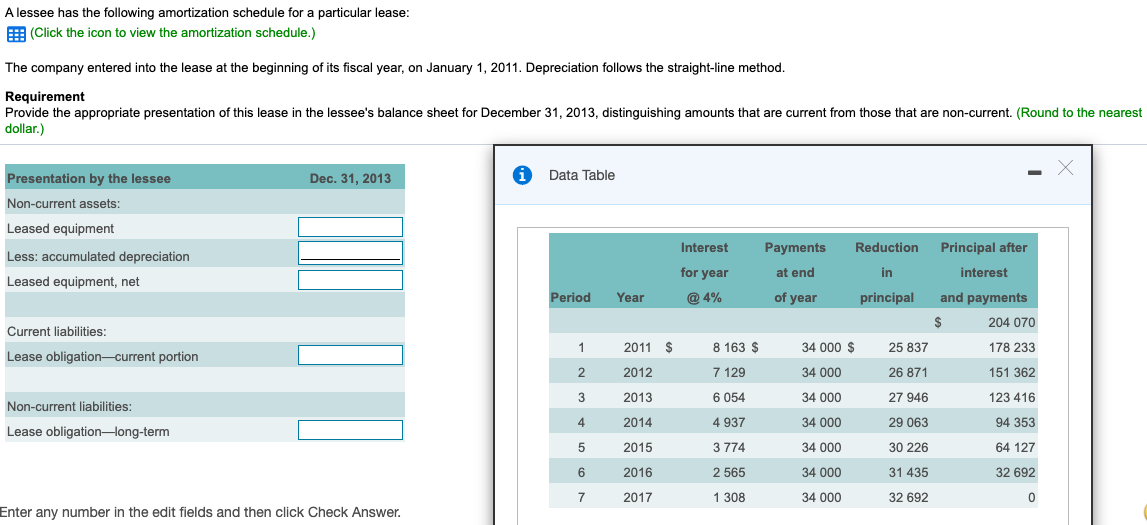

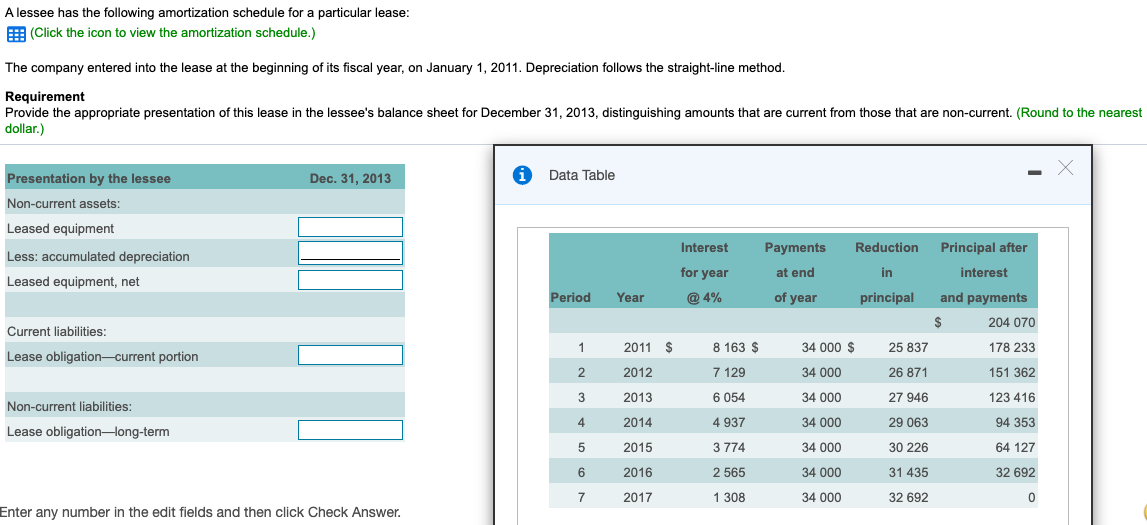

A lessee has the following amortization schedule for a particular lease: E: (Click the icon to view the amortization schedule.) The company entered into the lease at the beginning of its fiscal year, on January 1, 2011. Depreciation follows the straight-line method. Requirement Provide the appropriate presentation of this lease in the lessee's balance sheet for December 31, 2013, distinguishing amounts that are current from those that are non-current. (Round to the nearest dollar.) Presentation by the lessee Dec. 31, 2013 Data Table Non-current assets: Leased equipment Interest Payments Reduction Principal after Less: accumulated depreciation Leased equipment, net for year at end in interest Period Year @ 4% of year principal and payments $ 204 070 Current liabilities: Lease obligation-current portion 1 8 163 $ 34 000 $ 25 837 178 233 w N- 2011 $ 2012 7 129 34 000 26 871 151 362 2013 6054 34 000 27 946 123 416 Non-current liabilities: Lease obligationlong-term 4 2014 4 937 34 000 29 063 94 353 5 2015 3774 34 000 30 226 64 127 32 692 6 2016 2 565 34 000 31 435 7 2017 1 308 34 000 32 692 0 Enter any number in the edit fields and then click Check Answer. A lessee has the following amortization schedule for a particular lease: E: (Click the icon to view the amortization schedule.) The company entered into the lease at the beginning of its fiscal year, on January 1, 2011. Depreciation follows the straight-line method. Requirement Provide the appropriate presentation of this lease in the lessee's balance sheet for December 31, 2013, distinguishing amounts that are current from those that are non-current. (Round to the nearest dollar.) Presentation by the lessee Dec. 31, 2013 Data Table Non-current assets: Leased equipment Interest Payments Reduction Principal after Less: accumulated depreciation Leased equipment, net for year at end in interest Period Year @ 4% of year principal and payments $ 204 070 Current liabilities: Lease obligation-current portion 1 8 163 $ 34 000 $ 25 837 178 233 w N- 2011 $ 2012 7 129 34 000 26 871 151 362 2013 6054 34 000 27 946 123 416 Non-current liabilities: Lease obligationlong-term 4 2014 4 937 34 000 29 063 94 353 5 2015 3774 34 000 30 226 64 127 32 692 6 2016 2 565 34 000 31 435 7 2017 1 308 34 000 32 692 0 Enter any number in the edit fields and then click Check