT 4,960 9,107 14,324 Unusual Expense (422) 707 244 258 (130) Non Operating Income/Expense 773 476 567 327 626 Interest Expense 995 1,077 1,118 964 688 Interest Expense Growth -7.61% -3.67% 15.98% 40.12% Gross Interest Expense 995 1,077 1,118 964 688 Pretax Income 5,160 7,799 13,529 17,097 21,659 Pretax Income Growth -33.84% -42.35% -20.87% -21.06% Pretax Margin 23.12% Income Tax (204) 2,339 8,885 3,609 3,553 Income Tax - Current Domestic 1,781 1,878 8,914 3,482 3,726 Income Tax - Current Foreign 124 175 54 261 212 Income Tax-Deferred Domestic (885) 307 (143) (57) (334) Income Tax-Deferred Foreign (1,224) (21) 60 (77) (51) Consolidated Net Income 5,364 5,460 4,644 13,488 18,106 Minority Interest Expense (22) 5 5 16 (13) (2) Net Income 5,386 5,455 4,628 13,501 18,108 Net Income Growth -1.26% 17.87% -65.72% -25.44% Net Margin 24.13% Net Income After Extraordinaries 5,386 5,455 4,628 13,501 18,108 Net Income Available to common 5,386 5,455 4,628 13,501 18,108 EPS (Basic) 4.22 4.17 3.51 9.94 11.91 LL TTI i i EPS (Basic) Growth 1.13% 18.86% -64.71% -16.49% Basic Shares Outstanding 1,270 1,298 1,307 1,339 1,464 EPS (Diluted) 4.22 4.17 3.51 9.94 11.91 EPS (Diluted) Growth 1.13% 18.86% -64.71% -16.49% Diluted Shares Outstanding 1,277 1,308 1,319 1,358 1,521 EBITDA 6,364 10,536 15,610 19,150 22,689 EBITDA Growth -39.60% -32.50% -18.49% -15.60% EBITDA Margin 28.51% EBIT 4,960 9,107 14,324 QUARTERLY ANNUAL Fiscal year is January-December. All values USD Millions 2019 2018 2017 2016 2015 5-year trend Sales/Revenue 22,322 22,214 26,135 30,317 32,037 Sales Growth 0.49% -15.00% -13.79% -5.37% Cost of Goods Sold (COGS) incl. D&A 4,675 4.853 4,512 4.398 4.117 COGS excluding D&A 3.271 3,424 3,226 3,240 3,019 Depreciation & Amortization Expense 1,404 1,429 1,286 1,158 1,098 Depreciation 255 226 233 177 161 Amortization of Intangibles 1,149 1,203 1,053 981 937 COGS Growth -3,67% 7.56% 2.59% 6.83% Gross Income 17,647 17,361 21,623 25,919 27,920 Gross Income Growth 1.65% -19.71% -16.57% -7.17% Gross Profit Margin 79.06% SG&A Expense 12,687 8,254 7,299 7,927 6,329 Research & Development 8,306 4,198 3,562 4,666 3,014 Other SG&A 4,381 4,056 3.737 3,261 3,315 SGA Growth 53.71% 13.08% -7.92% 25.25% EBIT 4,960 9,107 14,324 Unusual Expense (422) 707 244 258 (130) Non Operating Income/Expense 773 476 567 327 626 Interest Expense 995 1,077 1,118 964 688 Interest Expense Growth -7.61% -3.67% 15.98% 40.12% Gross Interest Expense 995 1,077 1,118 964 688 Pretax Income 5,160 7,799 13,529 17,097 21,659 Pretax Income Growth -33.84% -42.35% -20.87% -21.06% Pretax Margin 23.12% Income Tax (204) 2,339 8,885 3,609 3,553 Income Tax - Current Domestic 1,781 1,878 8,914 3,482 3,726 Income Tax - Current Foreign 124 175 54 261 212 Income Tax-Deferred Domestic (885) 307 (143) (57) (334) Income Tax-Deferred Foreign (1,224) (21) 60 (77) (51) Consolidated Net Income 5,364 5,460 4,644 13,488 18,106 Minority Interest Expense (22) 5 5 16 (13) (2) Net Income 5,386 5,455 4,628 13,501 18,108 Net Income Growth -1.26% 17.87% -65.72% -25.44% Net Margin 24.13% Net Income After Extraordinaries 5,386 5,455 4,628 13,501 18,108 Net Income Available to common 5,386 5,455 4,628 13,501 18,108 EPS (Basic) 4.22 4.17 3.51 9.94 11.91 LL TTI i i EPS (Basic) Growth 1.13% 18.86% -64.71% -16.49% Basic Shares Outstanding 1,270 1,298 1,307 1,339 1,464 EPS (Diluted) 4.22 4.17 3.51 9.94 11.91 EPS (Diluted) Growth 1.13% 18.86% -64.71% -16.49% Diluted Shares Outstanding 1,277 1,308 1,319 1,358 1,521 EBITDA 6,364 10,536 15,610 19,150 22,689 EBITDA Growth -39.60% -32.50% -18.49% -15.60% EBITDA Margin 28.51% EBIT 4,960 9,107 14,324