Answered step by step

Verified Expert Solution

Question

1 Approved Answer

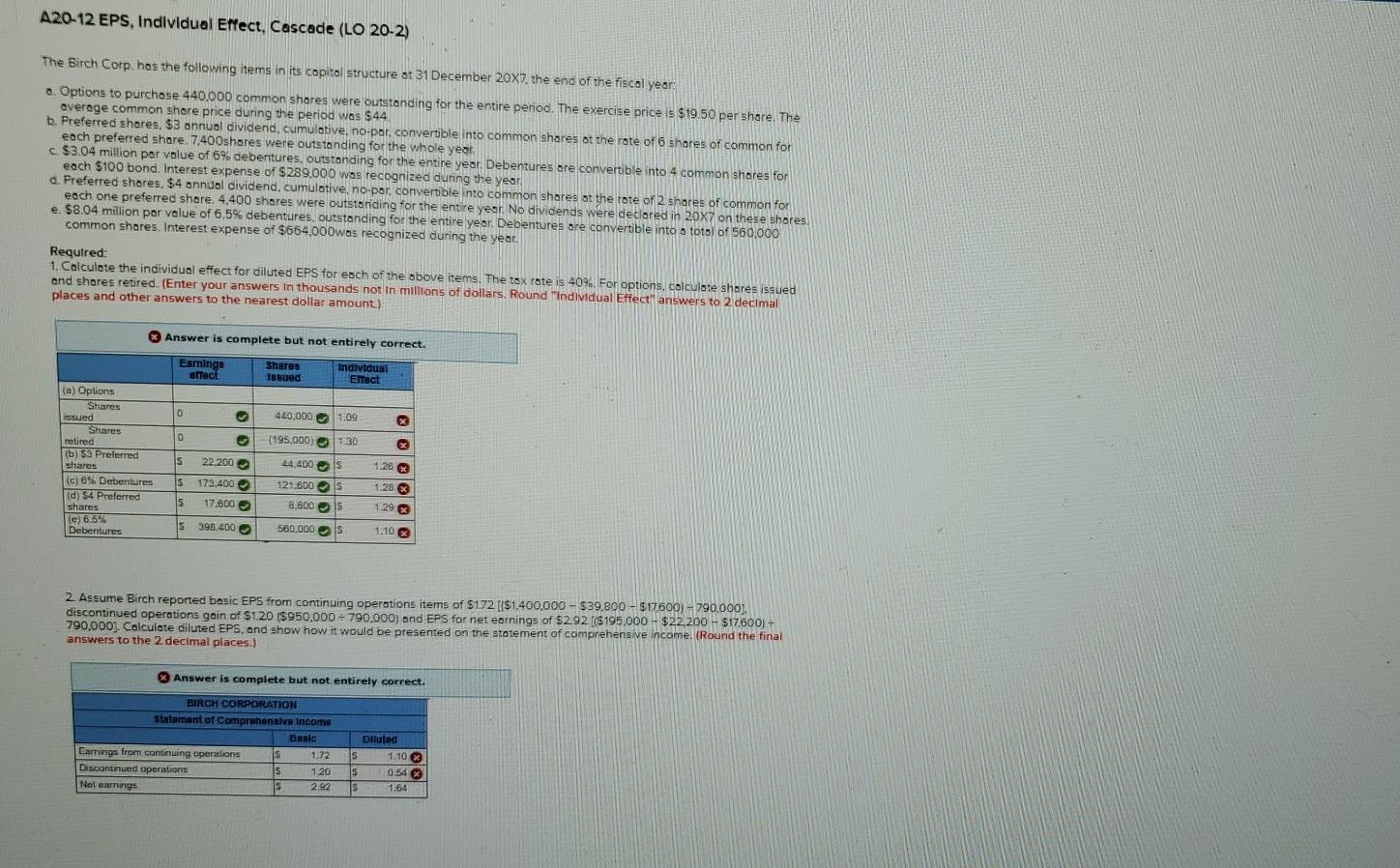

A20-12 EPS. Individual Effect, Cascade (LO 20-2) The Birch Corp. has the following items in its capital structure at 31 December 20X7, the end of

