Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A joint venture formed by South-East Investment Company (SEI) and North-West Property Limited (NWP) is going to bid for a site that could be

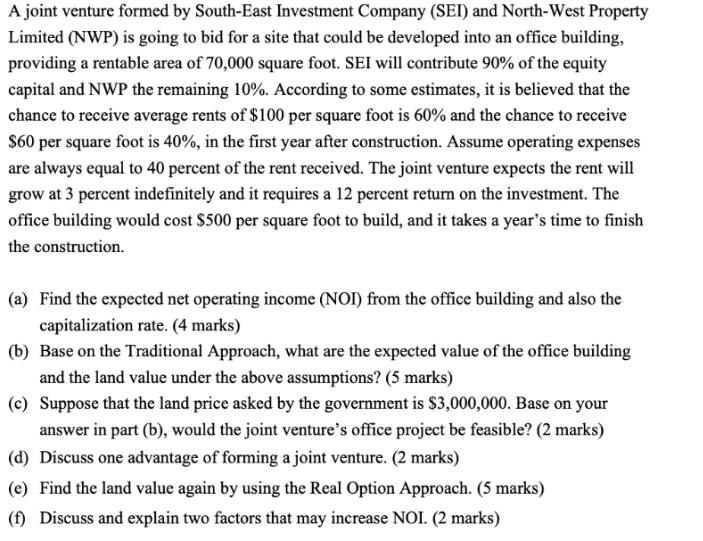

A joint venture formed by South-East Investment Company (SEI) and North-West Property Limited (NWP) is going to bid for a site that could be developed into an office building, providing a rentable area of 70,000 square foot. SEI will contribute 90% of the equity capital and NWP the remaining 10%. According to some estimates, it is believed that the chance to receive average rents of $100 per square foot is 60% and the chance to receive $60 per square foot is 40%, in the first year after construction. Assume operating expenses are always equal to 40 percent of the rent received. The joint venture expects the rent will grow at 3 percent indefinitely and it requires a 12 percent return on the investment. The office building would cost $500 per square foot to build, and it takes a year's time to finish the construction. (a) Find the expected net operating income (NOI) from the office building and also the capitalization rate. (4 marks) (b) Base on the Traditional Approach, what are the expected value of the office building and the land value under the above assumptions? (5 marks) (c) Suppose that the land price asked by the government is $3,000,000. Base on your answer in part (b), would the joint venture's office project be feasible? (2 marks) (d) Discuss one advantage of forming a joint venture. (2 marks) (e) Find the land value again by using the Real Option Approach. (5 marks) (f) Discuss and explain two factors that may increase NOI. (2 marks)

Step by Step Solution

★★★★★

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Stepbystep explanation aCalculation of expected net operating income and capitalization rate Expecte...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started