Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A granary is considering a conveyor used in the manufacture of grain for transporting, filling, or emptying. It can be purchased and installed for

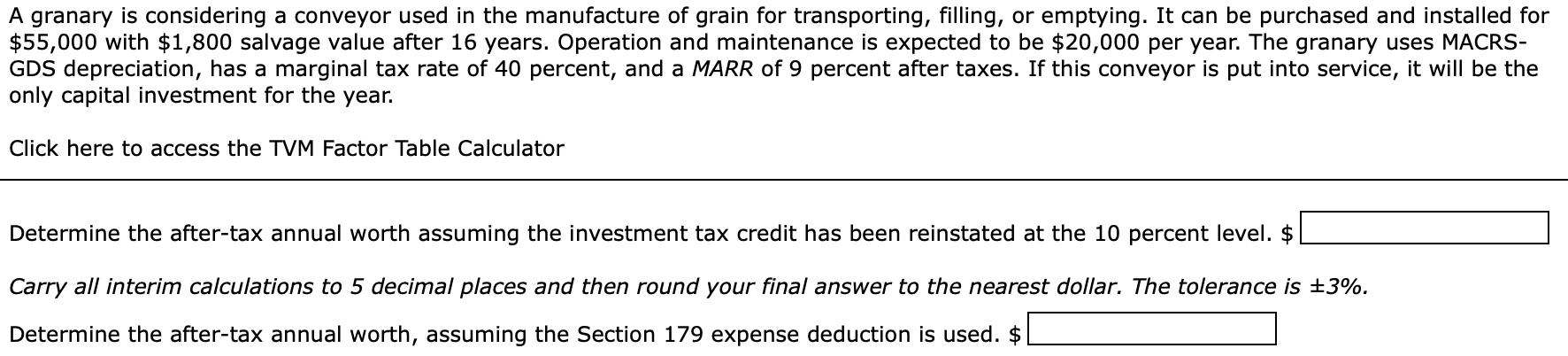

A granary is considering a conveyor used in the manufacture of grain for transporting, filling, or emptying. It can be purchased and installed for $55,000 with $1,800 salvage value after 16 years. Operation and maintenance is expected to be $20,000 per year. The granary uses MACRS- GDS depreciation, has a marginal tax rate of 40 percent, and a MARR of 9 percent after taxes. If this conveyor is put into service, it will be the only capital investment for the year. Click here to access the TVM Factor Table Calculator Determine the after-tax annual worth assuming the investment tax credit has been reinstated at the 10 percent level. $ Carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is +3%. Determine the after-tax annual worth, assuming the Section 179 expense deduction is used. $

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Solution Yearn 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 Cost 55000 1800 Maintenance Cost 2000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started