Answered step by step

Verified Expert Solution

Question

1 Approved Answer

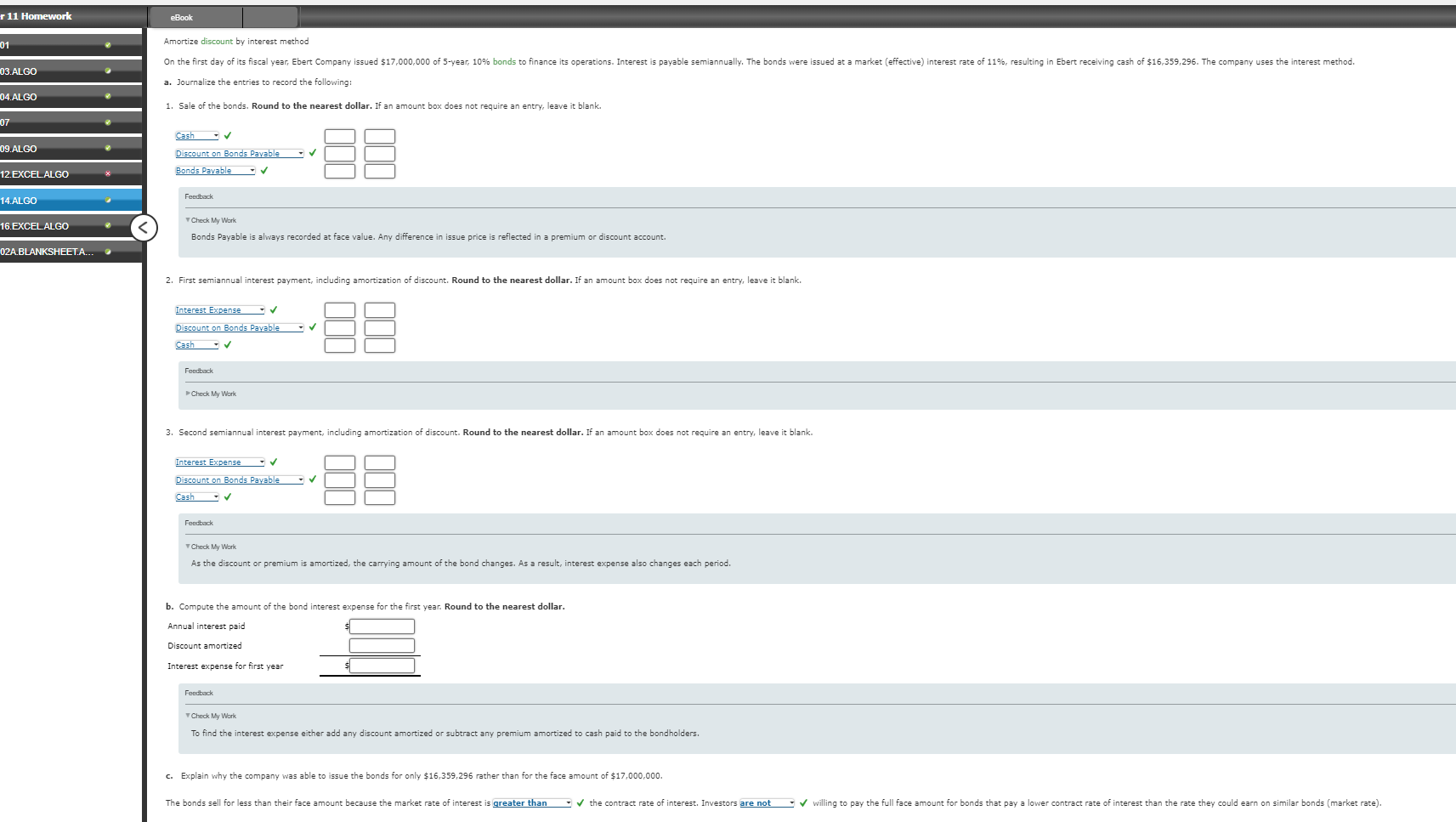

a . Journalize the entries to record the following: Sale of the bonds. Round to the nearest dollar. If an amount box does not require

a Journalize the entries to record the following:

Sale of the bonds. Round to the nearest dollar. If an amount box does not require an entry, leave it blank

First semiannual interest payment, including amortization of discount. Round to the nearest dollar. If an amount box does not require an entry, leave it blank.

Feedback

Check My Work

Second semiannual interest payment, including amortization of discount. Round to the nearest dollar. If an amount box does not require an entry, leave it blank.

Interest Expense

cash

Feedback

TCheck My Wark

As the discount or premium is amortized, the carrying amount of the bond changes. As a result, interest expense also changes each period.

b Compute the amount of the bond interest expense for the first year. Round to the nearest dollar.

Annual interest paid

Discount amortized

Interest expense for first year

Interest expense for first year

Feechack

Theck My Work

To find the interest expense either add any discount amortized or subtract any premium amortized to cash paid to the bondholders.

c Explain why the company was able to issue the bonds for only $ rather than for the face amount of $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started