Answered step by step

Verified Expert Solution

Question

1 Approved Answer

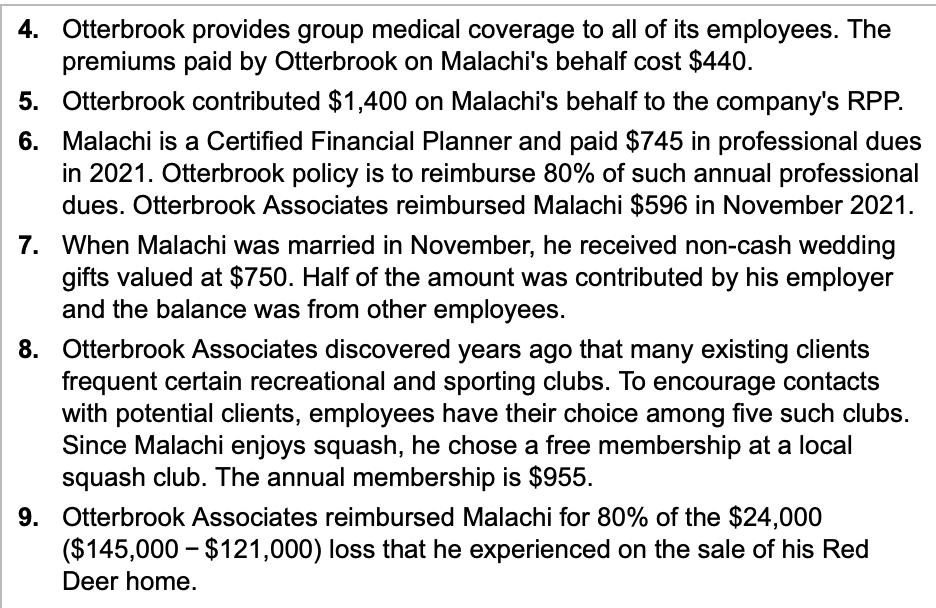

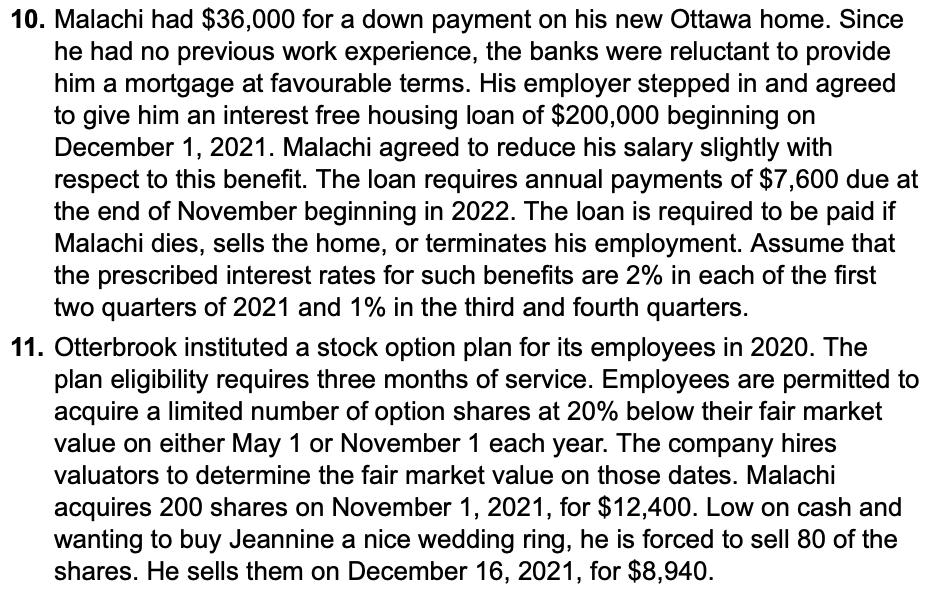

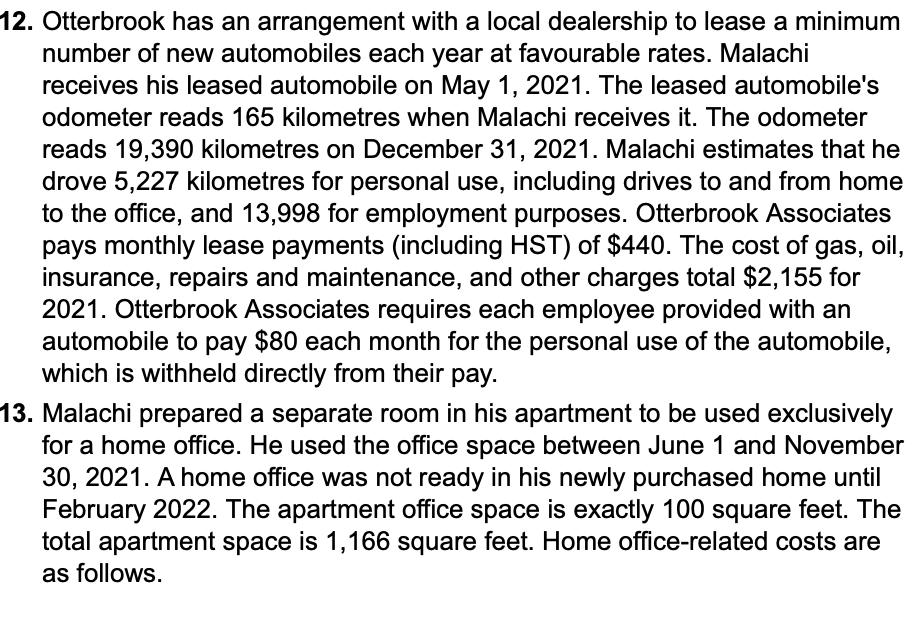

