Answered step by step

Verified Expert Solution

Question

1 Approved Answer

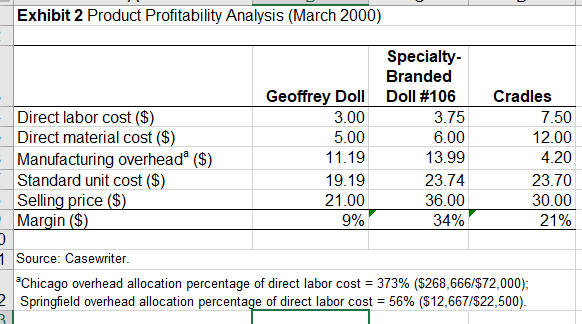

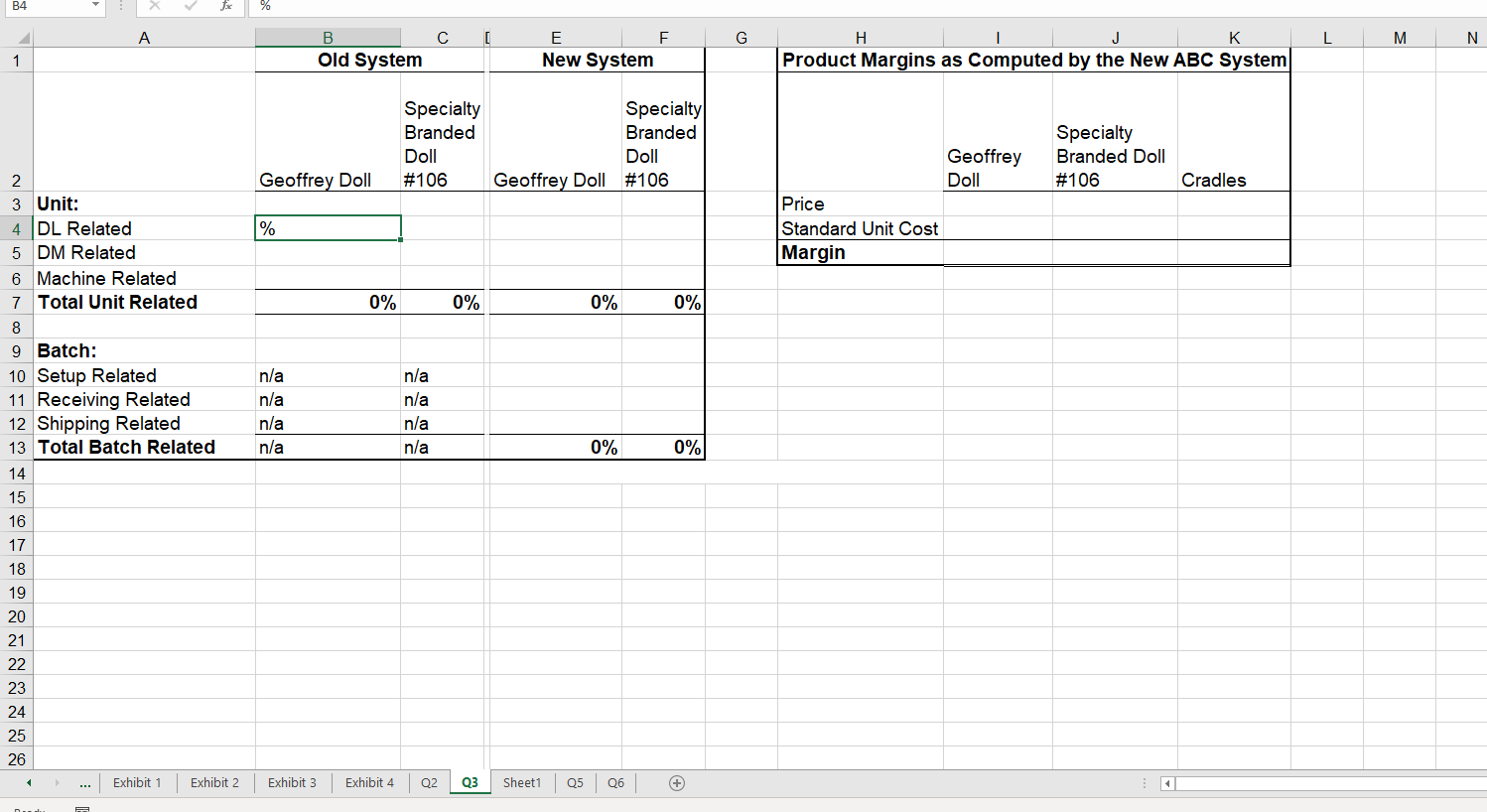

Compare and contrast the profitability of each doll under the ABC and old cost systems. Use the G.G. Toys Workpaper tab labeled Q3 to compute

Compare and contrast the profitability of each doll under the ABC and old cost systems. Use the G.G. Toys Workpaper tab labeled Q3 to compute margins under the ABC system. Explain why the margins under the old cost system (see Exhibit 2 in the case) are so different from the margins you computed under the ABC cost system. What actions does your team recommend the company consider to enhance its profitability?

Please using excel answer Q3.

