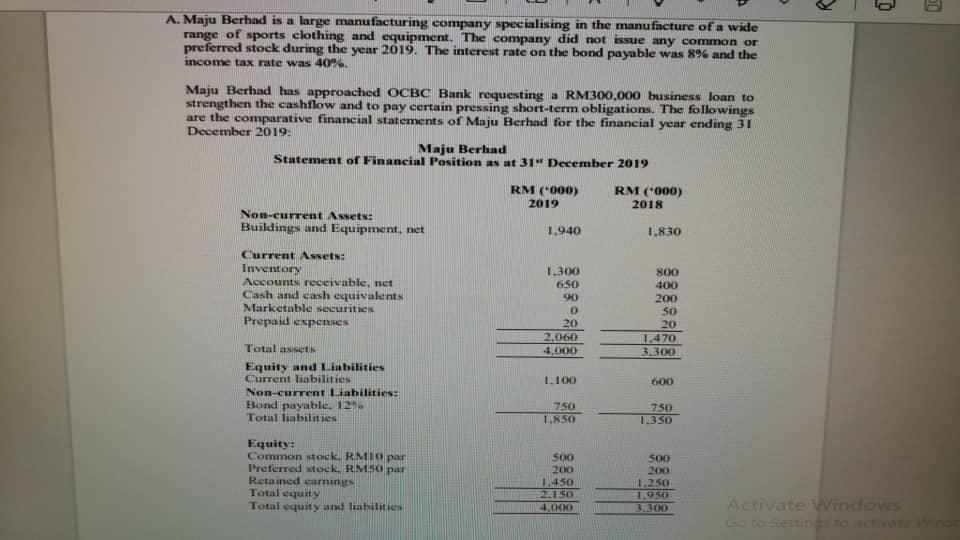

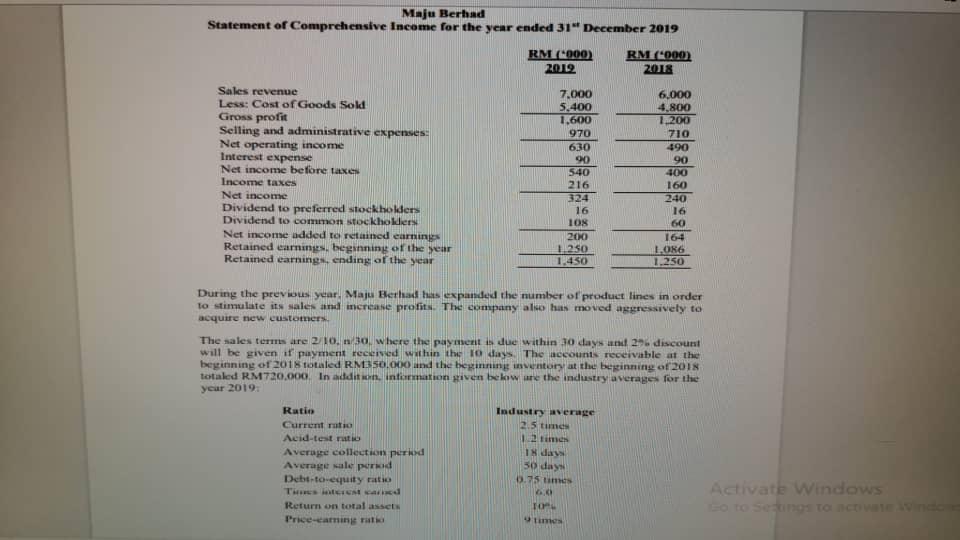

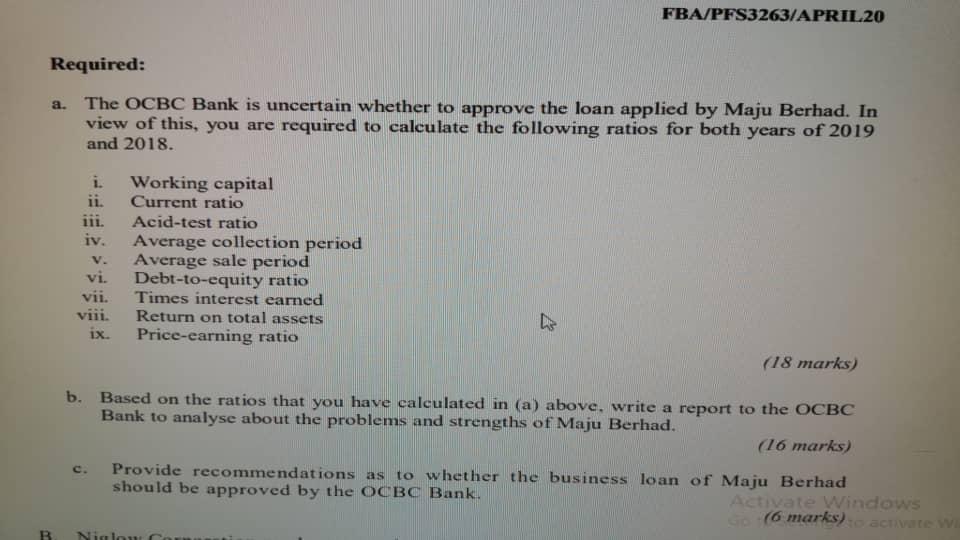

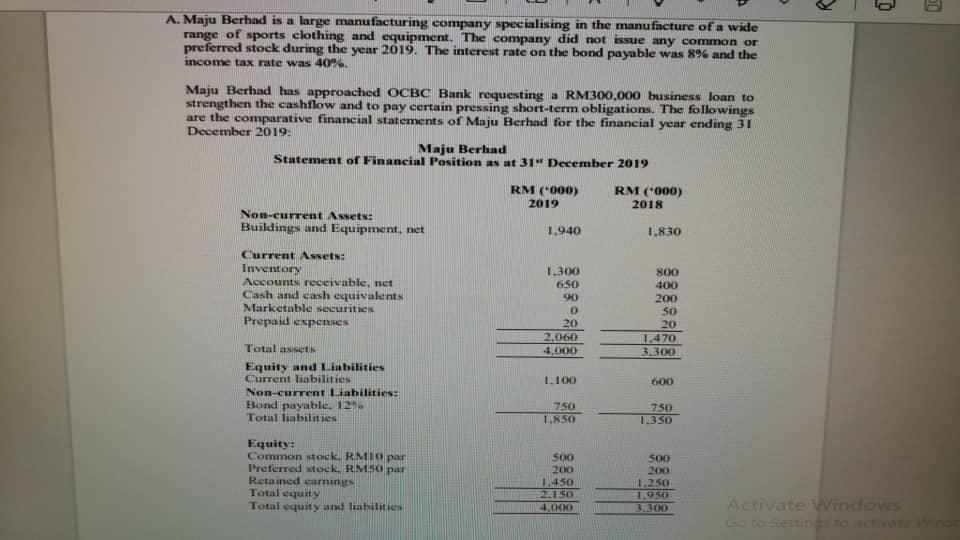

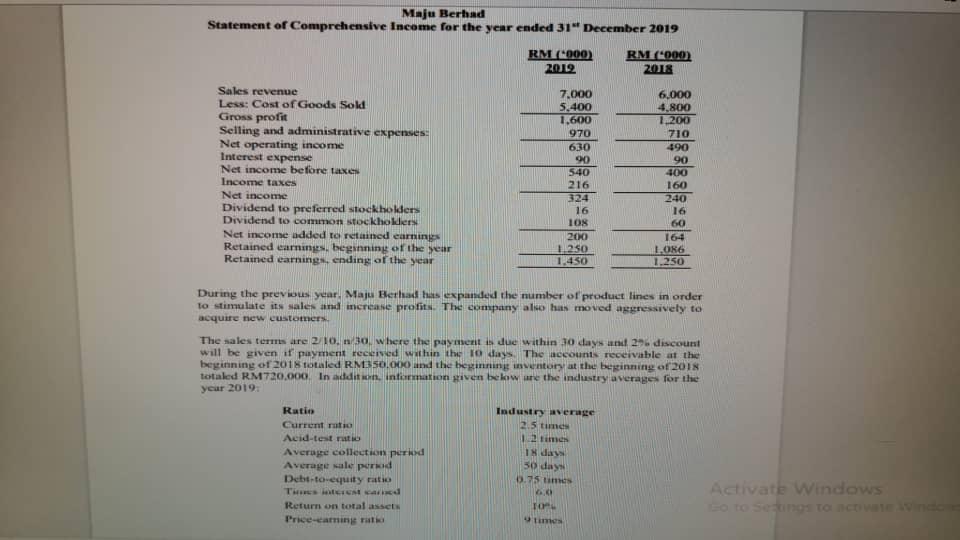

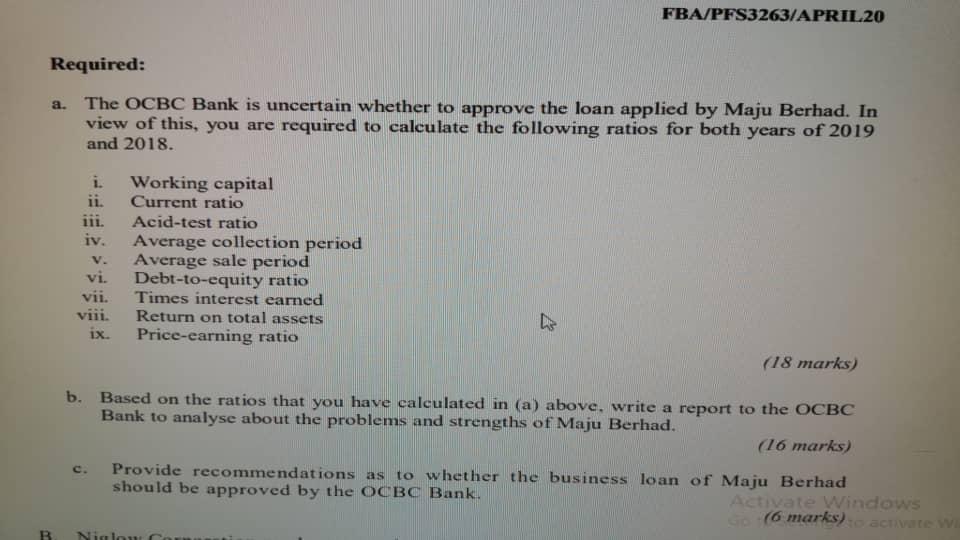

A. Maju Berhad is a large manufacturing company specialising in the manufacture of a wide range of sports clothing and equipment. The company did not issue any common or preferred stock during the year 2019. The interest rate on the bond payable was 8% and the income tax rate was 40%. Maju Berhad has approached OCBC Bank requesting a RM300,000 business loan to strengthen the cashflow and to pay certain pressing short-term obligations. The followings are the comparative financial statements of Maju Berhad for the financial year ending 31 December 2019: Maju Berhad Statement of Financial Position as at 31 December 2019 RM (000) 2019 RM (000) 2018 Non-current Assets: Buildings and Equipment, net 1.940 1,830 Current Assets: Inventory Accounts receivable, net Cash and cash equivalents Marketable securities Prepaid expenses 1.300 650 90 0 20 2.060 4.000 800 400 200 50 20 1.470 3.300 Total assets Equity and Liabilities Current liabilities Non-current Liabilities: Bond payable. 