Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a like will be provided if answered! (1) During the year, the Managing Director of Fife plc initiated a period of staff retraining and new

a like will be provided if answered!

a like will be provided if answered!

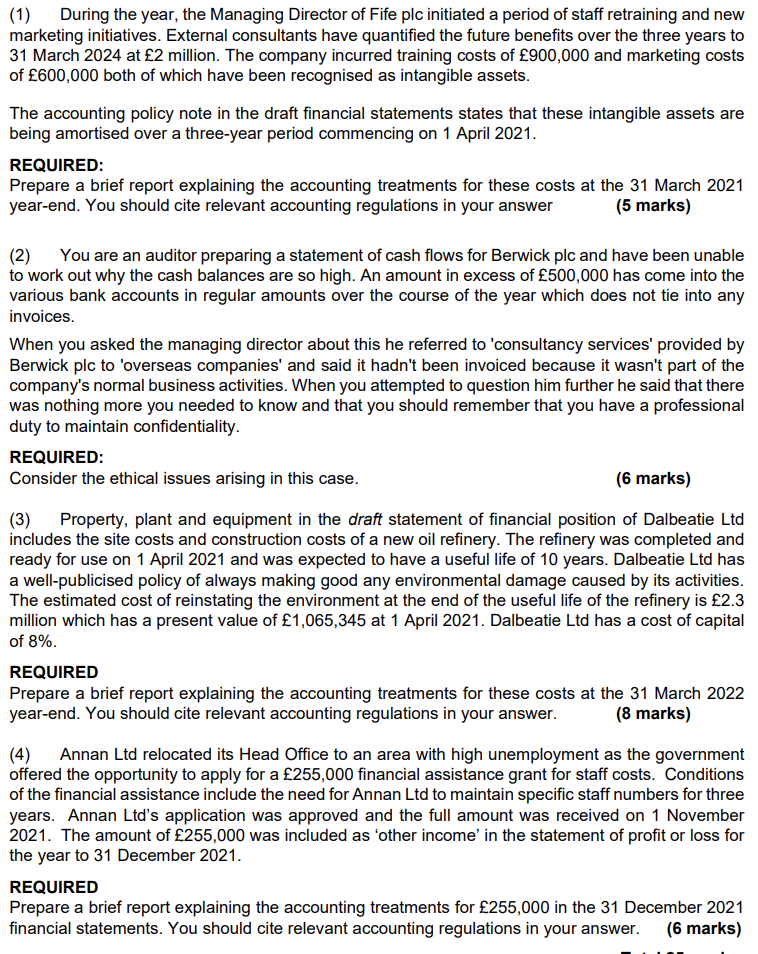

(1) During the year, the Managing Director of Fife plc initiated a period of staff retraining and new marketing initiatives. External consultants have quantified the future benefits over the three years to 31 March 2024 at 2 million. The company incurred training costs of 900,000 and marketing costs of 600,000 both of which have been recognised as intangible assets. The accounting policy note in the draft financial statements states that these intangible assets are being amortised over a three-year period commencing on 1 April 2021. REQUIRED: Prepare a brief report explaining the accounting treatments for these costs at the 31 March 2021 year-end. You should cite relevant accounting regulations in your answer (5 marks) (2) You are an auditor preparing a statement of cash flows for Berwick plc and have been unable to work out why the cash balances are so high. An amount in excess of 500,000 has come into the various bank accounts in regular amounts over the course of the year which does not tie into any invoices. When you asked the managing director about this he referred to 'consultancy services provided by Berwick plc to 'overseas companies' and said it hadn't been invoiced because it wasn't part of the company's normal business activities. When you attempted to question him further he said that there was nothing more you needed to know and that you should remember that you have a professional duty to maintain confidentiality. REQUIRED: Consider the ethical issues arising in this case. (6 marks) (3) Property, plant and equipment in the draft statement of financial position of Dalbeatie Ltd includes the site costs and construction costs of a new oil refinery. The refinery was completed and ready for use on 1 April 2021 and was expected to have a useful life of 10 years. Dalbeatie Ltd has a well-publicised policy of always making good any environmental damage caused by its activities. The estimated cost of reinstating the environment at the end of the useful life of the refinery is 2.3 million which has a present value of 1,065,345 at 1 April 2021. Dalbeatie Ltd has a cost of capital of 8%. REQUIRED Prepare a brief report explaining the accounting treatments for these costs at the 31 March 2022 year-end. You should cite relevant accounting regulations in your answer. (8 marks) (4) Annan Ltd relocated its Head Office to an area with high unemployment as the government offered the opportunity to apply for a 255,000 financial assistance grant for staff costs. Conditions of the financial assistance include the need for Annan Ltd to maintain specific staff numbers for three years. Annan Ltd's application was approved and the full amount was received on 1 November 2021. The amount of 255,000 was included as 'other income' in the statement of profit or loss for the year to 31 December 2021. REQUIRED Prepare a brief report explaining the accounting treatments for 255,000 in the 31 December 2021 financial statements. You should cite relevant accounting regulations in your answer. (6 marks) (1) During the year, the Managing Director of Fife plc initiated a period of staff retraining and new marketing initiatives. External consultants have quantified the future benefits over the three years to 31 March 2024 at 2 million. The company incurred training costs of 900,000 and marketing costs of 600,000 both of which have been recognised as intangible assets. The accounting policy note in the draft financial statements states that these intangible assets are being amortised over a three-year period commencing on 1 April 2021. REQUIRED: Prepare a brief report explaining the accounting treatments for these costs at the 31 March 2021 year-end. You should cite relevant accounting regulations in your answer (5 marks) (2) You are an auditor preparing a statement of cash flows for Berwick plc and have been unable to work out why the cash balances are so high. An amount in excess of 500,000 has come into the various bank accounts in regular amounts over the course of the year which does not tie into any invoices. When you asked the managing director about this he referred to 'consultancy services provided by Berwick plc to 'overseas companies' and said it hadn't been invoiced because it wasn't part of the company's normal business activities. When you attempted to question him further he said that there was nothing more you needed to know and that you should remember that you have a professional duty to maintain confidentiality. REQUIRED: Consider the ethical issues arising in this case. (6 marks) (3) Property, plant and equipment in the draft statement of financial position of Dalbeatie Ltd includes the site costs and construction costs of a new oil refinery. The refinery was completed and ready for use on 1 April 2021 and was expected to have a useful life of 10 years. Dalbeatie Ltd has a well-publicised policy of always making good any environmental damage caused by its activities. The estimated cost of reinstating the environment at the end of the useful life of the refinery is 2.3 million which has a present value of 1,065,345 at 1 April 2021. Dalbeatie Ltd has a cost of capital of 8%. REQUIRED Prepare a brief report explaining the accounting treatments for these costs at the 31 March 2022 year-end. You should cite relevant accounting regulations in your answer. (8 marks) (4) Annan Ltd relocated its Head Office to an area with high unemployment as the government offered the opportunity to apply for a 255,000 financial assistance grant for staff costs. Conditions of the financial assistance include the need for Annan Ltd to maintain specific staff numbers for three years. Annan Ltd's application was approved and the full amount was received on 1 November 2021. The amount of 255,000 was included as 'other income' in the statement of profit or loss for the year to 31 December 2021. REQUIRED Prepare a brief report explaining the accounting treatments for 255,000 in the 31 December 2021 financial statements. You should cite relevant accounting regulations in your answer. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started