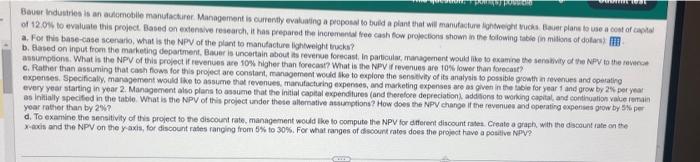

a. For this base-case scenario, What is the NPV of the plant to manutacture lightweight trucks? assumptions. What is the NPV of thil proyect if revenues are 10% higher than forecast? What is the NPV if revenues are 10% sower than forocant? every year starting in yoar 2. Management also plans to assume that the initial capeal expenditures (and therefore depreciationk addons to avorling capital and corthuation vatue iomain as inlially specifod in the yoar rather than by 2% ? d. To examine the sensitivity of this project to the discount rate, management would the lo compute the NPV for ditferent discount raset Create a graph. with the dasount rate on the x-axis and the NPY on the y-axis, for discount rates ranging from 5% to 30%. For what ranges of dscourt rates does the projedt have a positive NP?? Baver Industries is an automoblle manufacturer. Mariagement is currently evaluating a proposal to build a plant that will manufacture lightweight trucks. Bauer plans to use a cost of capital of 12.0\% to evaluate this project. Based on extensive research, it has prepased the incremental free cash flow projections shown in the following tabie (in milions of dolara): a. For this base-case tcenario, what is the NPV of the plant to manufacture lightweight trucks? b. Based on input trom the marketing department, Bauer is uncertain about its revenue forecast in patcular, management would like to examine the sensitily of the NPV to the revenue assumptions. What is the NPV of this projeet it revenues are 10\%s higher than forecas? What is the NPV if revenues are 10 ow lower than forecast? 0. Rather than assuming that cash fows lor thit project are constant, management would Ike to expiore the seneitivily of its analysis to possibio groweth in cevenues and coerating. expenset. Specificaly, management would like to assume that revenues, manufacturing expenses, and marketing expenses ave as given in the Lable for year 1 and grow by 216 per year every year otarting in yeat 2 Management also plans to astume that the intial capilat expenditures (and therefore depreciaton), additions to warking capeat, and continuation value remain as insally specifed in the table. What is the NPV of this preject under these altemative. assumptions? How does the NPV change if the revenues and cperating expensea grow by 5 S per year rather than by 2% ? d. To examine the sensitivity of this project to the discount rate, management would tike to compute the NPV for different discount rates. Create a graght, with the discount rate on the X-axis and the NPV on the y-axis, for discount rates ranging from 5% to 30%. For what ranges of discount nates does the project have a positive NPV? a. For this base-case scenario, what is the NPV of the plant to manutacture lighlwoight trucks? The NPV of the plant to manutacture lightweight trucks, based on the estanated tee cach flow is s b. Based on input from the marketing department. Bauer is uncertain about its revenue forecast In partcidar, managerment woukd ike to eraniene the sensitity of the Niv to ine fevenue assimptions. What is the fPpy of this project if ievenues are 10/s higher than forecaat? What is the NPV it revenues are tots lower than forecast? The NPWof this groject if ievenues are 10 higher than fotecast is 3 mation- (Round to ene decimal plice.) The NPV of this project if reverues are 10% lower than forecast is 1 milior. (Hound to one decimal piace.) c. Rathec than assuming that cash flows for this project are constant. manpgememt woud awe to explore the sensitvity of its analyai to possibio gionth in tevonues and operaang expenses. Specifically management wowld like to absume that reverues, manufacturing expenses, and marketing expenses are as given in the lable far yoac 1 and gouk by 2% per ynar remain as initialy specited in the toble. What is the NPV of this project uhder these alternatio assumptiona? How does the Nav change if the revenues and opevating eapenses grow by 5% per year rather than by 2 tis? If revenues. manutacturina exoenses. and maiketing expenses grow by 2 its per year evecy year starting in year 2. Fie NPV of the nstimsted tree cash fow in mition. (Round to one decimal place.) If tevenues, manufacturine expenses, and marketing oxpentes grow by 5% per year every year sarting in year 2, the NFV of the estimated the caak iow in imition. (Round to one decmal place) remain as initioly specilied in the table. What is the NPY of this project under these allemative assumptions? How does the NPV change if me covenues and optratha expenaes gow by 5% per year rather than by 2% ? If revenues, manutacturina exnenses. and marketing expenses grow by 2\%, per year every year stating in year 2 , the NPY of the estmaled free arah bow is mililion. (Round to one docimal place.) If revenues. manufacturine exnenses. and markoting expenses grow by 5% per year every year starthe in yeur 2 , the Npy of the eatimated toe cauh sow is. milion. (Round to one decimal place.) d. To exarnine the sonsitivity of this project to the discount fale, management would khe to compute the NPV for difecent ditcount tates using the base cose acenaro. Create angaph. The NPV is posfine for discount rales betow the IRte of (Recind to tro decimal places.)