Question

(a) For Scenario 1 (X acquires Z on 1 January 2024), apply the appropriate accounting rules in SFRS(I) 1-21 to translate Z Cos individual financial

(a) For Scenario 1 (X acquires Z on 1 January 2024), apply the appropriate accounting rules in SFRS(I) 1-21 to translate Z Co’s individual financial statements (statement of profit or loss and other comprehensive income, statement of financial position, and statement of change in equity (partial)) for the year ended 31 December 2024 into X Ltd’s presentation currency of S$. In your answer, include your workings for the calculation of translation difference for the year.

(b) For Scenario 1 (X acquires Z on 1 January 2024), apply the appropriate accounting rules in SFRS(I) 1-21 to translate Z Co’s individual financial statements (statement of profit or loss and other comprehensive income, statement of financial position, and statement of change in equity (partial)) for the subsequent year ended 31 December 2025 into X Ltd’s presentation currency of S$. In your answer, include your workings for the calculation of translation difference for the year.

(c) For Scenario 1 (X acquires Z on 1 January 2024), prepare the consolidation journal entries and the projected consolidated financial statements (consolidated statement of profit or loss and other comprehensive income, consolidated statement of financial position, and consolidated statement of change in equity (partial)) of X Ltd and its subsidiary for the year ended 31 December 2024.

(d) For Scenario 1 (X acquires Z on 1 January 2024), prepare the consolidation journal entries and the projected consolidated financial statements (consolidated statement of profit or loss and other comprehensive income, consolidated statement of financial position, and consolidated statement of change in equity (partial)) of X Ltd and its subsidiary for the subsequent year ended 31 December 2025.

(e) Ignore Parts (a) to (d) above. For Scenario 2 (X acquires Z on 1 January 2025), apply the appropriate accounting rules in SFRS(I) 1-21 to translate Z Co’s individual financial statements (statement of profit or loss and other comprehensive income, statement of financial position, and statement of change in equity (partial)) for the year ended 31 December 2025 into X Ltd’s presentation currency of S$. In your answer, include your workings for the calculation of translation difference for the year.

(f) Ignore Parts (a) to (d) above. For Scenario 2 (X acquires Z on 1 January 2025), prepare the consolidation journal entries and the projected consolidated financial statements (consolidated statement of profit or loss and other comprehensive income, consolidated statement of financial position, and consolidated statement of change in equity (partial)) of X Ltd and its subsidiary for the year ended 31 December 2025.

(g) Based on your answers in Parts (a) to (f) and the information given in the question, recommend whether X Ltd should acquire 60% of the shares of Z Co on 1 January 2024 (Scenario 1) or on 1 January 2025 (Scenario 2). Remember to provide justifications or explanations for your recommendation.

