Question

a) How much will you be able to save each month for the next two years? Remember to take into account the payments on her

a) How much will you be able to save each month for the next two years? Remember to take into account the payments on her debts.

b) How much will you be able to save every month after the first two years when her debt has been settled?

c) How much would you have saved at the end of the first two years?

d) How long will you have to save to have R500 000 in her savings account? Round your answer to the nearest year. (Hint: draw a timeline).

e) How much will your monthly bond repayments be if you succeed in saving a deposit and assuming that the price of the house does not change?

f) After paying the costs of the transfer, registration and deposit of the house as outlined in the initial information, how much money will you have left in your short-term deposit account if you purchase the house only at the end of the year after saving up enough money?

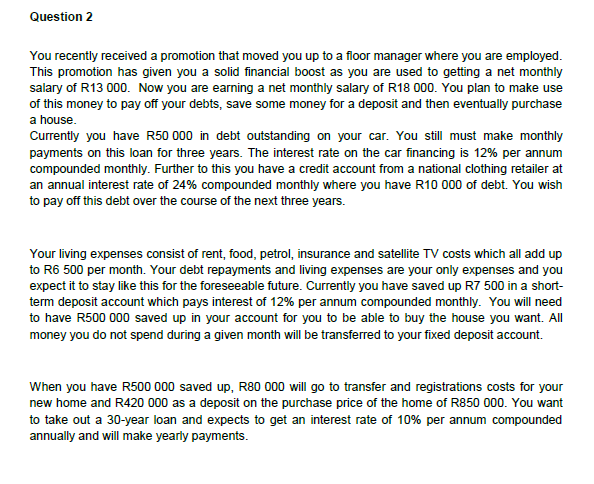

Question 2 You recently received a promotion that moved you up to a floor manager where you are employed This promotion has given you a solid financial boost as you are used to getting a net monthly salary of R13 000. Now you are earning a net monthly salary of R18 000. You plan to make use of this money to pay off your debts, save some money for a deposit and then eventually purchase a house Currently you have R50 000 in debt outstanding on your car. You still must make monthly payments on this loan for three years. The interest rate on the car financing is 12% per annum compounded monthly. Further to this you have a credit account from a national clothing retailer at an annual interest rate of 24% compounded monthly where you have R10 000 of debt. You wish to pay off this debt over the course of the next three years. Your living expenses consist of rent, food, petrol, insurance and satellite TV costs which all add up to R6 500 per month. Your debt repayments and living expenses are your only expenses and you expect it to stay like this for the foreseeable future. Currently you have saved up R7 500 in a short term deposit account which pays interest of 12% per annum compounded monthly. You will need to have R500 000 saved up in your account for you to be able to buy the house you want. All money you do not spend during a given month will be transferred to your fixed deposit account. When you have R500 000 saved up, R80 000 will go to transfer and registrations costs for your new home and R420 000 as a deposit on the purchase price of the home of R850 000. You want to take out a 30-year loan and expects to get an interest rate of 10% per annum compounded annually and will make yearly paymentsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started