Question

a. If the margin requirement is 27% of the futures price times the contract multiplier of $50, how much must you deposit with your broker

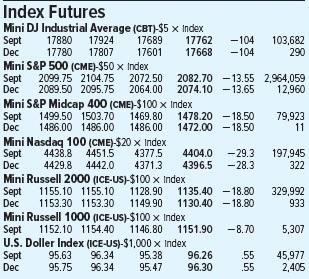

a. If the margin requirement is 27% of the futures price times the contract multiplier of $50, how much must you deposit with your broker to trade the December maturity contract? (Round your answer to 2 decimal places.)

b. If the December futures price were to increase to 2,090.23, what percentage return would you earn on your net investment if you entered the long side of the contract at the price shown in the figure? (Do not round intermediate calculations. Round your answer to 2 decimal places.)

c. If the December futures price falls by 1%, what is your percentage return? (Negative amount should be indicated by a minus sign. Round your answer to 2 decimal places.)

Index Futures Mini DJ Industrial Average (CBT)-$5 x Index Sept 17880 17924 17689 17762 -104 103,682 Dec 17780 17807 17601 17668 -104 290 Mini S&P 500 (CME)-$50 x Index Sept 2099.75 2104.75 2072.50 2082.70 -13.55 2.964,059 Dec 2089.50 2095.75 2064.00 2074.10 - 13.65 12,960 Mini S&P Midcap 400 (CME)-$100 x Index Sept 1499.50 1503.70 1469.80 1478.20 -18.50 79,923 Dec 1486.00 1486.00 1486.00 1472.00 18.50 11 Mini Nasdaq 100 (CME)-$20 x Index Sept 4438.8 4451.5 4377.5 4404.0 -29.3 197,945 Dec 4429.8 4442.0 4371.3 4396.5 -28.3 322 Mini Russell 2000 (ICE-US)-$100 x Index Sept 1155.10 1155.101128.90 1135.40 -18.80 329,992 Dec 1153.30 1153.30 1149.90 1130.40 -18.80 933 Mini Russell 1000 (ICE-US)-$100 x Index Sept 1152.10 1154.40 1146.80 1151.90 -8.70 5,307 U.S. Doller Index (ICE-US)-$1,000 x Index Sept 95.63 96.34 95.38 96.26 .55 45,977 Dec 95.75 96.34 95.47 96.30 .55 2,405Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started