Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A machine was purchased during 2013 for $3,080,000. At the time of purchase, it was estimated that the machine would have a useful life

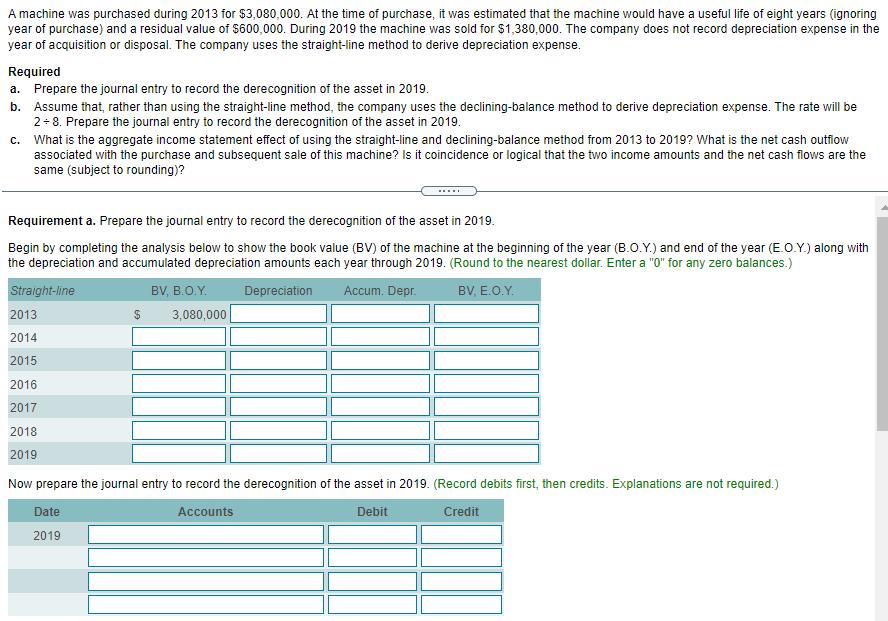

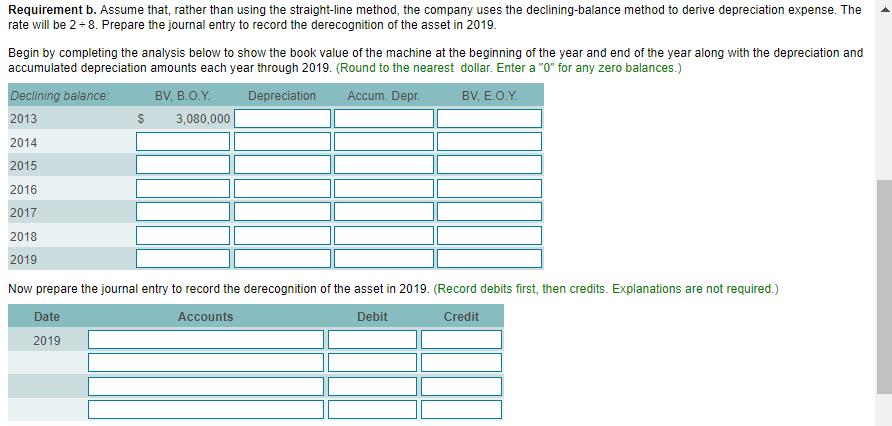

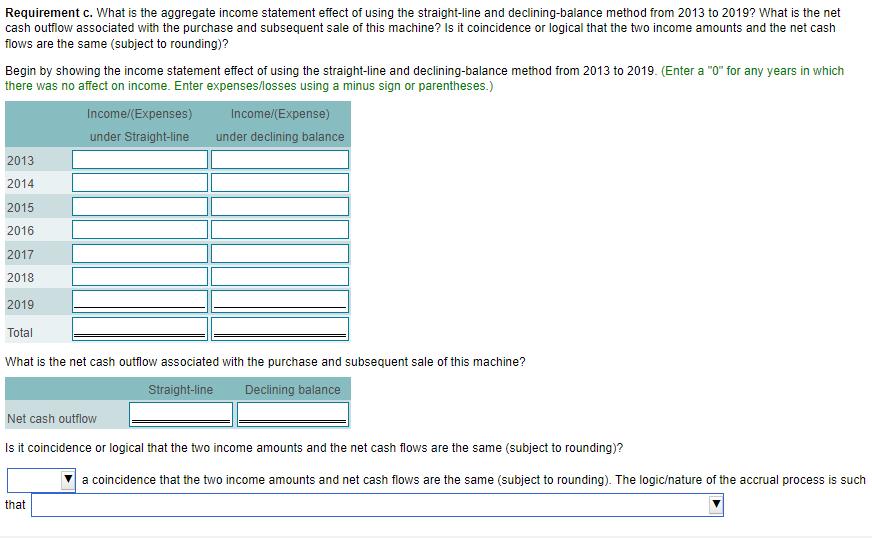

A machine was purchased during 2013 for $3,080,000. At the time of purchase, it was estimated that the machine would have a useful life of eight years (ignoring year of purchase) and a residual value of $600,000. During 2019 the machine was sold for $1,380,000. The company does not record depreciation expense in the year of acquisition or disposal. The company uses the straight-line method to derive depreciation expense. Required a. Prepare the journal entry to record the derecognition of the asset in 2019. b. Assume that, rather than using the straight-line method, the company uses the declining-balance method to derive depreciation expense. The rate will be 2+8. Prepare the journal entry to record the derecognition of the asset in 2019. What is the aggregate income statement effect of using the straight-line and declining-balance method from 2013 to 2019? What is the net cash outflow associated with the purchase and subsequent sale of this machine? Is it coincidence or logical that the two income amounts and the net cash flows are the same (subject to rounding)? C. Requirement a. Prepare the journal entry to record the derecognition of the asset in 2019. Begin by completing the analysis below to show the book value (BV) of the machine at the beginning of the year (B.O.Y.) and end of the year (E.O.Y.) along with the depreciation and accumulated depreciation amounts each year through 2019. (Round to the nearest dollar. Enter a "0" for any zero balances.) Depreciation Accum. Depr. BV. ... BV, B.O.Y. $ 3,080,000 Straight-line 2013 2014 2015 2016 2017 2018 2019 Now prepare the journal entry to record the derecognition of the asset in 2019. (Record debits first, then credits. Explanations are not required.) Accounts Debit Credit Date 2019 Requirement b. Assume that, rather