Question

a. Illustrate putcall parity today and at option expiry assuming stock prices at expiry (S T ) of 400p and of 500p. b. Draw a

a. Illustrate putcall parity today and at option expiry assuming stock prices at expiry (ST) of 400p and of 500p.

b. Draw a graph showing the prices at expiry of a fiduciary call and another one showing a protective put, including all of their components, in relation to the price of the stock in a range between 350p and 600p.

c. Suppose that instead of the information given above you find the following market data (all other information provided above remains the same):

- Call price (c0) = 38p

- Put price (p0) = 54p

- Risk-free interest rate (r) = 4%

Explain how you could exploit the potential arbitrage opportunity that is implied by these prices.

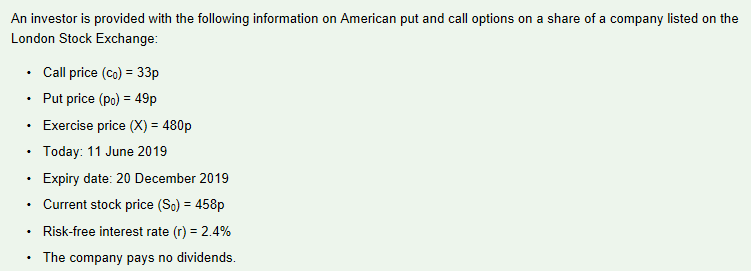

An investor is provided with the following information on London Stock Exchange: American put and call options on a share of a company listed on the Call price (co) 33p Put price (Po) 49p Exercise price (X) = 480p Today: 11 June 2019 Expiry date: 20 December 2019 Current stock price (So) 458p Risk-free interest rate (r) 2.4% The company pays no dividends. An investor is provided with the following information on London Stock Exchange: American put and call options on a share of a company listed on the Call price (co) 33p Put price (Po) 49p Exercise price (X) = 480p Today: 11 June 2019 Expiry date: 20 December 2019 Current stock price (So) 458p Risk-free interest rate (r) 2.4% The company pays no dividendsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started