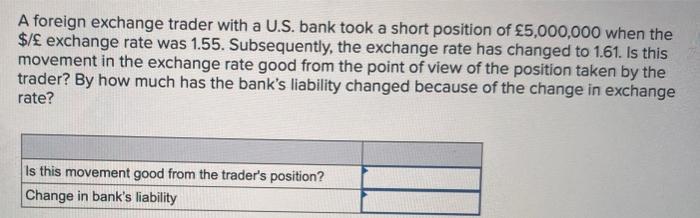

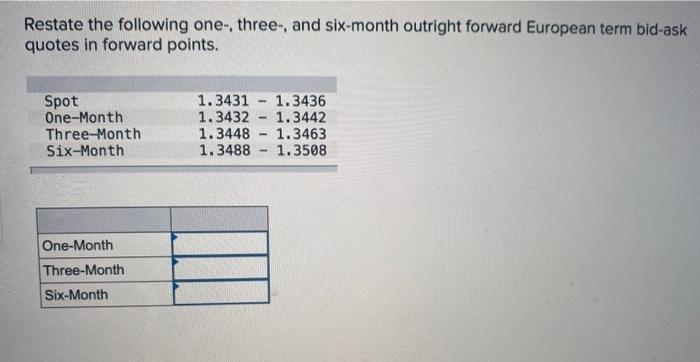

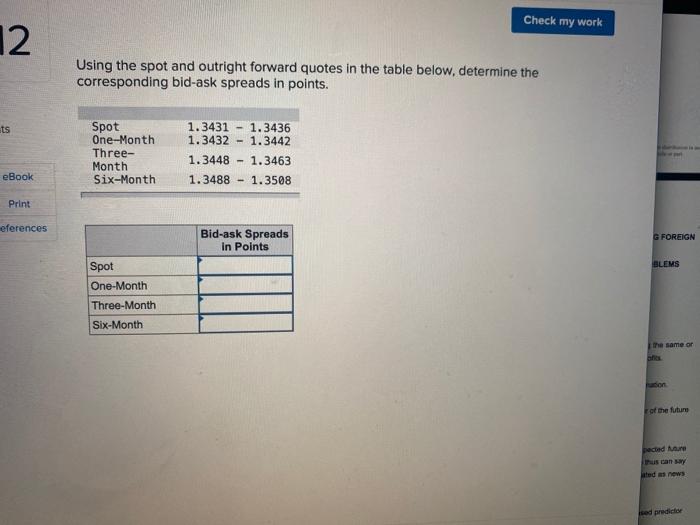

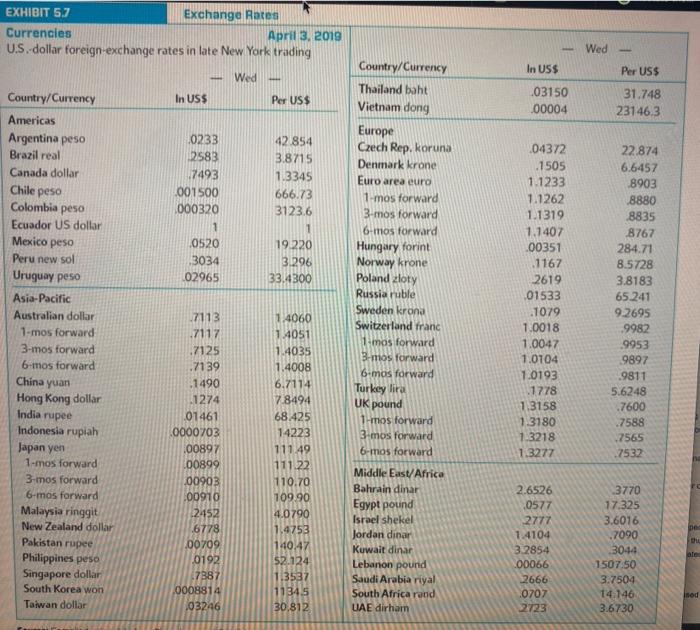

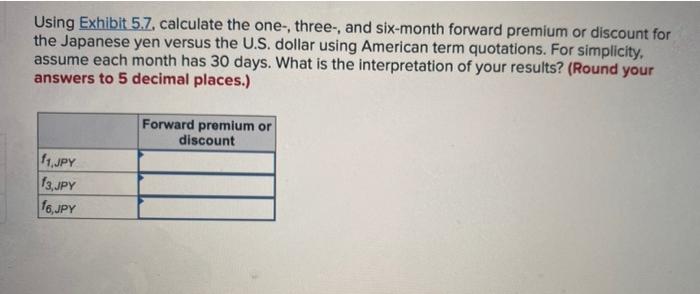

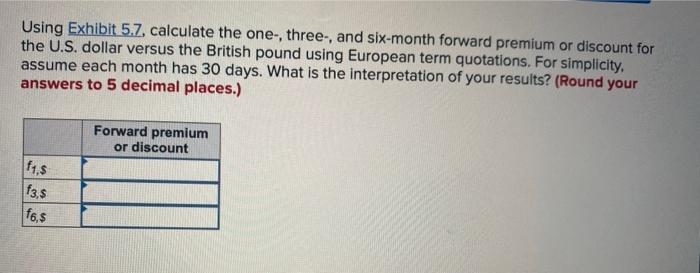

A foreign exchange trader with a U.S. bank took a short position of 5,000,000 when the $/ exchange rate was 1.55. Subsequently, the exchange rate has changed to 1.61. Is this movement in the exchange rate good from the point of view of the position taken by the trader? By how much has the bank's liability changed because of the change in exchange rate? Is this movement good from the trader's position? Change in bank's liability Restate the following one-, three-, and six-month outright forward European term bid-ask quotes in forward points. Spot One-Month Three-Month Six-Month 1.3431 1.3436 1.3432 1.3442 1.3448 - 1.3463 1.3488 1.3508 One-Month Three-Month Six-Month Check my work 2 Using the spot and outright forward quotes in the table below, determine the corresponding bid-ask spreads in points. ats Spot One-Month Three- Month Six-Month 1.3431 - 1.3436 1.3432 - 1.3442 1.3448 1.3463 1.3488 1.3508 eBook Print eferences Bid-ask Spreads in Points G FOREIGN BLEMS Spot One-Month Three-Month Six-Month the same or of the future pected more Pascany ed as news sed predictor EXHIBIT 5.7 Exchange Rates Currencies April 3, 2019 U.S. dollar foreign-exchange rates in late New York trading Wed Wed Per US$ - In US 203150 00004 In USS Per US$ 31.748 23146.3 Country/Currency Americas Argentina peso Brazil real Canada dollar Chile peso Colombia peso Ecuador US dollar Mexico peso Peru new sol Uruguay peso 0233 2583 7493 001500 000320 1 .0520 3034 02965 42 854 3.8715 1.3345 666.73 3123.6 1 19.220 3.296 33.4300 Country/Currency Thailand baht Vietnam dong Europe Czech Rep, koruna Denmark krone Euro area euro 1-mos forward 3-mos forward 6-os forward Hungary forint