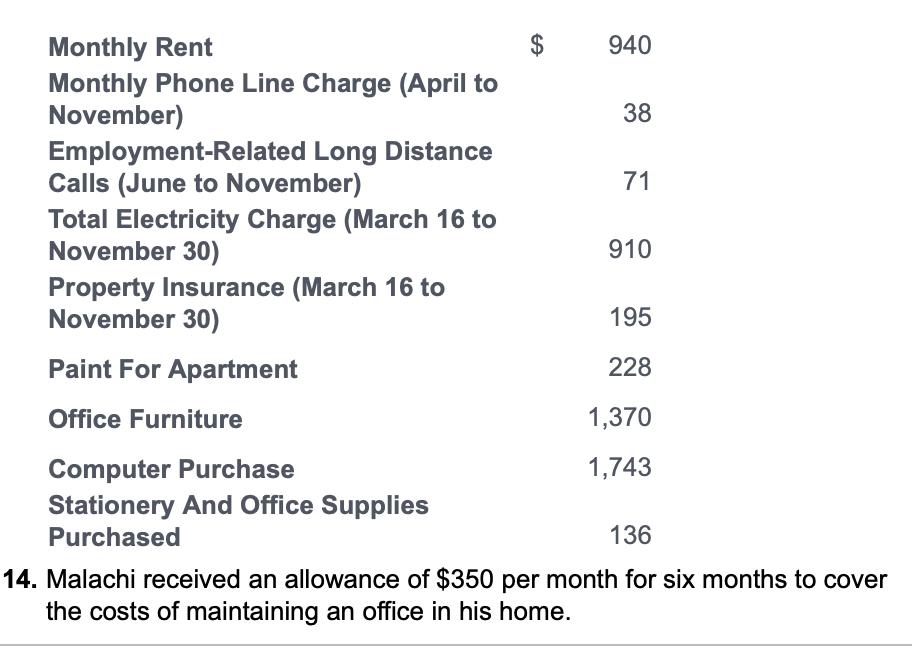

A graduated from the University in early 2021 at the age of 30. He immediately applied for a number of jobs and accepted a position

