Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A furniture company is producing and selling several products for grass sales (income) of 2.25 million shillings. Retums and allowances are 4 percent of gross

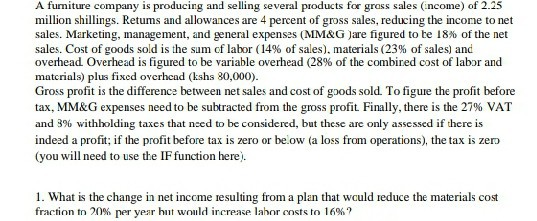

A furniture company is producing and selling several products for grass sales (income) of 2.25 million shillings. Retums and allowances are 4 percent of gross sales, reducing the income to net sales. Marketing, management, and general expenses (MM&G Jare figured to be 18% of the net sales. Cost of goods sold is the sum of labor (14% of sales), materials (23% of sales) and overhead Overhead is figured to be variable overhead (28% of the combined cost of labor and matcrials) plus fixed overhead (kshs 30,000). Gross profit is the difference between net sales and cost of goods sold. To figure the profit before tax, MM&G expenses need to be subtracted from the gross profit Finally, there is the 27% VAT and 3% withholding taxes that need to be considered, but these are only assessed if there is indeed a profit; if the profit before tax is zero or below (a loss from operations), the tax is zer (you will need to use the IF function here). 1. What is the change in net income resulting from a plan that would reduce the materials cost fraction to 20% per year but would increase labor costs to 16%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started