Question

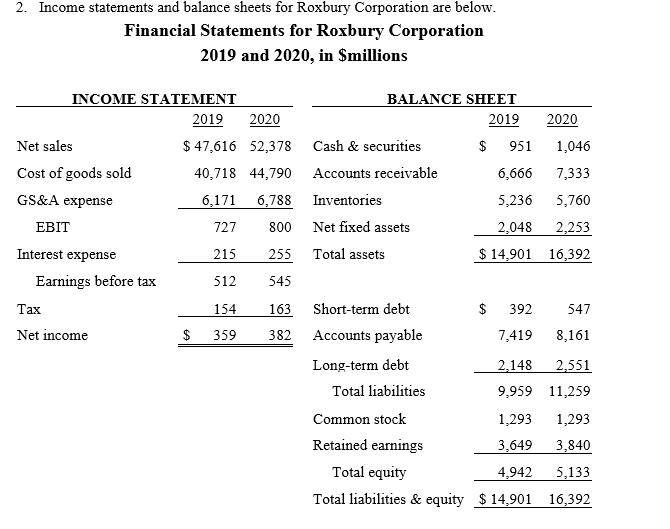

a. How much new external equity did Roxbury raise? New debt? Did its leverage (Assets/Equity) increase or decrease? b. A firms cash conversion cycle is

a. How much new external equity did Roxbury raise? New debt? Did its leverage (Assets/Equity) increase or decrease?

b. A firms cash conversion cycle is the amount of time that passes from when it pays for its inputs until it gets paid for its output. It is equal to the inventory period + the receivables period - the payables period. The longer the cash conversion cycle, the more external financing a firm will need. Calculate the length of Roxburys cash conversion cycle in 2020.

c. If we suppose that long-term debt is the marginal source of funds for Roxbury, how much new debt would they have needed if they reduced their payables period by 10 days? What if they reduced their receivables period by 10 days?

Financial Statements for Roxbury Corporation 2019 and 2020, in \$millions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started