A20-12 EPS. Individual Effect, Cascade (LO 20-2) The Birch Corp. has the following items in its capital structure at 31 December 20X7, the end of the fiscal year: a. Options to purchase 440.000 common shares were outstanding for the entire period. The exercise price is $19.50 per share. The average common share price during the period was $44 b. Preferred shares, $3 annual dividend, cumulative, no-par, convertible into common shares at the rate of 6 shares of common for each preferred share. 7.400shares were outstanding for the whole year. $3.04 million per value of 6% debentures, outstanding for the entire year. Debentures are convertible into 4 common shares for each $100 bond. Interest expense of $289,000 was recognized during the year. d. Preferred shares. $4 annual dividend. cumulative, no per convertible into common shares at the rate of 2 shares of common for each one preferred share. 4.400 shares were outstanding for the entire year. No dividends were declared in 20x7 on these shares e $8.04 million par value of 6,5% debentures, outstanding for the entire year. Debentures are convertible into a total of 560,000 common shares. Interest expense of $664,000was recognized during the year. Required: 1. Calculate the individual effect for diluted EPS for each of the above items. The tax rate is 40%. For options, calculate shores issued and shares retired. (Enter your answers in thousands not in millions of dollars. Round "Individual Effect" answers to 2 decimal places and other answers to the nearest dollar amount) Answer is complete but not entirely correct. Esminge Brfect Shares Ieued Individual EITBCE (a) Options Shares issued Shares 0 440,000 1.09 X reured (195,000) 1.30 S 22.200 44.400 IS 1.26 s 173.400 1.28 X (b) $3 Preferred shares (c) 6% Debertures d) $4 Preferred shares le) 6.5% Debentures 121,800S 8.800S 15 17.600 1.29 IS 398.400 560.000 IS 1.10 x 2. Assume Birch reported basic EPS from continuing operations items of $1.72 [($1,400,000 - $39,800 - $17600) - 790,000). discontinued operations goin of $1.20 ($950,000 - 790,000) and EPS for net earnings of $2.92 [($195,000 - $22.200 - $17,600) - 790,000). Calculate diluted EPS, and show how it would be presented on the statement of comprehensive income. (Round the final answers to the 2 decimal places.) Answer is complete but not entirely correct. BIRCH CORPORATION Statument of Comprehensive Income Basic Earnings from continuing operations Discontinued operations Naturings S Is is 1.72 1.20 2.62 Diluted 15 1.10 0.54 15 1.64 A20-12 EPS. Individual Effect, Cascade (LO 20-2) The Birch Corp. has the following items in its capital structure at 31 December 20X7, the end of the fiscal year: a. Options to purchase 440.000 common shares were outstanding for the entire period. The exercise price is $19.50 per share. The average common share price during the period was $44 b. Preferred shares, $3 annual dividend, cumulative, no-par, convertible into common shares at the rate of 6 shares of common for each preferred share. 7.400shares were outstanding for the whole year. $3.04 million per value of 6% debentures, outstanding for the entire year. Debentures are convertible into 4 common shares for each $100 bond. Interest expense of $289,000 was recognized during the year. d. Preferred shares. $4 annual dividend. cumulative, no per convertible into common shares at the rate of 2 shares of common for each one preferred share. 4.400 shares were outstanding for the entire year. No dividends were declared in 20x7 on these shares e $8.04 million par value of 6,5% debentures, outstanding for the entire year. Debentures are convertible into a total of 560,000 common shares. Interest expense of $664,000was recognized during the year. Required: 1. Calculate the individual effect for diluted EPS for each of the above items. The tax rate is 40%. For options, calculate shores issued and shares retired. (Enter your answers in thousands not in millions of dollars. Round "Individual Effect" answers to 2 decimal places and other answers to the nearest dollar amount) Answer is complete but not entirely correct. Esminge Brfect Shares Ieued Individual EITBCE (a) Options Shares issued Shares 0 440,000 1.09 X reured (195,000) 1.30 S 22.200 44.400 IS 1.26 s 173.400 1.28 X (b) $3 Preferred shares (c) 6% Debertures d) $4 Preferred shares le) 6.5% Debentures 121,800S 8.800S 15 17.600 1.29 IS 398.400 560.000 IS 1.10 x 2. Assume Birch reported basic EPS from continuing operations items of $1.72 [($1,400,000 - $39,800 - $17600) - 790,000). discontinued operations goin of $1.20 ($950,000 - 790,000) and EPS for net earnings of $2.92 [($195,000 - $22.200 - $17,600) - 790,000). Calculate diluted EPS, and show how it would be presented on the statement of comprehensive income. (Round the final answers to the 2 decimal places.) Answer is complete but not entirely correct. BIRCH CORPORATION Statument of Comprehensive Income Basic Earnings from continuing operations Discontinued operations Naturings S Is is 1.72 1.20 2.62 Diluted 15 1.10 0.54 15 1.64

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started