Norway krone Poland Zloty Russia ruble Sweden krona Switzerland Franc 1-mos forward 3-mos forward 6-mos forward Turkey lira UK pound 1-os forward 3-mos forward 6-mos forward Asia-Pacific Australian dollar 1-mos forward 3-mos forward 6-mos forward .04372 1505 1.1233 1.1262 1.1319 1.1407 .00351 .1167 2619 01533 1079 1.0018 1.0047 1.0104 1.0193 11778 1.3158 1.3180 1.3218 1.3277 22.874 6.6457 8903 8880 8835 8767 284.71 8.5728 3.8183 65.241 9.2695 .9982 9953 9897 .9811 5.6248 .7600 7588 7565 .7532 China yuan Hong Kong dollar India rupee Indonesia rupiah Japan yen 1-mos forward 3-mos forward 6-mos forward Malaysia ringgit New Zealand dollar Pakistan rupee Philippines peso Singapore dollar South Korea won Taiwan dollar 17113 7117 .7125 .7139 .1490 1274 01461 0000703 200897 00899 00903 00910 2452 6778 00709 0192 7387 0008814 103246 1.4060 14051 1.4035 1.4008 6.7114 7.8494 68.425 14223 111.49 111.22 110.70 109.90 4.0790 1.4753 140.47 52.124 1.3537 11345 30,812 Middle East/Africa Bahrain dinar Egypt pound Israel shekel Jordan dinar Kuwait dinar Lebanon pound Saudi Arabia Riyal South Africa rond UAE dirham 2.6526 0577 2777 1.4104 3.2854 .00066 2666 0707 2723 3770 17.325 3.6016 .7090 3044 1507 50 3.7504 14.146 3.6730 ale Using Exhibit 5.7. calculate the one-, three-, and six-month forward premium or discount for the Japanese yen versus the U.S. dollar using American term quotations. For simplicity, assume each month has 30 days. What is the interpretation of your results? (Round your answers to 5 decimal places.) Forward premium or discount 11.jpY 113.jpy 16.JPY Using Exhibit 5.7, calculate the one-, three-, and six-month forward premium or discount for the U.S. dollar versus the British pound using European term quotations. For simplicity assume each month has 30 days. What is the interpretation of your results? (Round your answers to 5 decimal places.) Forward premium or discount f1.5 f3,5 f6,9