Question

a) Interpret the following diagram. Your interpretation should be backed by solid logical arguments. b) A 20-year bond has a coupon rate of 8 percent,

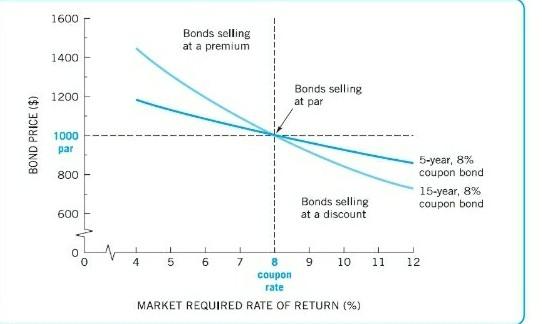

a) Interpret the following diagram. Your interpretation should be backed by solid logical arguments.

b) A 20-year bond has a coupon rate of 8 percent, and another bond of the same maturity has a coupon rate of 15 percent. If the bonds are alike in all other respects, which will have the greater relative market price decline if interest rates increase sharply? Why? c) Which financial ratios would you be most likely to consult if you were the following? Why? 1) As a banker 2) As equity investor 3) Pension fund considering the purchase of a firms bonds

1600 Bonds selling at a premium 1400 1200 Bonds selling at par BOND PRICE ($) 1000 par 800 5-year, 8% coupon bond 15-year, 8% coupon bond Bonds selling at a discount 600 1 4 1 5 6 7 9 10 11 12 8 coupon rate MARKET REQUIRED RATE OF RETURN (%)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started