Question

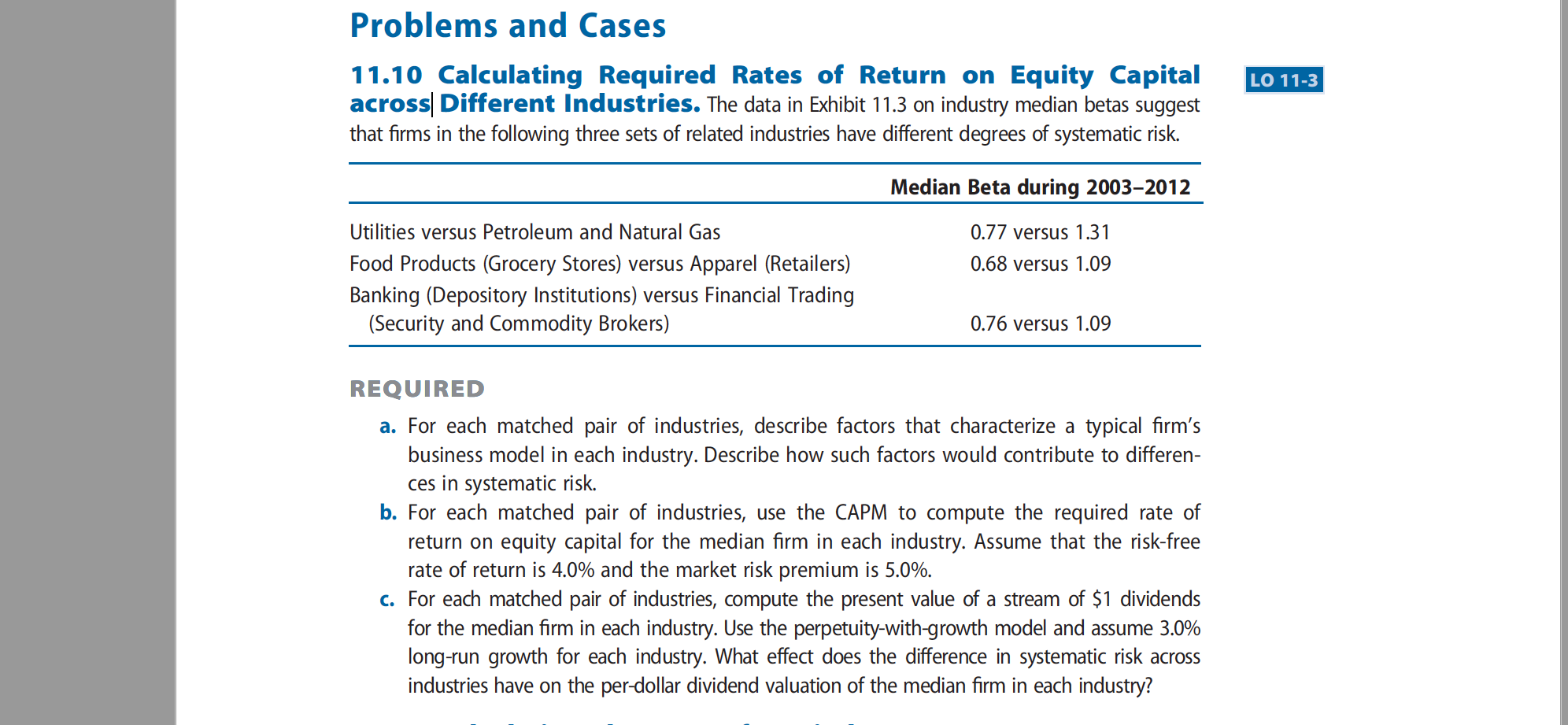

Assignment Content Complete Problems and Cases 11.10 (Page 899 of the Financial Reporting Text) Calculating Required Rates of Return on Equity Capital Across Different Industries.

Assignment Content

-

Complete Problems and Cases 11.10 (Page 899 of the Financial Reporting Text) Calculating Required Rates of Return on Equity Capital Across Different Industries.

Please submit your homework as a Word Document. Do not exceed 100 words per answer for each of the three comparisons in part "a." Create tables to show your work in parts b and c; these should created in Excel and then pasted into Word as a "Microsoft Excel Worksheet Object."

For the text answer to the last part of "c" limit your answer to one or two sentences and 150 words (maximum). In fact a well developed single sentence is preferable.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started