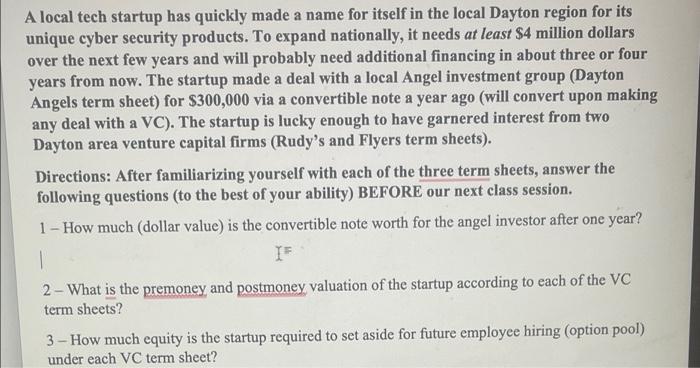

A local tech startup has quickly made a name for itself in the local Dayton region for its unique cyber security products. To expand nationally, it needs at least $4 million dollars over the next few years and will probably need additional financing in about three or four years from now. The startup made a deal with a local Angel investment group (Dayton Angels term sheet) for $300,000 via a convertible note a year ago (will convert upon making any deal with a VC). The startup is lucky enough to have garnered interest from two Dayton area venture capital firms (Rudy's and Flyers term sheets). Directions: After familiarizing yourself with each of the three term sheets, answer the following questions (to the best of your ability) BEFORE our next class session. 1 - How much (dollar value) is the convertible note worth for the angel investor after one year? 2 - What is the premoney and postmoney valuation of the startup according to each of the VC term sheets? 3 - How much equity is the startup required to set aside for future employee hiring (option pool) under each VC term sheet? A local tech startup has quickly made a name for itself in the local Dayton region for its unique cyber security products. To expand nationally, it needs at least $4 million dollars over the next few years and will probably need additional financing in about three or four years from now. The startup made a deal with a local Angel investment group (Dayton Angels term sheet) for $300,000 via a convertible note a year ago (will convert upon making any deal with a VC). The startup is lucky enough to have garnered interest from two Dayton area venture capital firms (Rudy's and Flyers term sheets). Directions: After familiarizing yourself with each of the three term sheets, answer the following questions (to the best of your ability) BEFORE our next class session. 1 - How much (dollar value) is the convertible note worth for the angel investor after one year? 2 - What is the premoney and postmoney valuation of the startup according to each of the VC term sheets? 3 - How much equity is the startup required to set aside for future employee hiring (option pool) under each VC term sheet