Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) In 2022 Widget Company, a calendar year and cash method taxpayer, sold $50,000 of widgets on credit to one of its customers. In 2023,

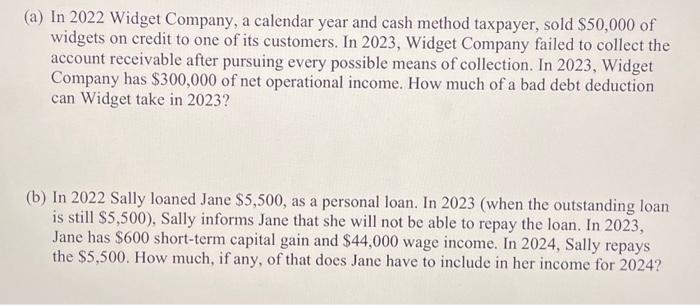

(a) In 2022 Widget Company, a calendar year and cash method taxpayer, sold $50,000 of widgets on credit to one of its customers. In 2023, Widget Company failed to collect the account receivable after pursuing every possible means of collection. In 2023, Widget Company has $300,000 of net operational income. How much of a bad debt deduction can Widget take in 2023? (b) In 2022 Sally loaned Jane $5,500, as a personal loan. In 2023 (when the outstanding loan is still $5,500), Sally informs Jane that she will not be able to repay the loan. In 2023, Jane has $600 short-term capital gain and $44,000 wage income. In 2024, Sally repays the $5,500. How much, if any, of that does Jane have to include in her income for 2024?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started