Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A long synthetic bond When the prices in the market are not properly aligned can result in this. Buying certain number of shares so

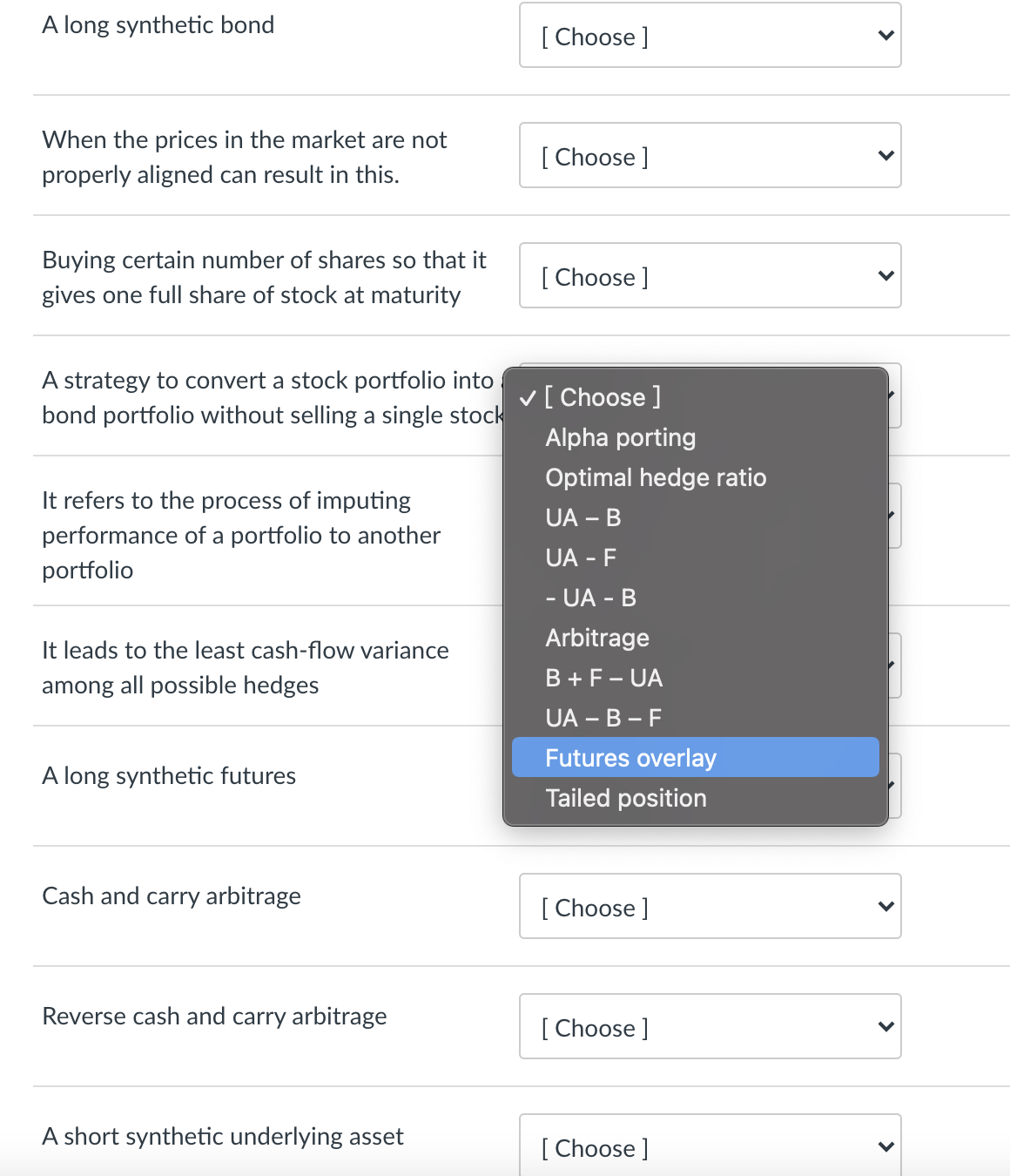

A long synthetic bond When the prices in the market are not properly aligned can result in this. Buying certain number of shares so that it gives one full share of stock at maturity A strategy to convert a stock portfolio into bond portfolio without selling a single stock It refers to the process of imputing performance of a portfolio to another portfolio It leads to the least cash-flow variance among all possible hedges A long synthetic futures Cash and carry arbitrage Reverse cash and carry arbitrage A short synthetic underlying asset [Choose ] [Choose ] [Choose ] [Choose ] Alpha porting Optimal hedge ratio UA - B UA - F -UA - B Arbitrage B + F - UA UA - B - F Futures overlay Tailed position [Choose ] [Choose ] [Choose ] <

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below A long synthetic bond is created by combining a long position in a call option and a short position in a put option both with the same stri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started