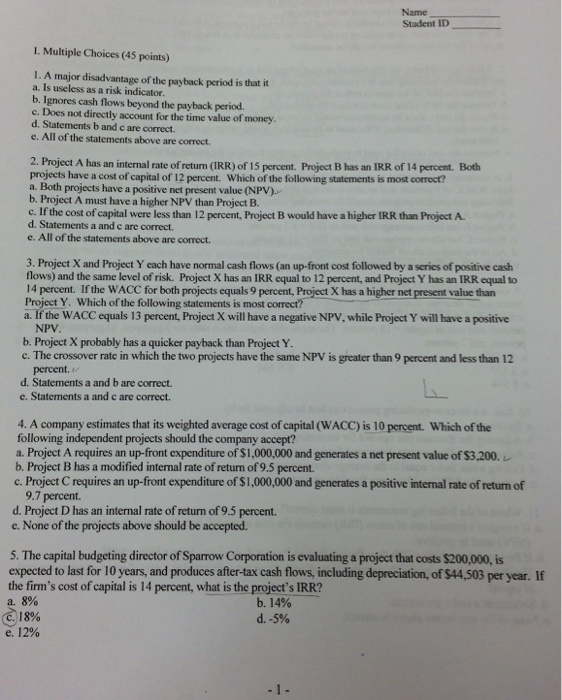

A major disadvantage of the payback period is that it a. Is useless as a risk indicator. b. Ignores cash flows beyond the payback period. c. Does not directly account for the time value of money. d. Statements b and c are correct. e. All of the statements above are correct. 2. Project A has an internal rate of return (IRR) of 15 percent. Project B has an IRR of 14 percent. Both projects have a cost of capital of 12 percent. Which of the following statements is most correct? a. Both projects have a positive net present value (NPV). b. Project A must have a higher NPV than Project B. c. If the cost of capital were less than 12 percent, Project B would have a higher IRR than Project A. d. Statements a and c arc correct. c. All of the statements above are correct. 3. Project X and Project Y each have normal cash flows (an up-front cost followed by a series of positive cash flows) and the same level of risk. Project X has an IRR equal to 12 percent, and Project Y has an IRR equal to 14 percent. If the WACC for both projects equals 9 percent Project X has a higher net present value than Project Y. Which of the following statements is most correct? a. If the WACC equals 13 percent Project X will have a negative NPV, while Project Y will have a positive NPV. b. Project X probably has a quicker payback than Project Y. c. The crossover rate in which the two projects have the same NPV is greater than 9 percent and less than 12 percent. d. Statements a and b are correct. e. Statements a and c are correct. 4. A company estimates that its weighted average cost of capital (WACC) is 10 percent. Which of the following independent projects should the company accept? a. Project A requires an up-front expenditure of $1,000,000 and generates a net present value of $3,200. b. Project B has a modified internal rate of return of 9.5 percent. c. Project C requires an up-front expenditure of $1,000,000 and generates a positive internal rate of return of 9.7 percent. d. Project D has an internal rate of return of 9.5 percent. e. None of the projects above should be accepted. 5. The capital budgeting director of Sparrow Corporation is evaluating a project that costs $200,000, is expected to last for 10 years, and produces after-tax cash flows, including depreciation, of $44,503 per year. If the firm's cost of capital is 14 percent, what is the project's IRR? a. 8% b. 14% c.l8% d. -5% e. 12%