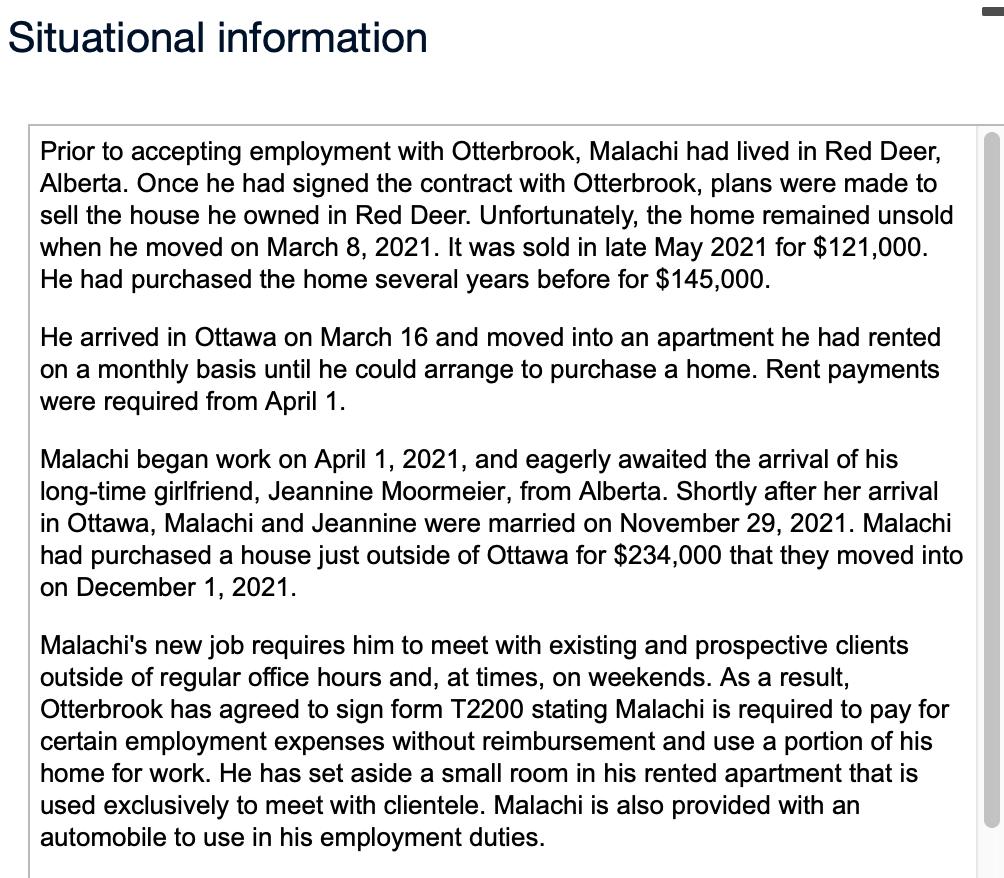

A graduated from the University in early 2021 at the age of 30. He immediately applied for a number of jobs and accepted a position as a financial planner in the Ottawa office of Otterbrook Associates Ltd. Otterbrook is a large Canadian controlled private corporation (CCPC) employing more than 200 people. Prior to accepting employment with Otterbrook, Malachi had lived in Red Deer, Alberta.

