Answered step by step

Verified Expert Solution

Question

1 Approved Answer

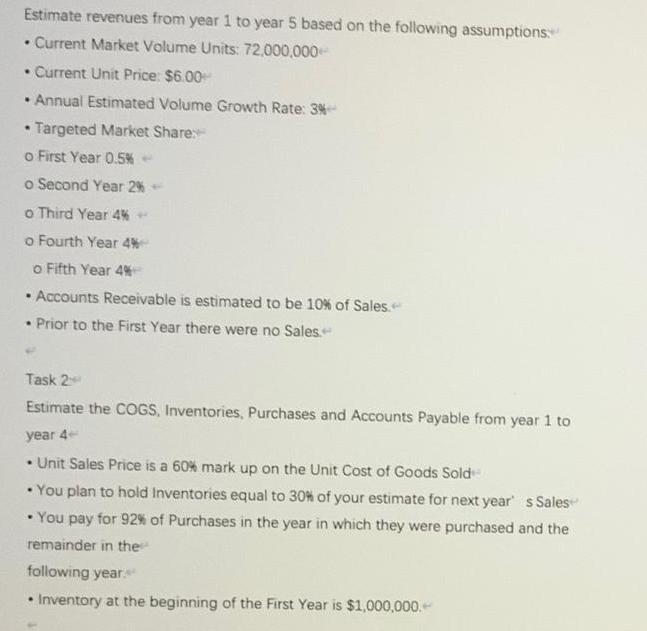

Estimate revenues from year 1 to year 5 based on the following assumptions: . Current Market Volume Units: 72,000,000 . Current Unit Price: $6.00+