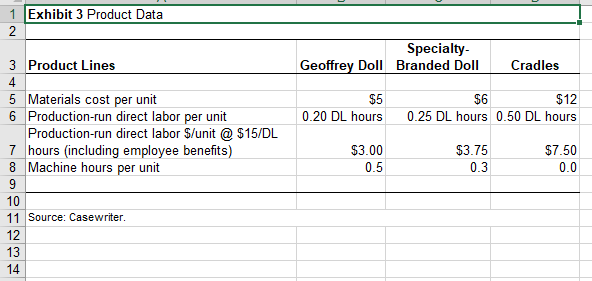

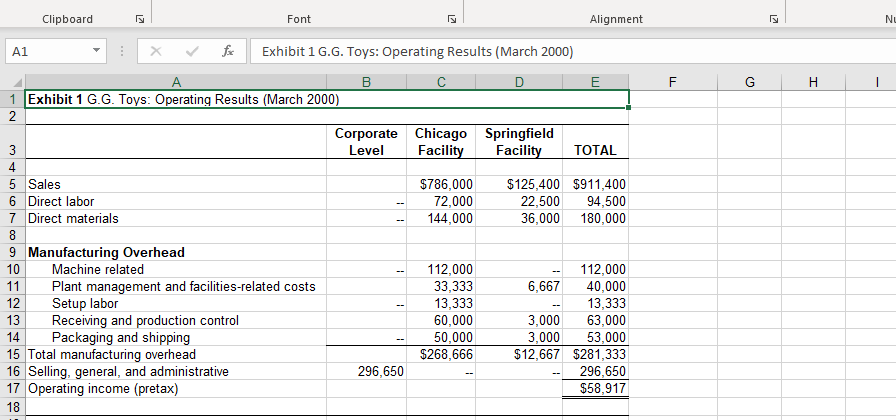

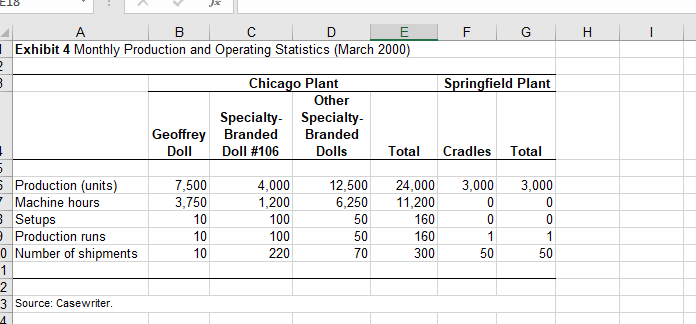

Exhibit 2 Product Profitability Analysis (March 2000) Direct labor cost ($) Direct material cost ($) Manufacturing overhead ($) Standard unit cost ($) Selling price ($) Margin ($) Specialty- Branded Geoffrey Doll Doll #106 3.00 3.75 5.00 6.00 11.19 13.99 19.19 23.74 21.00 36.00 9% 34% Cradles 7.50 12.00 4.20 23.70 30.00 21% 1 Source: Casewriter. Chicago overhead allocation percentage of direct labor cost = 373% ($268,666/$72,000); 2 Springfield overhead allocation percentage of direct labor cost = 56% ($12,667/$22,500). 3 1 Exhibit 3 Product Data 2 Specialty- Geoffrey Doll Branded Doll Cradles $5 0.20 DL hours $6 $12 0.25 DL hours 0.50 DL hours 3 Product Lines 4 5 Materials cost per unit 6 Production-run direct labor per unit Production-run direct labor $/unit @ $15/DL 7 hours (including employee benefits) 8 Machine hours per unit 9 10 11 Source: Casewriter. 12 13 14 $3.00 0.5 $3.75 0.3 $7.50 0.0 Clipboard 2 Font Alignment NI A1 Exhibit 1 G.G. Toys: Operating Results (March 2000) F G H 1 . B C D E 1 Exhibit 1 G.G. Toys: Operating Results (March 2000) 2 Corporate Chicago Springfield 3 Level Facility Facility TOTAL 4 5 Sales $786,000 $125,400 $911,400 6 Direct labor 72,000 22,500 94,500 7 Direct materials 144,000 36,000 180,000 8 9 Manufacturing Overhead 10 Machine related 112,000 112,000 11 Plant management and facilities-related costs 33,333 6,667 40,000 12 Setup labor 13,333 13,333 13 Receiving and production control 60,000 3,000 63,000 14 Packaging and shipping 50,000 3,000 53,000 15 Total manufacturing overhead $268,666 $12,667 $281,333 16 Selling, general, and administrative 296,650 296,650 17 Operating income (pretax) $58,917 18 -- tlo F G Springfield Plant Cradles Total . B D E | Exhibit 4 Monthly Production and Operating Statistics (March 2000) 2 3 Chicago Plant Other Specialty- Specialty- Geoffrey Branded Branded Doll Doll #106 Dolls Total 5 Production (units) 7,500 4,000 12,500 24,000 - Machine hours 3,750 1,200 6,250 11,200 3 Setups 10 100 50 160 9 Production runs 10 100 50 160 0 Number of shipments 10 220 70 300 1 2 3 Source: Casewriter. 4 3,000 0 0 1 50 3,000 0 0 1 50 B4 A [ G L M N B Old System E F New System H J K Product Margins as Computed by the New ABC System 1 Specialty Specialty Branded Branded Doll Doll #106 Geoffrey Doll #106 Specialty Branded Doll #106 Geoffrey Doll Cradles Geoffrey Doll Price Standard Unit Cost Margin % 0% 0% 0% 0% n/a n/a n/a n/a n/a n/a n/a n/a 0% 0% 2 3 Unit: 4 DL Related 5 DM Related 6 Machine Related 7 Total Unit Related 8 9 Batch: 10 Setup Related 11 Receiving Related 12 Shipping Related 13 Total Batch Related 14 15 16 17 18 19 20 21 22 23 24 25 26 Exhibit 1 Exhibit 2 Exhibit 3 Exhibit 4 02 Q3 Sheet1 Q5 Q6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started