Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A large clothing retailer chain, Koll's, offers a sales incentive program where customers receive direct credit toward future purchases based upon the dollar amount of

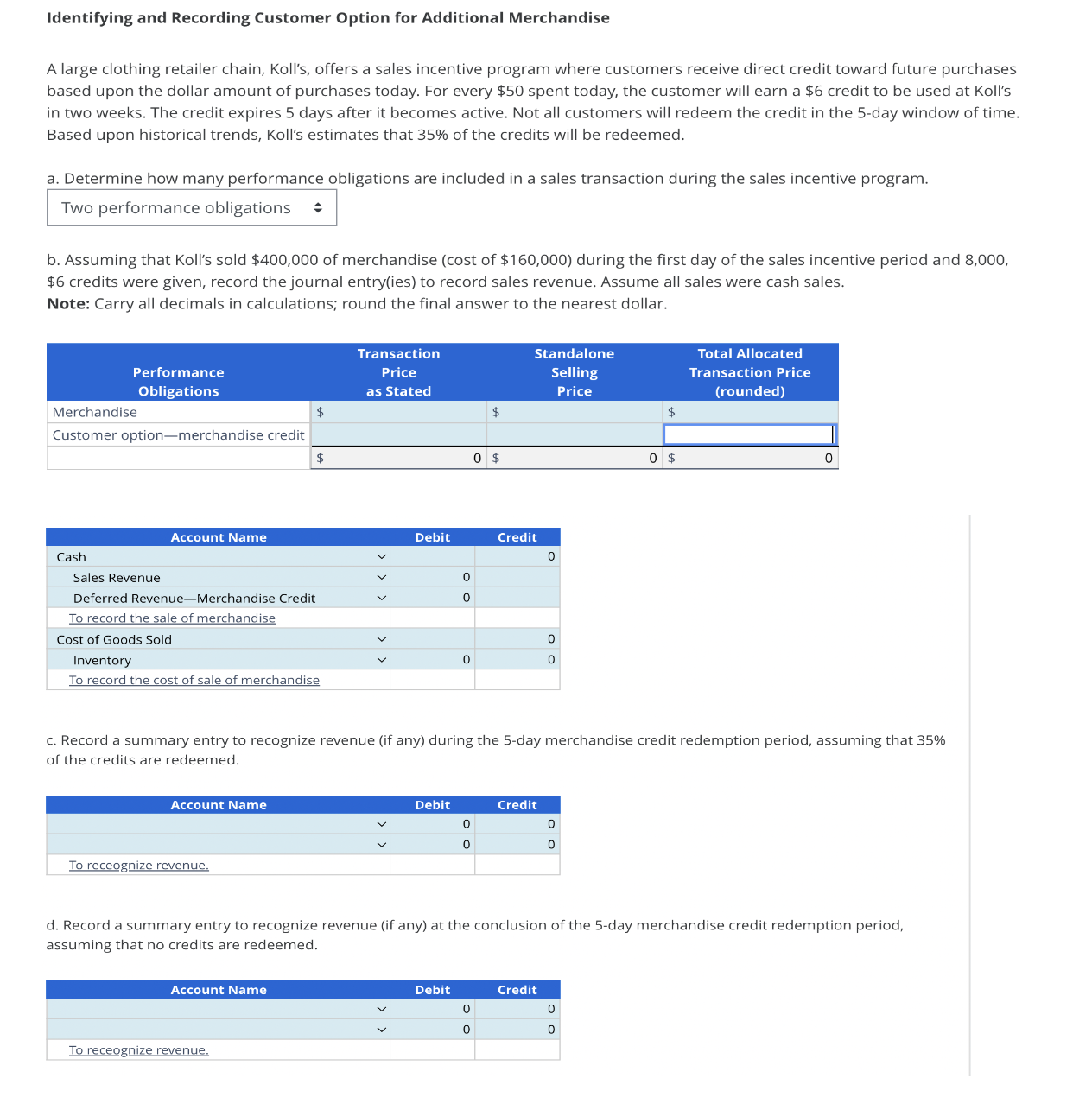

A large clothing retailer chain, Koll's, offers a sales incentive program where customers receive direct credit toward future purchases

based upon the dollar amount of purchases today. For every $ spent today, the customer will earn a $ credit to be used at Koll's

in two weeks. The credit expires days after it becomes active. Not all customers will redeem the credit in the day window of time.

Based upon historical trends, Koll's estimates that of the credits will be redeemed.

a Determine how many performance obligations are included in a sales transaction during the sales incentive program.

b Assuming that Koll's sold $ of merchandise cost of $ during the first day of the sales incentive period and

$ credits were given, record the journal entryies to record sales revenue. Assume all sales were cash sales.

Note: Carry all decimals in calculations; round the final answer to the nearest dollar.

c Record a summary entry to recognize revenue if any during the day merchandise credit redemption period, assuming that

of the credits are redeemed.

d Record a summary entry to recognize revenue if any at the conclusion of the day merchandise credit redemption period,

assuming that no credits are redeemed. please refer to the screenshot. there is no more info i can give.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started