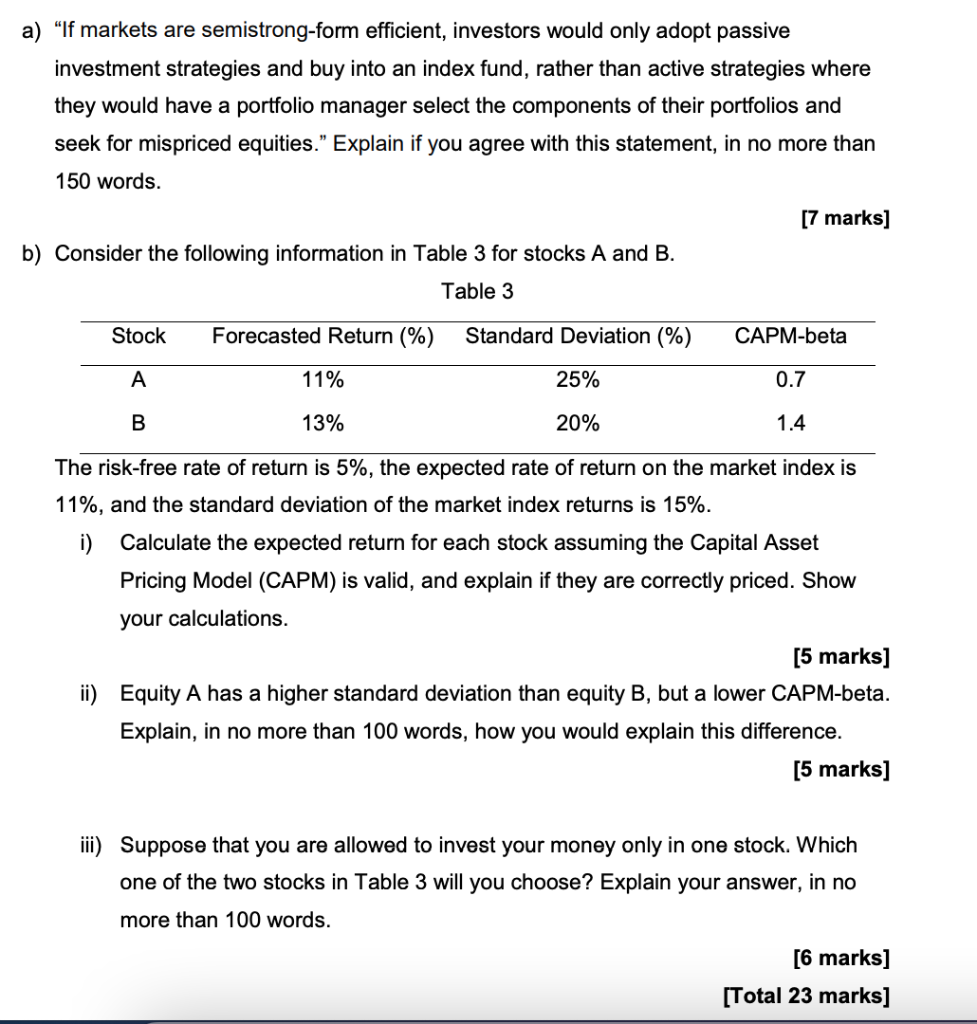

a) If markets are semistrong-form efficient, investors would only adopt passive investment strategies and buy into an index fund, rather than active strategies where they would have a portfolio manager select the components of their portfolios and seek for mispriced equities. Explain if you agree with this statement, in no more than 150 words. [7 marks] b) Consider the following information in Table 3 for stocks A and B. Table 3 Stock Forecasted Return (%) Standard Deviation (%) CAPM-beta 11% 25% 0.7 B 13% 20% 1.4 The risk-free rate of return is 5%, the expected rate of return on the market index is 11%, and the standard deviation of the market index returns is 15%. i) Calculate the expected return for each stock assuming the Capital Asset Pricing Model (CAPM) is valid, and explain if they are correctly priced. Show your calculations. [5 marks] Equity A has a higher standard deviation than equity B, but a lower CAPM-beta. Explain, in no more than 100 words, how you would explain this difference. [5 marks] iii) Suppose that you are allowed to invest your money only in one stock. Which one of the two stocks in Table 3 will you choose? Explain your answer, in no more than 100 words. [6 marks] [Total 23 marks] a) If markets are semistrong-form efficient, investors would only adopt passive investment strategies and buy into an index fund, rather than active strategies where they would have a portfolio manager select the components of their portfolios and seek for mispriced equities. Explain if you agree with this statement, in no more than 150 words. [7 marks] b) Consider the following information in Table 3 for stocks A and B. Table 3 Stock Forecasted Return (%) Standard Deviation (%) CAPM-beta 11% 25% 0.7 B 13% 20% 1.4 The risk-free rate of return is 5%, the expected rate of return on the market index is 11%, and the standard deviation of the market index returns is 15%. i) Calculate the expected return for each stock assuming the Capital Asset Pricing Model (CAPM) is valid, and explain if they are correctly priced. Show your calculations. [5 marks] Equity A has a higher standard deviation than equity B, but a lower CAPM-beta. Explain, in no more than 100 words, how you would explain this difference. [5 marks] iii) Suppose that you are allowed to invest your money only in one stock. Which one of the two stocks in Table 3 will you choose? Explain your answer, in no more than 100 words. [6 marks] [Total 23 marks]