Answered step by step

Verified Expert Solution

Question

1 Approved Answer

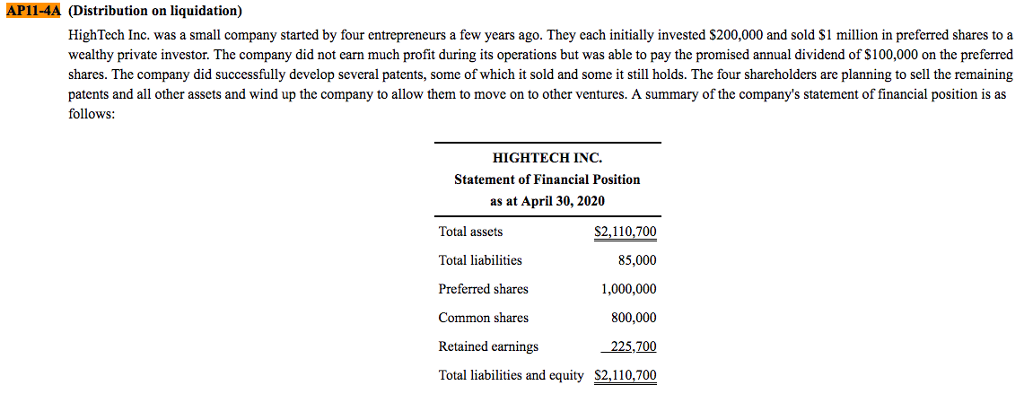

a. How much will each group of shareholders receive on the windup if HighTech is able to sell its assets for: i. $2,110,700? ii. $5,000,000?

a.

How much will each group of shareholders receive on the windup if HighTech is able to sell its assets for:

i.

$2,110,700?

ii.

$5,000,000?

iii.

$1,800,000?

b.

Why is it unlikely that HighTech would be able to sell its assets for $2,110,700?

c.

If HighTech had never paid dividends to the common shareholders, what would be the total rate of return the common shareholders earned on their venture for each of the three prices given in part a?

AP11-4A (Distribution on liquidation) HighTech Inc. was a small company started by four entrepreneurs a few years ago. They each initially invested S200,000 and sold S1 million in preferred shares toa wealthy private investor. The company did not earn much profit during its operations but was able to pay the promised annual dividend of S100,000 on the preferred shares. The company did successfully develop several patents, some of which it sold and some it still holds. The four shareholders are planning to sell the remaining patents and all other assets and wind up the company to allow them to move on to other ventures. A summary of the company's statement of financial position is as follows: HIGHTECH INC. Statement of Financial Position as at April 30, 2020 Total assets Total liabilities Preferred shares Common shares Retained earnings 25.700 Total liabilities and equity S2,110.700 S2,110,700 85,000 ,000,000 800,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started