Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) M of Mumbai sent on consignment, goods valued 4,00,000 to A of Agra on 1st March, 2020. He incurred the expenditure of 48,000

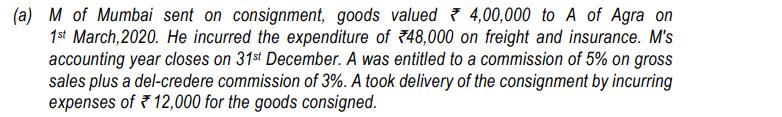

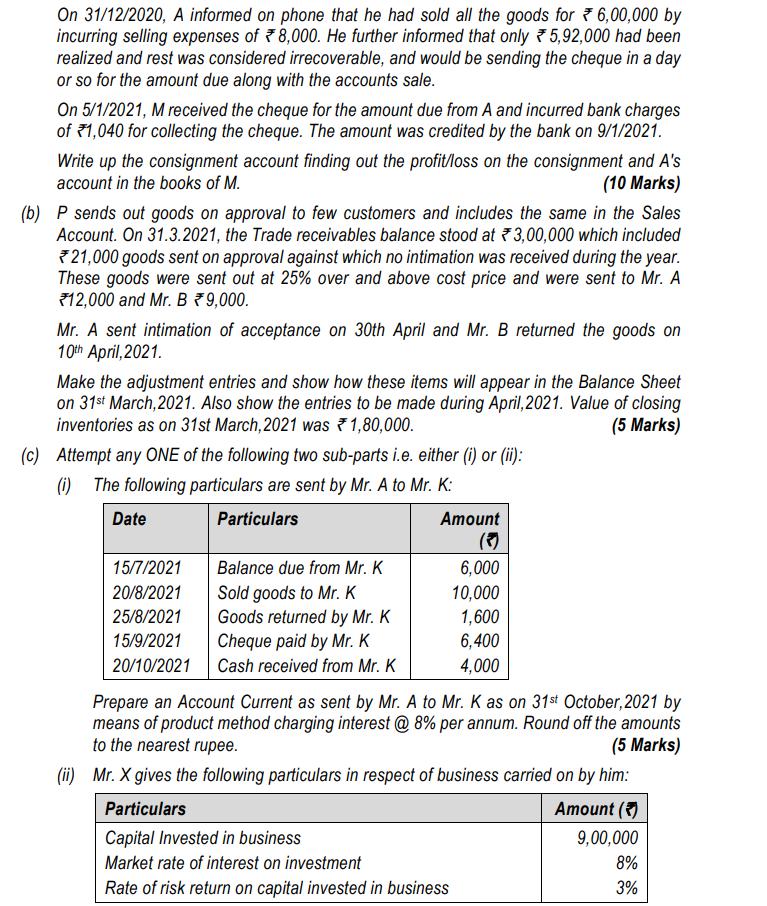

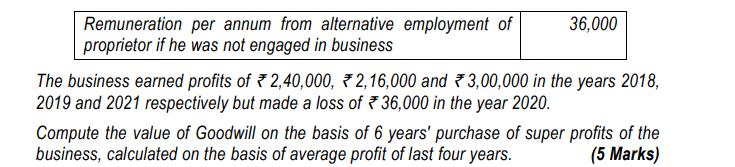

(a) M of Mumbai sent on consignment, goods valued 4,00,000 to A of Agra on 1st March, 2020. He incurred the expenditure of 48,000 on freight and insurance. M's accounting year closes on 31st December. A was entitled to a commission of 5% on gross sales plus a del-credere commission of 3%. A took delivery of the consignment by incurring expenses of 12,000 for the goods consigned. On 31/12/2020, A informed on phone that he had sold all the goods for 6,00,000 by incurring selling expenses of 8,000. He further informed that only 5,92,000 had been realized and rest was considered irrecoverable, and would be sending the cheque in a day or so for the amount due along with the accounts sale. On 5/1/2021, M received the cheque for the amount due from A and incurred bank charges of 1,040 for collecting the cheque. The amount was credited by the bank on 9/1/2021. Write up the consignment account finding out the profit/loss on the consignment and A's account in the books of M. (10 Marks) (b) P sends out goods on approval to few customers and includes the same in the Sales Account. On 31.3.2021, the Trade receivables balance stood at 3,00,000 which included *21,000 goods sent on approval against which no intimation was received during the year. These goods were sent out at 25% over and above cost price and were sent to Mr. A 12,000 and Mr. B *9,000. Mr. A sent intimation of acceptance on 30th April and Mr. B returned the goods on 10th April, 2021. Make the adjustment entries and show how these items will appear in the Balance Sheet on 31st March, 2021. Also show the entries to be made during April, 2021. Value of closing inventories as on 31st March, 2021 was * 1,80,000. (5 Marks) (c) Attempt any ONE of the following two sub-parts i.e. either (i) or (ii): (i) The following particulars are sent by Mr. A to Mr. K: Date Particulars 15/7/2021 Balance due from Mr. K 20/8/2021 Sold goods to Mr. K 25/8/2021 Goods returned by Mr. K 15/9/2021 Cheque paid by Mr. K 20/10/2021 Cash received from Mr. K Amount (3) 6,000 10,000 1,600 6,400 4,000 Prepare an Account Current as sent by Mr. A to Mr. K as on 31st October, 2021 by means of product method charging interest @ 8% per annum. Round off the amounts to the nearest rupee. (5 Marks) (ii) Mr. X gives the following particulars in respect of business carried on by him: Particulars Amount () Capital Invested in business 9,00,000 Market rate of interest on investment 8% Rate of risk return on capital invested in business 3% Remuneration per annum from alternative employment of proprietor if he was not engaged in business 36,000 The business earned profits of 2,40,000, 2,16,000 and 3,00,000 in the years 2018, 2019 and 2021 respectively but made a loss of 36,000 in the year 2020. Compute the value of Goodwill on the basis of 6 years' purchase of super profits of the business, calculated on the basis of average profit of last four years. (5 Marks)

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started