than using the straight-line method, the company uses the declining-balance method to derive depreciation expense. The rate will be 2+ 8. Prepare the journal entry to record the derecognition of the asset in 2019. Begin by completing the analysis below to show the book value of the machine at the beginning of the year and end of the year along with the depreciation and accumulated depreciation amounts each year through 2019. (Round to the nearest dollar. Enter a "0" for any zero balances.) Declining balance: Depreciation Accum. Depr. BV, E.O.Y. 2013 2014 2015 2016 2017 2018 2019 Now prepare the journal entry to record the derecognition of the asset in 2019. (Record debits first, then credits. Explanations are not required.) Date Accounts Debit Credit 2019 BV, B.O.Y. S 3,080,000 Requirement c. What is the aggregate income statement effect of using the straight-line and declining-balance method from 2013 to 2019? What is the net cash outflow associated with the purchase and subsequent sale of this machine? Is it coincidence or logical that the two income amounts and the net cash flows are the same (subject to rounding)? Begin by showing the income statement effect of using the straight-line and declining-balance method from 2013 to 2019. (Enter a "0" for any years in which there was no affect on income. Enter expenses/losses using a minus sign or parentheses.) Income/(Expenses) Income/(Expense) under Straight-line under declining balance 2013 2014 2015 2016 2017 2018 2019 Total What is the net cash outflow associated with the purchase and subsequent sale of this machine? Straight-line Declining balance Net cash outflow Is it coincidence or logical that the two income amounts and the net cash flows are the same (subject to rounding)? a coincidence that the two income amounts and net cash flows are the same (subject to rounding). The logic/nature of the accrual process is such that

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

2013 2014 2015 2016 2017 2018 2019 Depreciation BV BOY 3080000 3080000 310000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started