Question

A friend of yours, Grace, wants to purchase a house in five years. To save for the house, Grace decides to deposit $120,000 in a

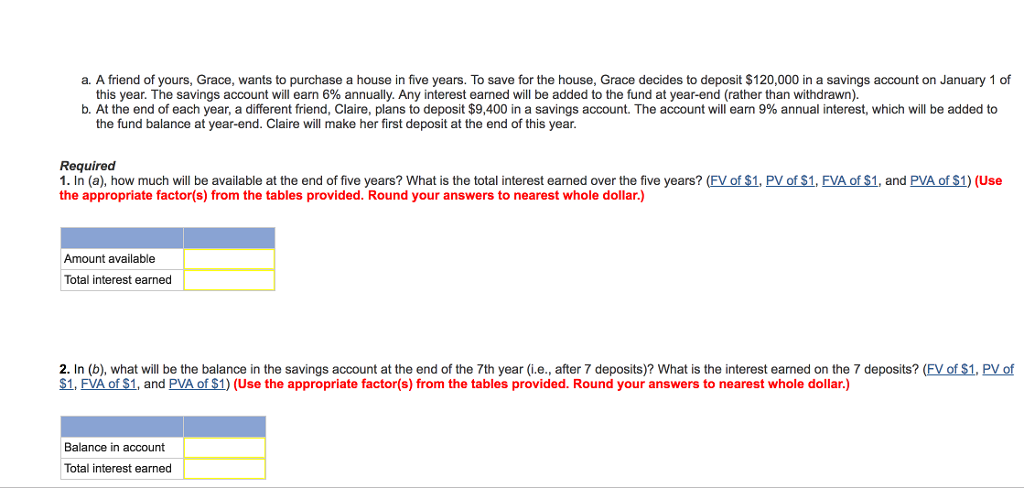

A friend of yours, Grace, wants to purchase a house in five years. To save for the house, Grace decides to deposit $120,000 in a savings account on January 1 of this year. The savings account will earn 6% annually. Any interest earned will be added to the fund at year-end (rather than withdrawn).

At the end of each year, a different friend, Claire, plans to deposit $9,400 in a savings account. The account will earn 9% annual interest, which will be added to the fund balance at year-end. Claire will make her first deposit at the end of this year.

a. A friend of yours, Grace, wants to purchase a house in five years. To save for the house, Grace decides to deposit $120,000 in a savings account on January 1 of this year. The savings account will earn 6% annually. Any interest earned will be added to the fund at year-end (rather than withdrawn b. At the end of each year, a different friend, Claire, plans to deposit $9,400 in a savings account. The account will earn 9% annual interest, which will be added to the fund balance at year-end. Claire will make her first deposit at the end of this year. Required 1. In (a), how much will be available at the end of five years? What is the total interest earned over the five years? (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use the appropriate factor(s) from the tables provided. Round your answers to nearest whole dollar.) Amount available Total interest earned 2. In (b), what will be the balance in the savings account at the end of the 7th year (i.e., after 7 deposits)? What is the interest earned on the 7 deposits? (FVof $1, PV of $1, FVA of $1, and PVA of $1) Use the appropriate factor(s) from the tables provided. Round your answers to nearest whole dollar. Balance in account Total interest earned

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started