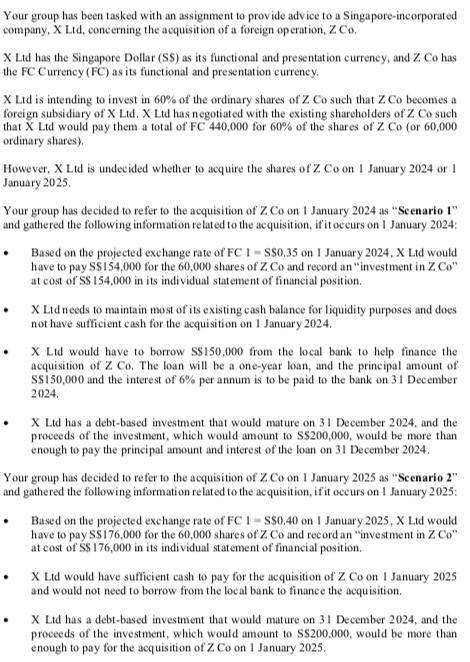

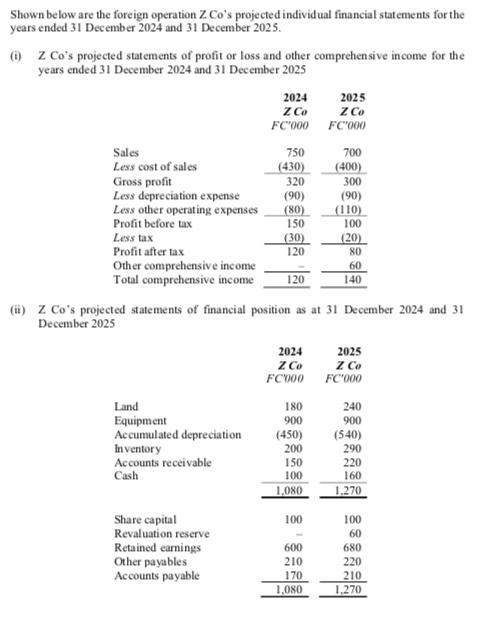

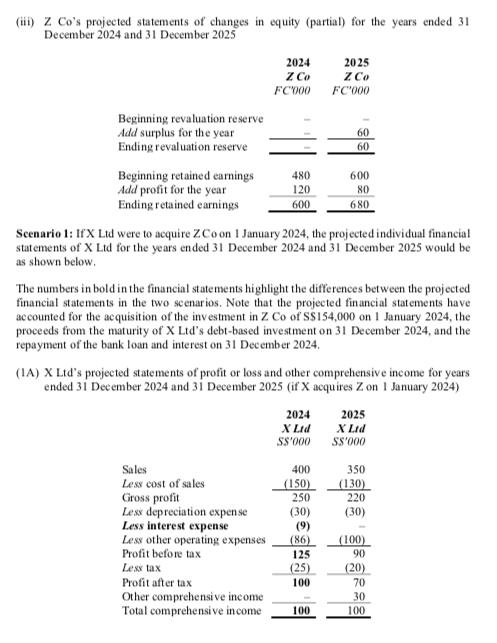

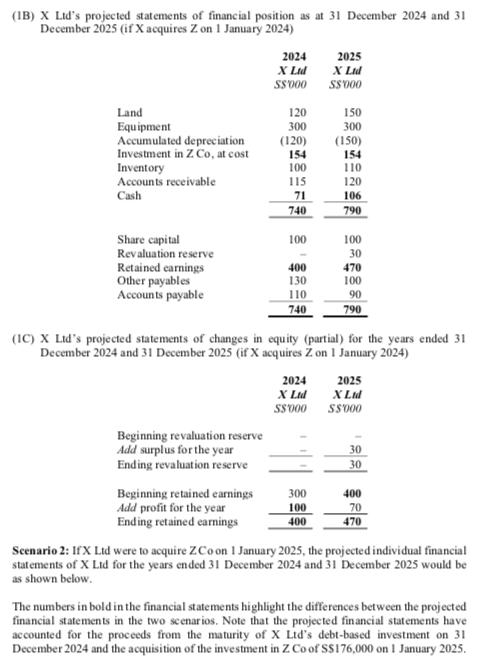

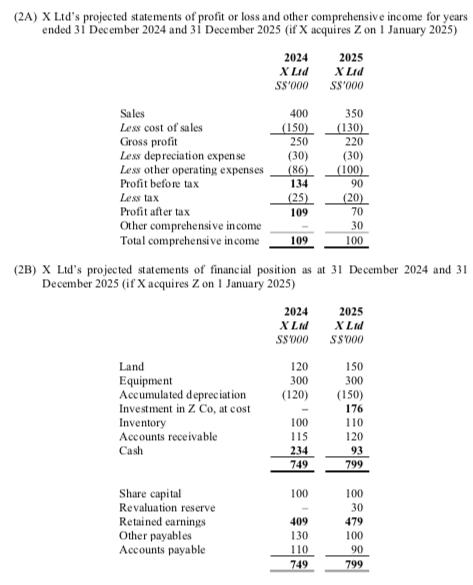

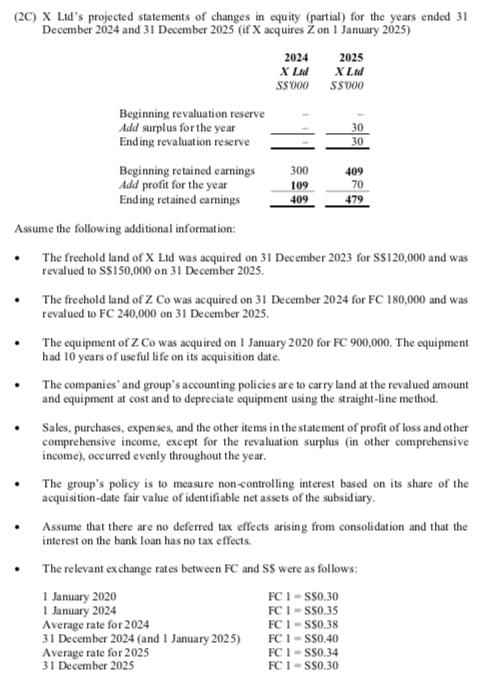

Your group has been tasked with an assignment to provide advice to a Singapore-incorporated company, X Ltd, concerning the acquisition of a foreign operation, Z. Co. X Ltd has the Singapore Dollar (SS) as its functional and presentation currency, and Z. Co has the FC Currency (FC) as its functional and presentation currency. X Ltd is intending to invest in 60% of the ordinary shares of Z. Co such that Z. Co becomes a foreign subsidiary of X Ltd. X Ltd has negotiated with the existing shareholders of Z Co such that X Ltd would pay them a total of FC 440,000 for 60% of the shares of Z Co (or 60,000 ordinary shares). However, X Ltd is undecided whether to acquire the shares of Z. Co on 1 January 2024 or 1 January 2025. Your group has decided to refer to the acquisition of Z. Co on 1 January 2024 as "Scenario 1" and gathered the following information related to the acquisition, if it occurs on 1 January 2024: Based on the projected exchange rate of FC 1-S$0.35 on 1 January 2024, X Ltd would have to pay $$154,000 for the 60,000 shares of Z. Co and record an "investment in Z. Co" at cost of S$ 154,000 in its individual statement of financial position. X Ltd needs to maintain most of its existing cash balance for liquidity purposes and does not have sufficient cash for the acquisition on 1 January 2024. X Ltd would have to borrow S$150,000 from the local bank to help finance the acquisition of Z Co. The loan will be a one-year loan, and the principal amount of S$150,000 and the interest of 6% per annum is to be paid to the bank on 31 December 2024. X Ltd has a debt-based investment that would mature on 31 December 2024, and the proceeds of the investment, which would amount to S$200,000, would be more than enough to pay the principal amount and interest of the loan on 31 December 2024. Your group has decided to refer to the acquisition of Z Co on 1 January 2025 as "Scenario 2" and gathered the following information related to the acquisition, if it occurs on 1 January 2025: Based on the projected exchange rate of FC 1-S$0.40 on 1 January 2025, X Ltd would have to pay $$176,000 for the 60,000 shares of Z. Co and record an "investment in Z. Co" at cost of S$ 176,000 in its individual statement of financial position. X Ltd would have sufficient cash to pay for the acquisition of Z Co on 1 January 2025 and would not need to borrow from the local bank to finance the acquisition. X Ltd has a debt-based investment that would mature on 31 December 2024, and the proceeds of the investment, which would amount to S$200,000, would be more than enough to pay for the acquisition of Z. Co on 1 January 2025.

Step by Step Solution

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided heres the analysis for both scenarios Scenario 1 Acquisition on 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started