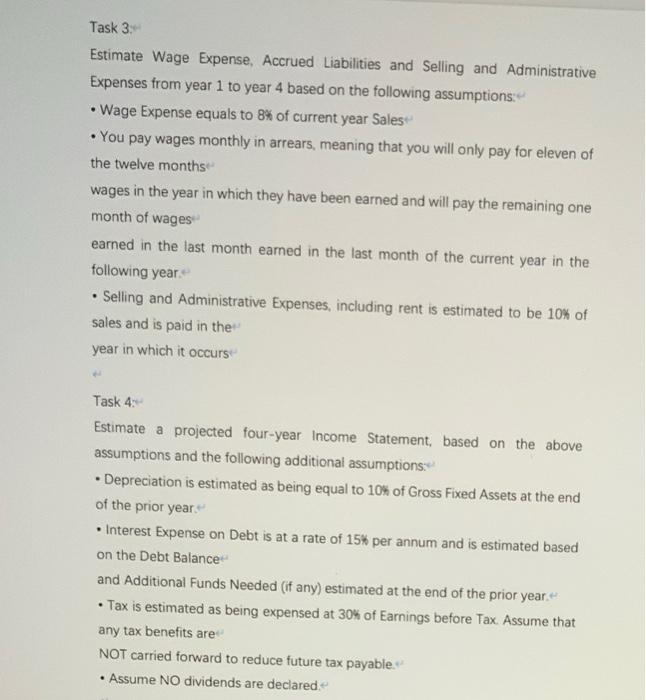

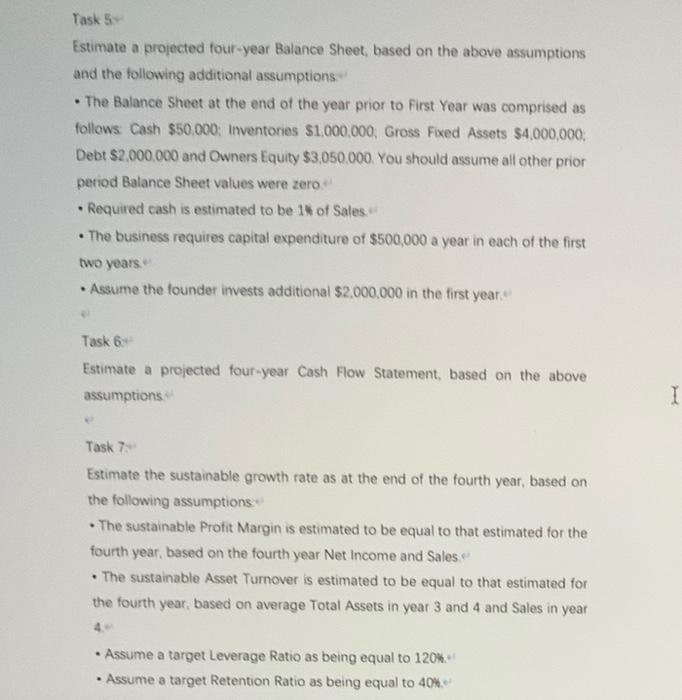

Estimate revenues from year 1 to year 5 based on the following assumptions: . Current Market Volume Units: 72,000,000 . Current Unit Price: $6.00+ Annual Estimated Volume Growth Rate: 3%- Targeted Market Share: o First Year 0.5% - o Second Year 2% o Third Year 4% o Fourth Year 4% o Fifth Year 4% Accounts Receivable is estimated to be 10% of Sales. Prior to the First Year there were no Sales. . Task 2 Estimate the COGS, Inventories, Purchases and Accounts Payable from year 1 to year 4- Unit Sales Price is a 60% mark up on the Unit Cost of Goods Sold You plan to hold Inventories equal to 30% of your estimate for next year's Sales . You pay for 92% of Purchases in the year in which they were purchased and the remainder in the following year. Inventory at the beginning of the First Year is $1,000,000.- Task 3 Estimate Wage Expense, Accrued Liabilities and Selling and Administrative Expenses from year 1 to year 4 based on the following assumptions: . Wage Expense equals to 8% of current year Sales You pay wages monthly in arrears, meaning that you will only pay for eleven of the twelve months wages in the year in which they have been earned and will pay the remaining one month of wages earned in the last month earned in the last month of the current year in the following year. Selling and Administrative Expenses, including rent is estimated to be 10% of sales and is paid in the year in which it occurs . W Task 4: Estimate a projected four-year Income Statement, based on the above assumptions and the following additional assumptions: Depreciation is estimated as being equal to 10% of Gross Fixed Assets at the end of the prior year. . Interest Expense on Debt is at a rate of 15% per annum and is estimated based on the Debt Balance and Additional Funds Needed (if any) estimated at the end of the prior year. Tax is estimated as being expensed at 30% of Earnings before Tax. Assume that any tax benefits are NOT carried forward to reduce future tax payable. Assume NO dividends are declared Task 5+ Estimate a projected four-year Balance Sheet, based on the above assumptions and the following additional assumptions . The Balance Sheet at the end of the year prior to First Year was comprised as follows: Cash $50.000: Inventories $1,000,000, Gross Fixed Assets $4,000,000; Debt $2,000,000 and Owners Equity $3,050,000. You should assume all other prior period Balance Sheet values were zero. Required cash is estimated to be 1% of Sales The business requires capital expenditure of $500,000 a year in each of the first two years. Assume the founder invests additional $2,000,000 in the first year. Task 6 Estimate a projected four-year Cash Flow Statement, based on the above assumptions Task 7 Estimate the sustainable growth rate as at the end of the fourth year, based on the following assumptions The sustainable Profit Margin is estimated to be equal to that estimated for the fourth year, based on the fourth year Net Income and Sales. The sustainable Asset Turnover is estimated to be equal to that estimated for the fourth year, based on average Total Assets in year 3 and 4 and Sales in year Assume a target Leverage Ratio as being equal to 120% Assume a target Retention Ratio as being equal to 40%. . I

Step by Step Solution

★★★★★

3.52 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Task 1 Estimate Revenues Assumptions Current Market Volume Units 72000000 Current Unit Price 600 Annual Estimated Volume Growth Rate 3 Targeted Market Share First Year 05 Second Year 2 Third Year 4 Fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started