Question: A machine costing $209,800 with a four-year Ilife and an estimated $19,000 salvage value is installed in Luther Company's factory on January 1 (The

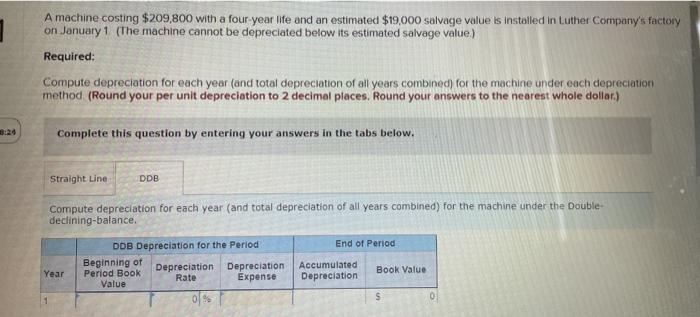

A machine costing $209,800 with a four-year Ilife and an estimated $19,000 salvage value is installed in Luther Company's factory on January 1 (The machine cannot be depreciated below its estimated salvage value.) Required: Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method (Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar.) 24 Complete this question by entering your answers in the tabs below. Straight Line- DDB Compute depreciation for each year (and total depreciation of all years combined) for the machine under the Double- declining-balance. End of Period DDB Depreciation for the Period Beginning of Period Book Value Depreciation Depreciation Rate Accumulated Book Value Year Expense Depreciation ofs

Step by Step Solution

3.41 Rating (148 Votes )

There are 3 Steps involved in it

answers Adoy Ea Format Painter General ste A E Merge Center 898 Conditional Format ... View full answer

Get step-by-step solutions from verified subject matter experts