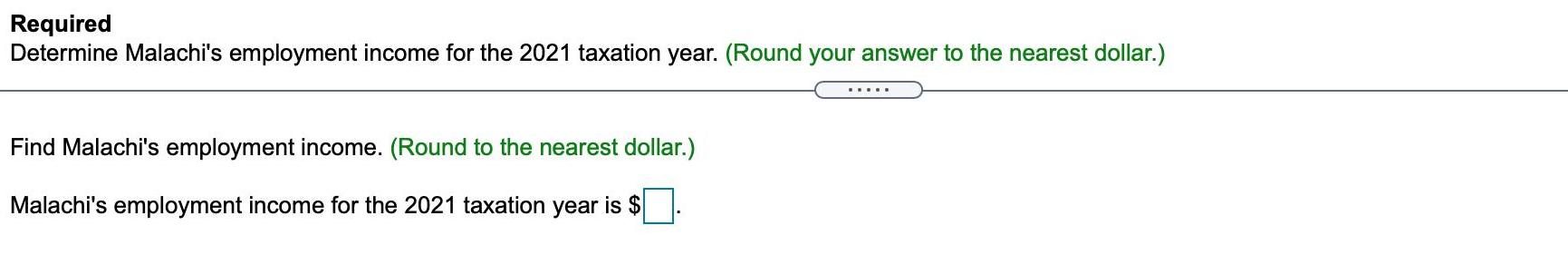

Required Determine Malachi's employment income for the 2021 taxation year. (Round your answer to the nearest dollar.) Find Malachi's employment income. (Round to the nearest dollar.) Malachi's employment income for the 2021 taxation year is $ *****

Step by Step Solution

★★★★★

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

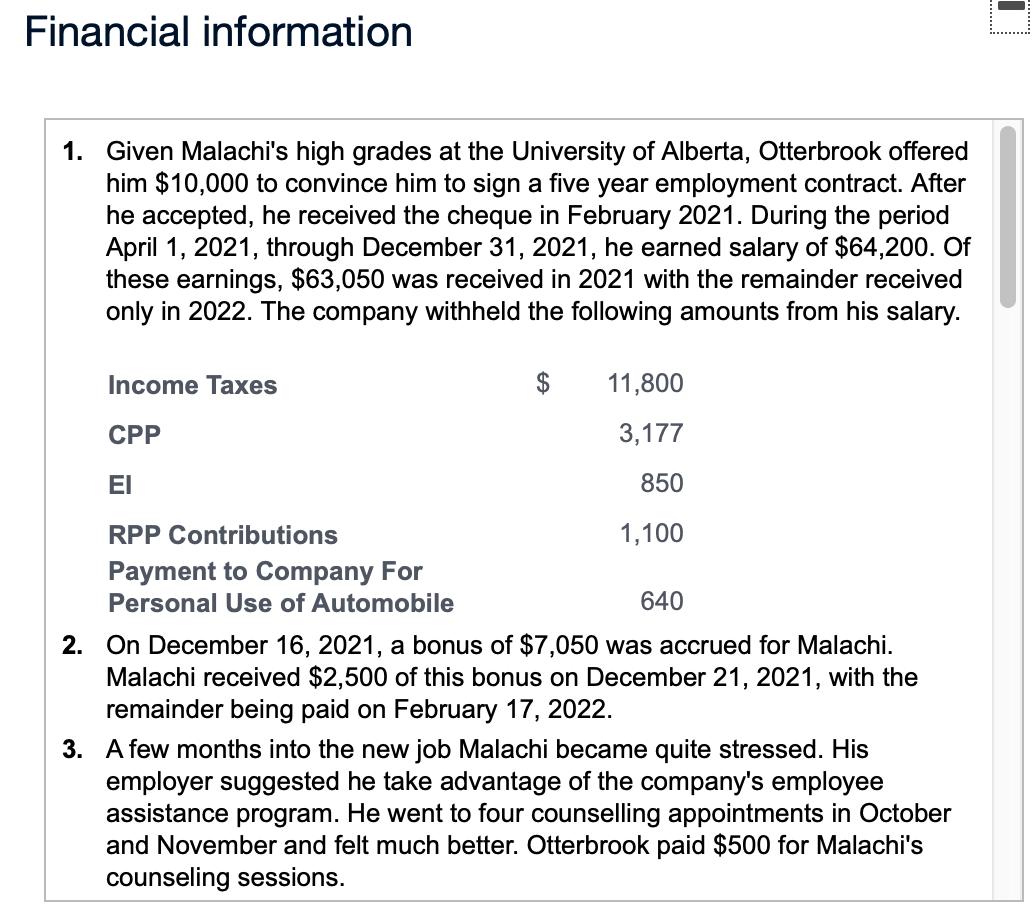

2 On December 16 2021 a bonus of was a7050 accrued for Malachi Malachi received 2500 of this bonus on December 21 2021 with the remainder being paid on February 17 2022 Only the 2500 amount of the bon...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started