Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A home is purchased for $230,000 with an amortized loan over 15 years at an interest rate of 4.4%. Complete an amortized loan schedule

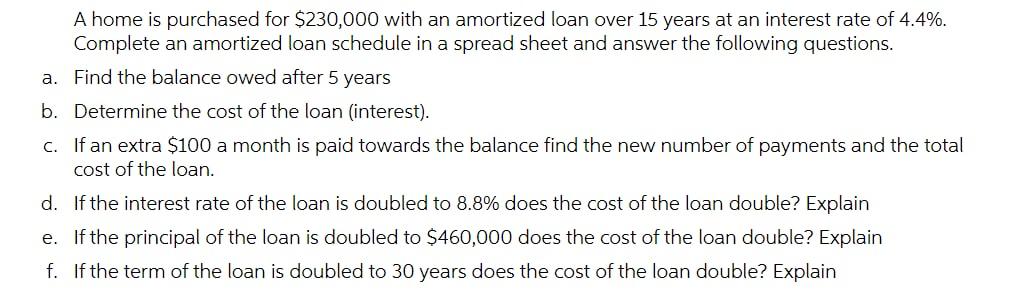

A home is purchased for $230,000 with an amortized loan over 15 years at an interest rate of 4.4%. Complete an amortized loan schedule in a spread sheet and answer the following questions. a. Find the balance owed after 5 years b. Determine the cost of the loan (interest). c. If an extra $100 a month is paid towards the balance find the new number of payments and the total cost of the loan. d. If the interest rate of the loan is doubled to 8.8% does the cost of the loan double? Explain e. If the principal of the loan is doubled to $460,000 does the cost of the loan double? Explain f. If the term of the loan is doubled to 30 years does the cost of the loan double? Explain

Step by Step Solution

★★★★★

3.28 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

23 1 2 3 No of Years 4 Payments in year 5 Total no of Payments 8 9 10 11 182 183 184 185 6 Monthly I...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started