126 Total liabilities 1.100 600 750 1.850 750 1.350 Equity: Common stock RM10 par Preferred stock. RM50 par Retained earning Total equity Total equity and liabilities 500 200 1 450 20150 3.000 500 200 1.250 1.950 Activate Windows Maju Berhad Statement of Comprehensive Income for the year ended 31" December 2019 RM1000) 2012 RM4000) 2018 Sales revenue Less: Cost of Goods Sold Gross profit Selling and administrative expenses: Net operating income Interest expense Net income before taxes Income taxes Net income Dividend to preferred stockholders Dividend to common stockholders Net income added to retained earnings Retained earnings, beginning of the year Retained carnings, ending of the year 7.000 5.400 1.600 970 630 90 540 216 324 16 108 200 1250 1.450 6,000 4.800 1.200 710 490 90 400 160 240 16 60 164 1086 1.250 During the previous year. Maju Berhad has expanded the number of product lines in order to stimulate its sales and increase profits. The company also has moved aggressively to acquire new customers The sales termes are 2/10,n30, where the payment due within 30 days a 29 discount will be given if payment received within the 10 days. The accounts receivable at the beginning of 2018 totaled RM350.000 and the beginning inventory at the beginning of 2018 totaled RM720.000. In addition, information given below are the industry average for the yeur 2019 Ratio Current rutie Acid-test ratio Average collection period Average sale pornid Debt-to-equity ratio Industry iverage 2.5 times 12 times 1 days 30 days 0.75 times Activath Windows so to Settings to the TO Return on total asset Price-camins ratio FBA/PFS3263/APRIL 20 Required: a. The OCBC Bank is uncertain whether to approve the loan applied by Maju Berhad. In view of this, you are required to calculate the following ratios for both years of 2019 and 2018. i. ii. iii. iv. Working capital Current ratio Acid-test ratio Average collection period Average sale period Debt-to-equity ratio Times interest earned Return on total assets Price-earning ratio vi. vii. viii. ix. (18 marks) b. Based on the ratios that you have calculated in (a) above, write a report to the OCBC Bank to analyse about the problems and strengths of Maju Berhad. (16 marks) c. Provide recommendations as to whether the business loan of Maju Berhad should be approved by the OCBC Bank. Activate Windows (6 marks) activate w B Nilo