Answered step by step

Verified Expert Solution

Question

1 Approved Answer

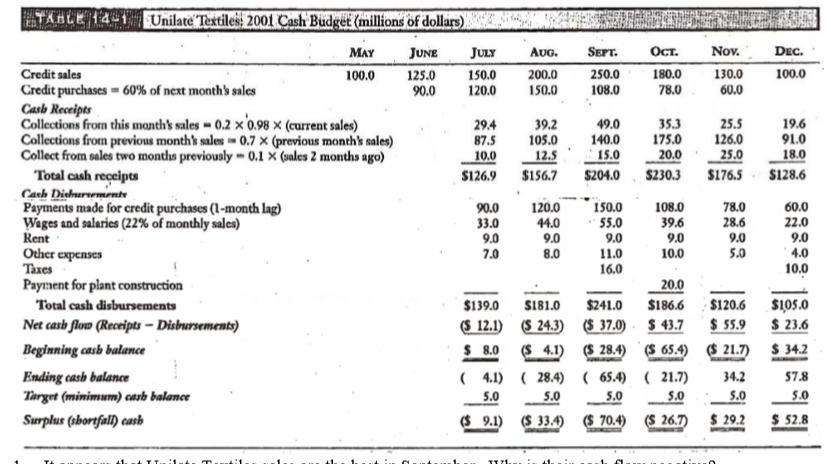

a. It appears that Unilate Textiles sales are the best in September. Why is their cash flow negative? b. How does borrowing the 9.1 million

a. It appears that Unilate Textiles sales are the best in September. Why is their cash flow negative? b. How does borrowing the 9.1 million dollars that they are short in July in the cash budget impact the future cash budget? c. In August, why is the target cash balance added to the negative ending cash balance to give Unilate a larger shortfall? d . What happens to Unilates short term borrowing between September and October?

. What happens to Unilates short term borrowing between September and October?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started